Get a first impression, scheduled soon.

Request a demo to see how NIPO can help you meet your requirements with our smart survey solutions.

Our article Your Nfield login’s value on the dark web explains why access to your Nfield account is such a tempting prize for hackers. The good news is you can make it almost impossible for them to get in by deploying two-factor authentication. Adding this extra security layer to your username and password login makes your Nfield account more than 99.9% less likely to be compromised, according to research by Alex Weinert, Group Program Manager for Identity Security and Protection at Microsoft1.

This article explains the concept of two-factor authentication (2FA) and its benefits, as well as giving instructions for setting it up and rolling it out in your organization.

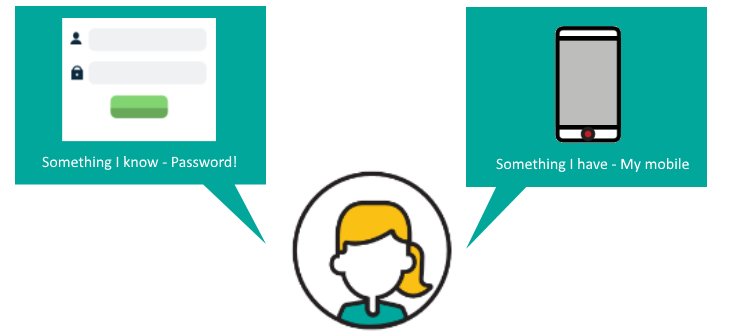

You’re probably already familiar with using two-factor authentication to access things such as bank, social media (Facebook, LinkedIn, Instagram) and email accounts. 2FA adds to the first factor – your email address/username and password combination – by asking for a code which can only be obtained via a physical object you have in your possession. This might be a key-like token, an office access card or an SMS message received on your mobile phone. Very highly secured systems may even require a third factor, such as a fingerprint or iris scan.

Nfield accounts secured with two-factor authentication require users to enter a code (a token) generated by a standard authenticator app on a mobile phone. This has the effect of complementing something you know (your username and password) with a code obtained through something you have (your phone). It effectively blocks any hackers who have obtained your username and password from getting into your Nfield account, as they would not be able to retrieve the second factor code from the phone. Your valuable Nfield fieldwork and respondent data is thereby protected from prying eyes.

Different companies have different policies for protecting different types of data. Even if your organization doesn’t require two-factor authentication, your client’s organization might. Having it set up on your Nfield account means you’ll be compliant with every policy or project requirement.

With compliance and IT policies regularly being updated to fend off new security threats, it’s probably only a matter of time before two-factor authentication becomes a standard requirement.

2 https://www.zivver.com/blog/which-type-of-2fa-do-i-need-to-use-under-the-gdpr

3 https://advisera.com/27001academy/blog/2017/01/16/how-two-factor-authentication-enables-compliance-with-iso-27001-access-controls/

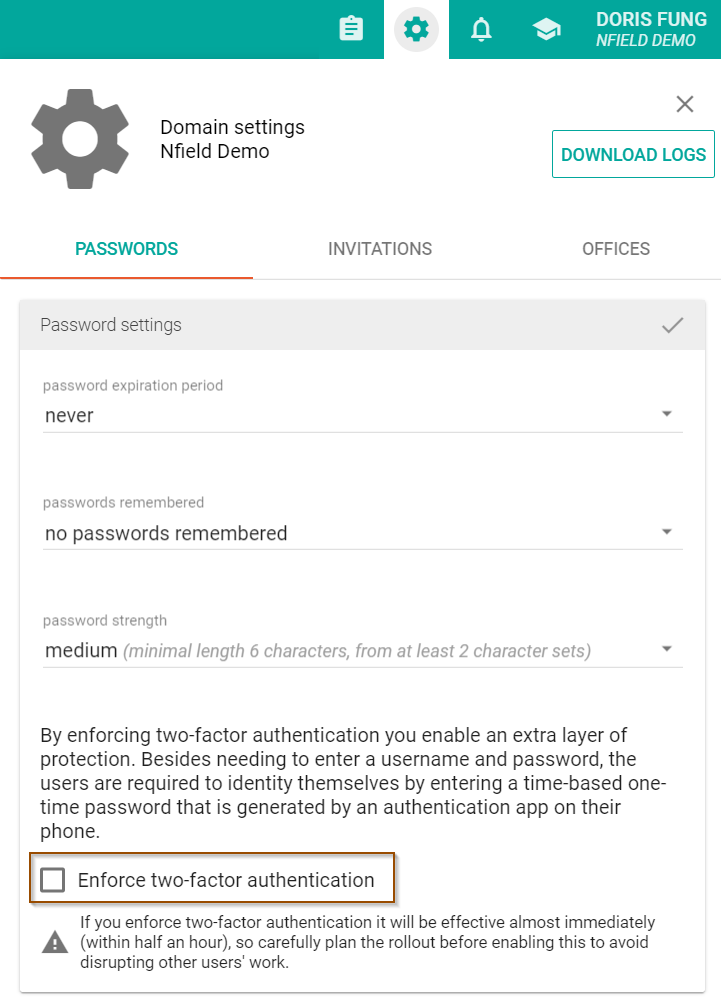

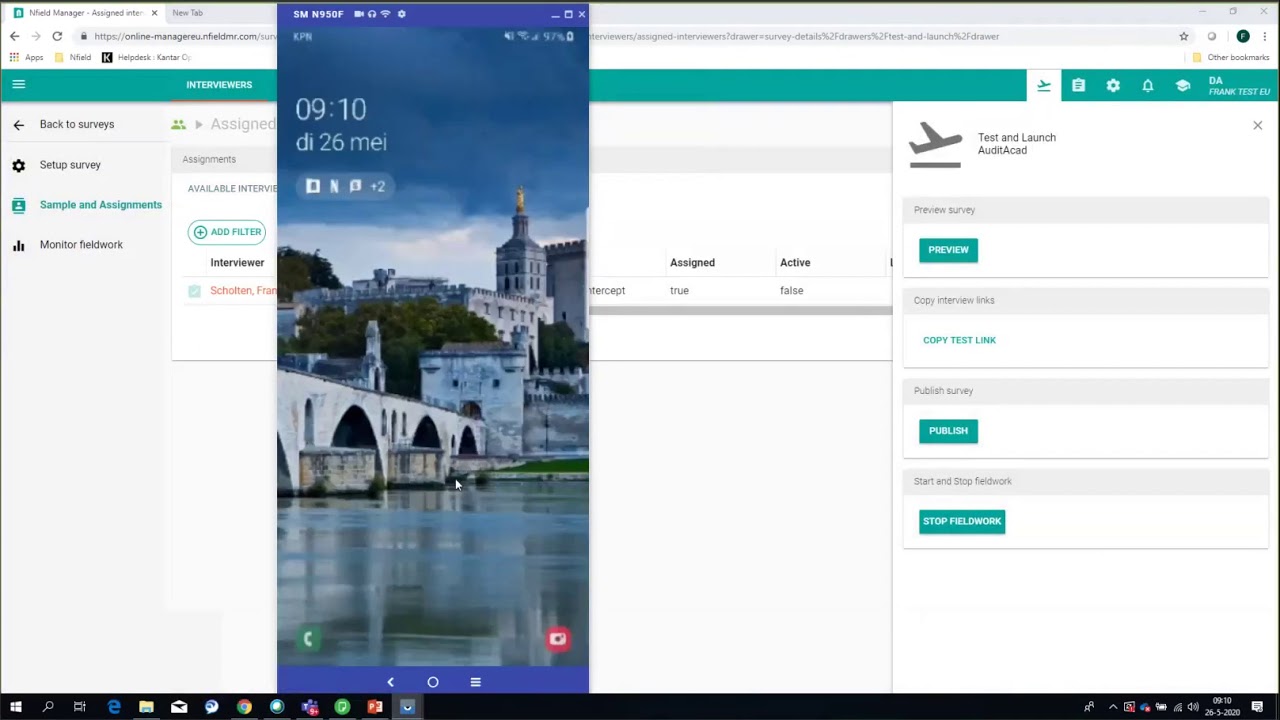

Enabling this feature across an Nfield domain can only be done by domain administrators or local domain managers. The instruction to enable is located in the password policy page in the domain settings.

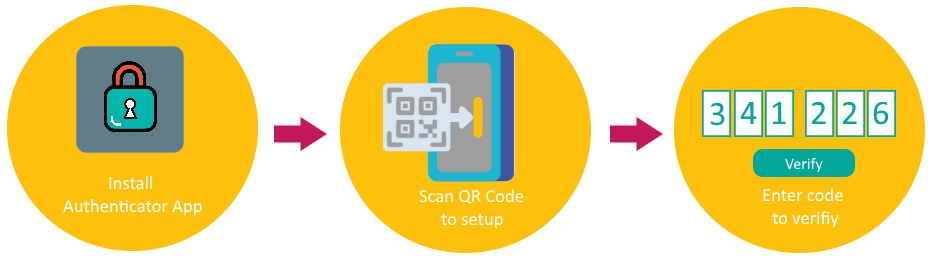

After enabling two-factor authentication, follow the on-screen instructions for setting up two-factor configuration. You’ll need to start by selecting and setting up an authenticator app, such as Microsoft Authenticator, Google Authenticator or others. Next, use the app to scan the QR code provided by Nfield. Once all is correctly configured, the app will provide a code which needs to be entered into Nfield to complete the two-factor authentication. It is as simple as that! Every time you log in to Nfield, you go through the same process, getting a new code each time.

Two-factor authentication will become effective across your Nfield domain within 30 minutes of being enabled. Any logged-in users will get the same prompt asked them to complete their configuration setup. Other users will get this prompt when they try to log in. Using public API (https://www.nipo.com/api-what-researchers-need-to-know) is excepted from using two-factor authentication.

To minimize disruption to your team, please plan this carefully. We recommend you consider the following:

Whether or not you feel you need it right now, we highly recommend enabling two-factor authentication for your Nfield domain, to enjoy better security protection and gain more benefits from Nfield. If you have any questions, please contact our helpdesk. And, of course, we’re always curious to get your feedback via your account manager.

Invisible to standard internet browsers and search engines, the Dark Web is a place where users anonymously access content which is either illegal or related to illegal activities. This includes the lucrative marketplace for stolen login details, which are bought by criminals who are able to monetize the data and permissions they unlock. Among these, your Nfield login is a desirable prize, as it opens the door to a large pool of personal information.

How desirable? This can be worked out by taking a look at trading prices for the items your Nfield data helps unlock.

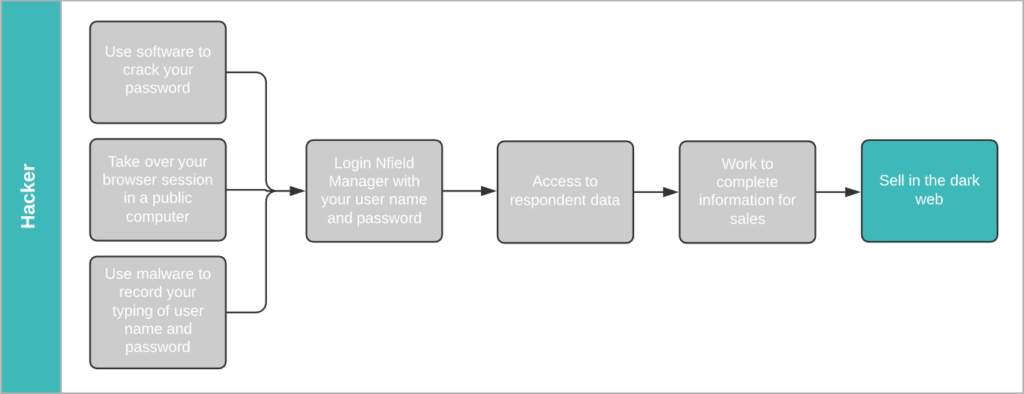

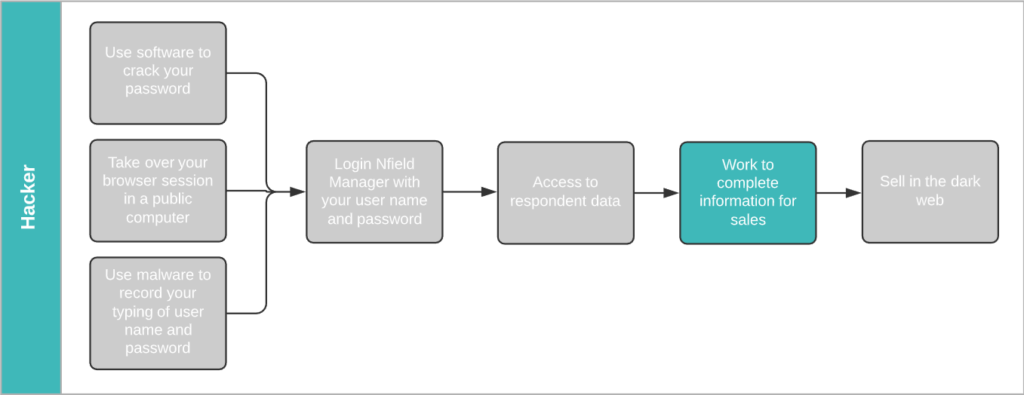

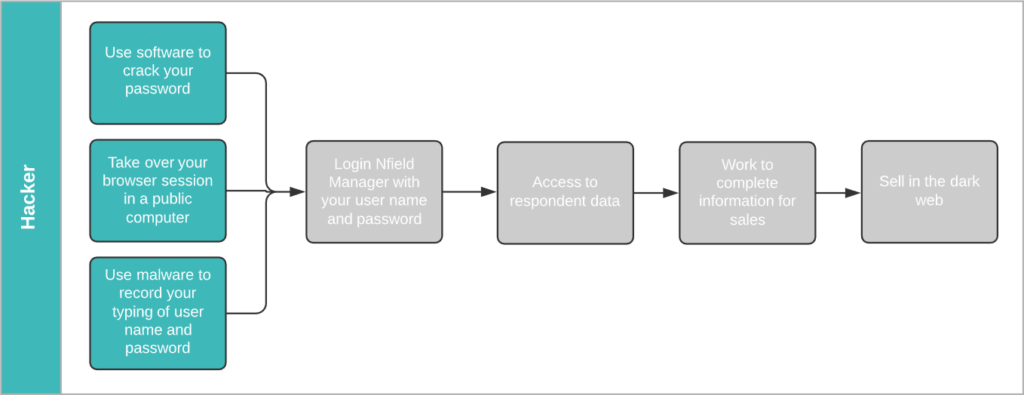

The illustration below shows the process a hacker would go through to harvest your survey participants’ login details from Nfield and make them saleable. If we work backwards from the end prize, we get an idea of the financial temptation.

According to Dark Web Price Index 2020, a stolen Gmail login (email address/username + password) sells for $155.73. A hacker who obtains your Nfield Manager login name and password gains access to all the sample information in all your surveys. That’s likely to include a high percentage of valid Gmail addresses. To make these saleable on the dark web, all the hacker now has to do is get the corresponding passwords.

Hackers commonly obtain passwords via phishing emails and database matching. Both of which are automated processes that easily deliver the goods.

Because login to Google accounts is protected by limitation on incorrect password attempts, there’s no point in trying to obtain passwords by endless guessing. Phishing, whereby a hacker approaches you via fake emails pretending to be from a trusted source and asks you to sign in to a related account – thereby revealing your password – is a far more successful method.

Every successful attempt can reap multiple payouts for the hacker. According to LastPass, 65% of people re-use passwords. A lucky hacker could net themselves an additional $74.50 if the same login details give access to a Facebook account and $50 each for Twitter and Instagram accounts1.

Another popular commodity traded on the dark web is credit card details, which sell for between $12 and $20 each.

Credit card details are composed of two parts. The first part is the info displayed on the card itself – credit card number, expiry date, CVV number (on the back) and holder name. These are plentifully available in a nicely formatted database, obtained through skimming devices planted in ATM machines, train ticket machines and are even sold by unscrupulous retailers who’ve been paid via card swipe machines.

The second part is the card owner zip code (derived from address), city, address, email and phone. Details which are commonly held in survey sample data! Armed with this information, a hacker can easily run a database matching tool between a purchased credit card database and your sample data to obtain complete sets of credit card details, ready to sell.

If you think this seems a lot of work for relatively modest returns, think again. Phishing and database matching are automated processes which take no more effort than a few clicks. Easy money.

Hackers have all the tools they need to crack your password, take over your browser session and use malware to get hold of your Nfield login.

Cracking passwords using software is a basic skill in the hacking world. It’s simply a matter of time. Did you know 90% of passwords can be cracked in less than six hours2.

Using shared computers in public spaces, such as cafés, airport lounges or even client meeting rooms, can lay out the welcome mat for hackers. You never know who’s hanging around waiting to inspect your activity in the event of you rushing off without logging out, or through having installed password capture software.

At the time of writing, a great many of us are working from home due to the COVID-19 pandemic. In this situation, the companies we work for usually have very limited control over the equipment we’re using for both work and recreation. It’s a vulnerability that makes it easier to implant malware that records your key strokes and can hack into your Nfield account.

2 https://www.servalsystems.co.uk/6-facts-about-passwords-that-will-make-you-think/

Although the sales values for individual login details and credit cards aren’t particularly high, they easily add up. How much do you think all the sample data held in your Nfield account is potentially worth to a criminal? Selling just one Gmail login per day would net a hacker over $56,000 a year. That’s too tempting to ignore. Which is why Nfield is now equipped with two-factor authentication, to keep hackers out of your account, even if they have cracked your password.

At the very end of 2020, NIPO further enhanced its status within the Microsoft Partner Network by adding a third Gold Competency. Complementing already-held Gold competencies for Application Development and Cloud Platform, the addition of Gold status for Application Integration means NIPO’s team has now received the highest possible recognition from Microsoft for its proficiency in three separate areas.

This achievement underscores NIPO’s ability to provide its customers with a cutting-edge SaaS Azure Cloud based platform, leveraging the latest Microsoft technologies and fully meeting Microsoft’s standards. NIPO has earned its Gold competencies by demonstrating “best-in-class” ability and commitment to meeting Microsoft customers’ evolving needs in today’s mobile-first, cloud-first world.

Jeroen Noordman, Managing Director of NIPO: “The Application Integration competency is highly relevant to NIPO. Our Nfield platform is open by nature, so we have been very eager to demonstrate our comprehensive understanding of all the opportunities and challenges this topic presents. Attaining this third Gold Competency is also proof of our ongoing commitment to continuous investment in keeping our NIPO team members’ knowledge fully up-to-date. This recognition from the Microsoft Partner Network ecosystem benefits both NIPO and our customers. We are very proud to announce this latest achievement and look forward to having more exciting news to share relating to our MPN involvement during 2021”.

Gavriella Schuster, corporate vice president at One Commercial Partner (OCP) at Microsoft Corp.: “Achieving Gold Competency confirms that partners have demonstrated the highest, most consistent capability and commitment to the latest Microsoft technology. These partners have deep expertise that positions them at the top of our partner ecosystem, with a proficiency which can help customers drive innovative solutions”.

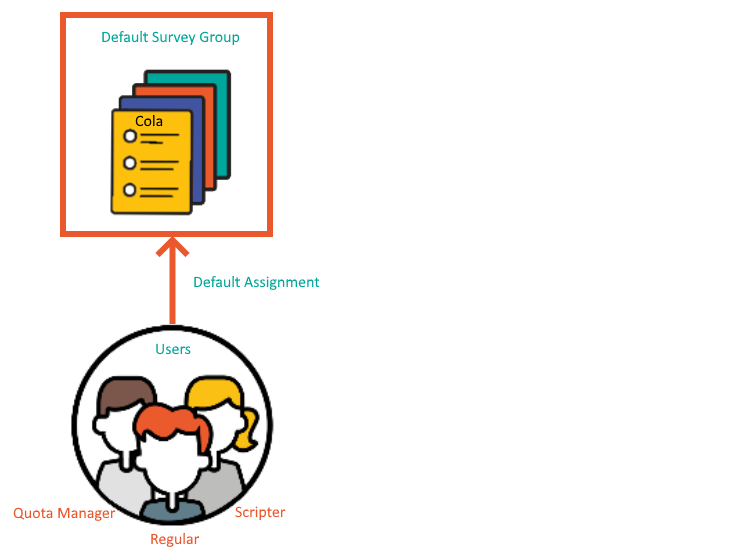

Surveys contain valuable, and sometimes sensitive, information. It’s therefore essential to restrict access to certain parts of surveys to those who really need it, in order to do their jobs. This works by assigning users with specific roles which only allow access to designated areas and functionality.

Nfield surveys incorporate a number of default roles: Domain Administrator, Power User, Regular User, Scripter, Supervisor, Limited User and Quota Manager. Each of which allows an appropriate scope of access.

For example, Scripters can create questionnaires and publish surveys for testing purposes. But cannot publish surveys to go live, send out email invitations or access survey data.

By default, each role is granted their access rights for every survey within a domain. But there might be reasons to also restrict which surveys each user can access.

For example:

Nfield survey access rights can be customized to fit your needs. This requires API implementation and is an add-on to your Nfield subscription.

To explain the set-up, we need to look at how Survey Groups work.

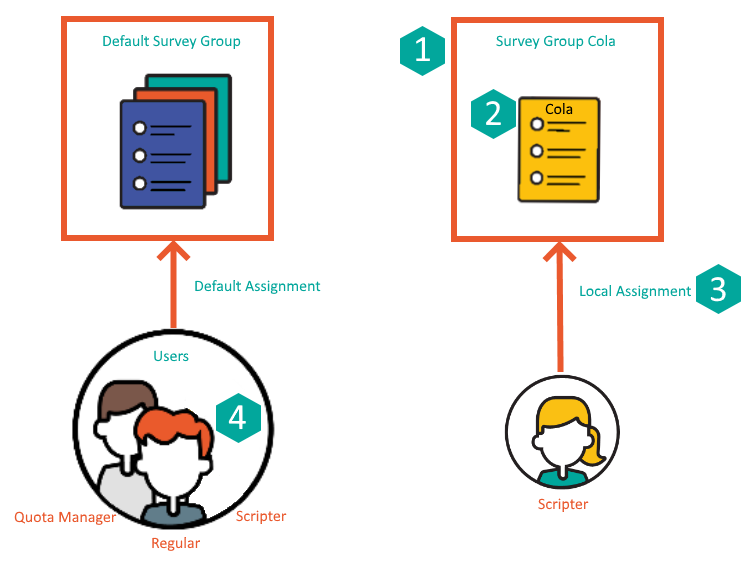

A Survey Group is a container for surveys in which users are assigned their access. By default, existing and newly created surveys are put under the Default Survey Group, so your existing and newly created users are given the access specified in this Default Survey Group.

To demonstrate, let’s say you have a survey about Cola, which is highly confidential and access must therefore be restricted to an individual Scripter. This would need to be set up as shown below, with a new container called “Survey Group Cola” that contains this Cola Survey and only specifies access to your designated Scripter.

In terms of API calls, this breaks down into the following steps:

| Step | API call |

| 1) Create the group “Survey Group Cola”. | POST v1/SurveyGroups |

| 2) Move the Cola survey from “Default Survey Group” to “Survey Group Cola”. | PUT v1/Surveys/{surveyId}/SurveyGroup |

| 3) Assign the Scripter to “Survey Group Cola”. | PUT v1/SurveyGroups/{surveyGroupId}/AssignLocal |

| 4) Unassign the Scripter from “Default Assignment”.* | PUT v1/SurveyGroups/{surveyGroupId}/UnassignLocal |

*remarks: One user can be assigned to multiple survey groups. So you may skip this step to keep the default survey group access according to your wish.

The following illustration demonstrates this using Postman for executing the API calls.

As described in ISO 27001, “Put simply, access control is about who needs to know, who needs to use and how much they get access to.” It’s something people are always talking about on our own work floor. This Nfield feature gives you the control you need to restrict access to survey rights as appropriate, to safeguard data security while enabling people to do their jobs.

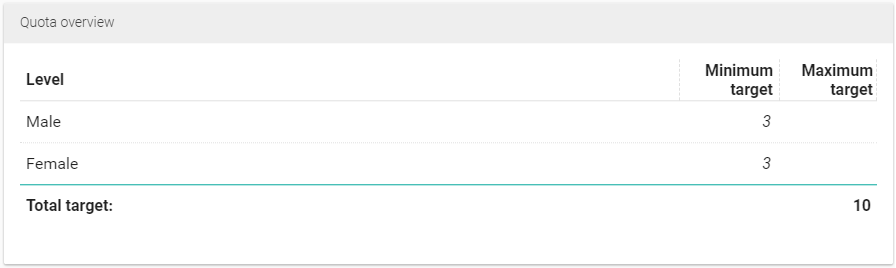

Following some testing on a limited number of domains we are now ready to release this feature to every Nfield Online customer. Before doing this, we would like to walk you once through this feature and explain how to keep track of your survey progress when multiple quota frames are used.

In an ideal world, every survey you do will begin with a perfectly set up quota frame structure. Reality, however, can be a different story. Even after the most considered planning, a need for changes sometimes only becomes apparent once survey fieldwork has got underway. Nfield gives you the ability to edit quota frames even after fieldwork has begun, while retaining valid responses already collected.

Just because you can edit active quota frames, that doesn’t mean you shouldn’t strive to get them right from the start. This will create the smoothest ride. However, mistakes and unforeseen circumstances still happen. The most common scenarios which require quota frames to be edited are:

Spellings

Quota variable and items names (e.g. Leisure Activity Type – Dance / Football / Volleyball / Tennis) need to be spelled exactly the same as they are in the survey script. It sounds simple enough, but mismatches can still happen if:

Additional brand names

In surveys which gather information about competing brands, the number of brands specified is usually kept to a minimum to keep costs down. However, as the survey progresses, the selection may prove insufficient. E.g. Netflix is surveying rivals Videoland and Amazon Prime Video. When Disney Plus starts emerging as a strong competitor, this needs to be added.

Inappropriate structure

After a survey has got underway, it may become apparent that the quota frame is too complex, requiring responses from specific groups which are too difficult to achieve. E.g. region-by-region targets may have to be abandoned to a broader geographic grouping.

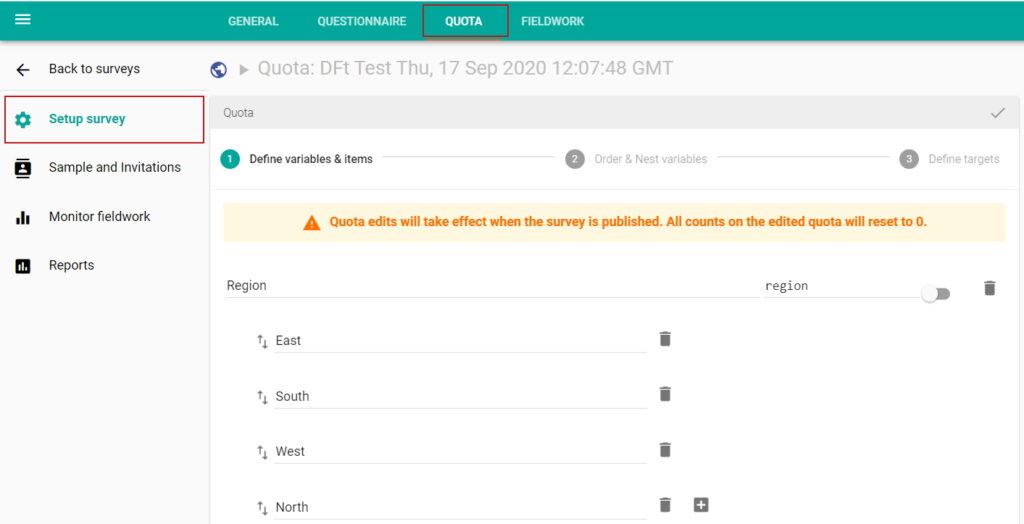

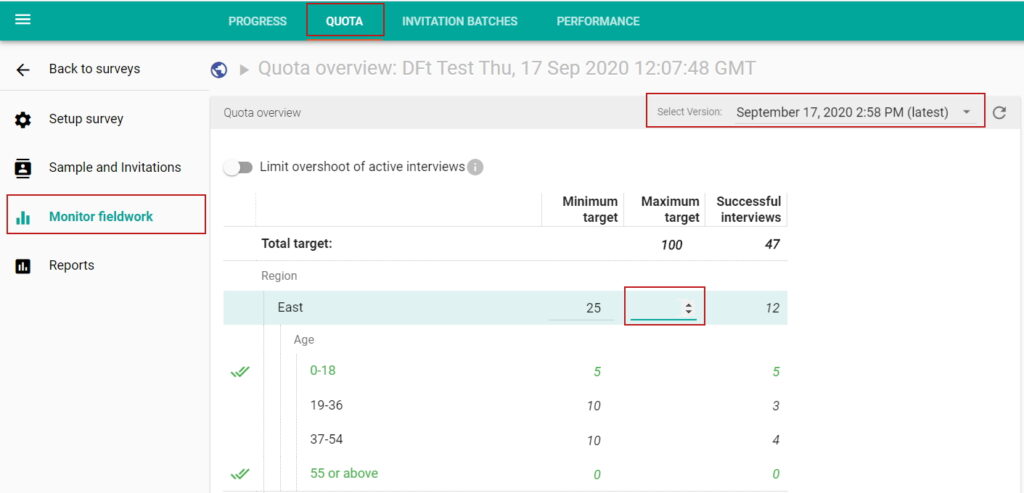

You can access quota in two pages – Quota tab under Setup Survey; and Quota tab under Monitoring Survey. Let’s see how it works.

Setting up quota frame is now available after fieldwork. You can go back to previous steps to define quota variables and order and nest quota variables, same way as in the first time setup.

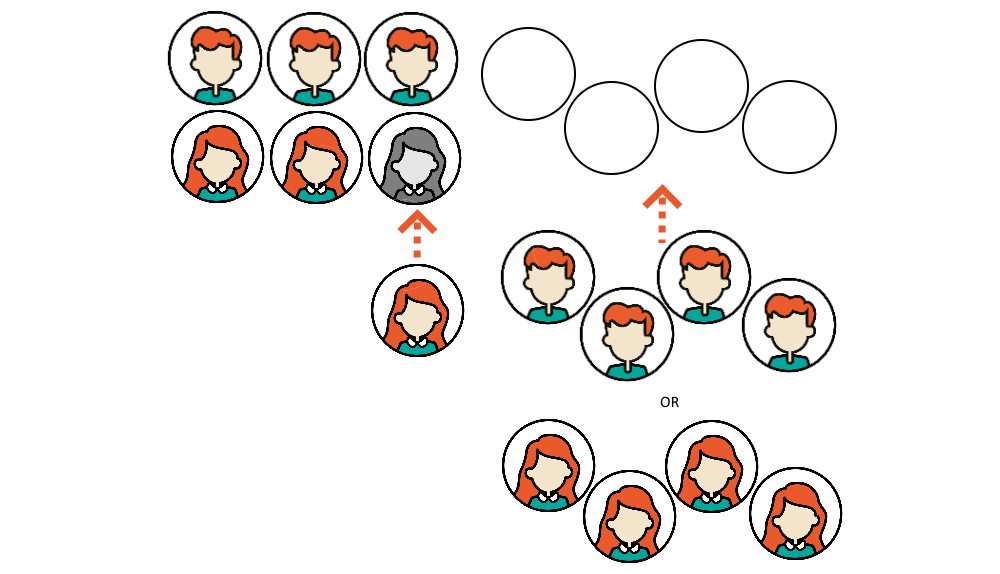

Quota frame editing works with a concept of version. When the quota frame is changed, it stores as a new version. It needs publishing to make it effective. Successful interviews are now added to its corresponding quota frame version. It implies that succesful interviews before this change is counted in version 1.

Version 1:

| Video Streaming Providers | Target | Successful Interviews |

|---|---|---|

| Netflix | 40 | 30 |

| Videoland | 40 | 30 |

| Amazon Prime Video | 40 | 30 |

After changing the quota frame (e.g. adding Disney Plus), this quota frame is now saved as a new version (thus version 2) to start with. Depending on your scenario and the purpose of changes, you may want to adjust the target. In this case of adding a new brand to catch up with the other existing brands, target of each brand in the new version is adjusted as Target minus Successful Interviews of version 1.

Version 2:

| Video Streaming Providers | Target | Successful Interviews |

|---|---|---|

| Netflix | 10 | 0 |

| Videoland | 10 | 0 |

| Amazon Prime Video | 10 | 0 |

| Disney Plus | 40 | 0 |

As a general rule of thumb, check all the quota targets to make sure they are updated as you wish and remember to update the ssurvey script before publishing.

This page allows you to edit quota targets and monitor quota progress. The addition is a timestamp of quota frame version. By default, it shows the latest quota frame version and its successful interviews added in since its last publish. You can also select other versions to show its quota progress.

Editing quota frame during fieldwork is a very powerful feature to adapt changes easier. The change should be carefully managed. We hope it benefits you. If you have any feedback on this feature or any challenges you have, please feel free to contact us.

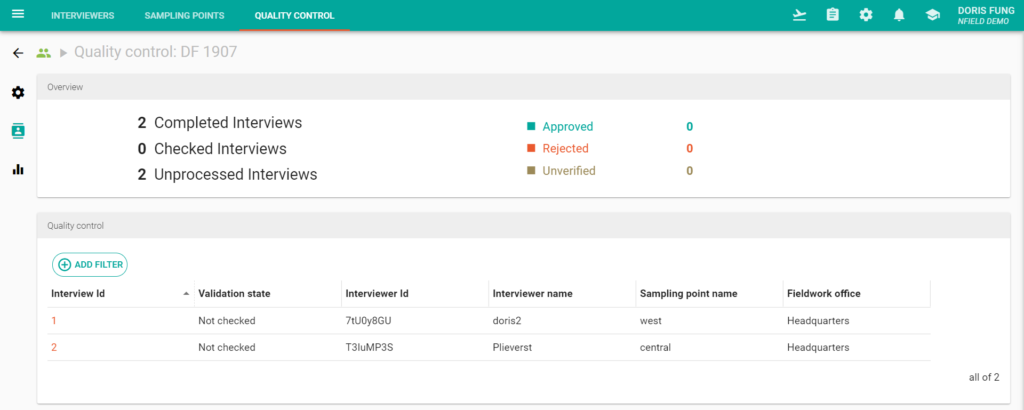

To uphold the quality of your CAPI and Online research, you need to ensure survey results aren’t contaminated by ‘bad’ interviews. This calls for identifying and disqualifying responses which show evidence of being falsified.

Simple pointers to unreal answers and/or respondents include short interview duration, short time spent on each question, short or meaningless open-ended answers and lack of cohesion between answers to related questions. Another giveaway in CAPI fieldwork could be when a particular interviewer’s work is completed via the shortest-possible route.

Methods for identifying these pointers in Nfield CAPI interviews are explained in CAPI Quality Control: Audit Trail helps you eliminate falsified fieldwork and Nfield’s Quality Control Options for Rock-Solid CAPI Data.

In addition to identifying suspicious interviews from interview completion data, you can also adopt a practice of contacting certain respondents to verify their input.

Every company or survey project has its own criteria for whether an interview should be classed as ‘bad’ and therefore disqualified from results.

Samples from panel providers are generally trustworthy, as panel providers deploy their own mechanisms for maintaining an honest and active respondent pool. But if your survey is conducted outside the confines of a panel, there is a higher chance of contribution from respondents who are just making mischief, possibly to get promised rewards, whose answers are not genuine.

To determine where to set your tolerance, you need to get to know your own typical response patterns for the criteria described above (under “Keeping it Real). When answers fall outside of these, it’s time to raise a red flag.

Just as bad apples need to be disposed of to avoid the whole crop becoming unusable, ‘bad’ interviews need to be disqualified from survey results in order to come away with genuinely useful insights.

This is easily done in via the Nfield Manager for Nfield Online and Nfield CAPI.

Once you reject an interview, it is automatically removed from all counts related to successful completes and corresponding quota cells. So disqualification of ‘bad’ interviews may mean continuing your survey a bit longer to reach all the required targets.

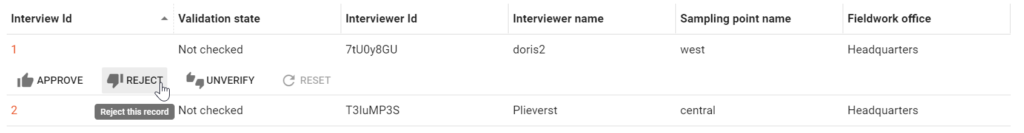

In Nfield Manager, go to the Quality Control tab. Here you’ll find a Qualification Control overview, as well as each individual interview’s validation status.

To disqualify an untrusted interview from survey results, simply select the interview ID and click Reject.

As an alternative to rejection, you can carry out positive selection by approving individual interviews. And if you aren’t sure whether to approve or reject an interview, you can un-verify it, indicating a requirement to conduct further checking.

Clicking “Reset” will restore all validation states to “Not checked”. This will include any interviews which had been set to “Rejected”, thereby re-including them in corresponding quota counts as successful completes.

If you want to automate identification and disqualification of untrusted interviews, this can be achieved by integrating appropriate tools with Nfield via an API. See API – Developer’s guide to learn more about Nfield API.

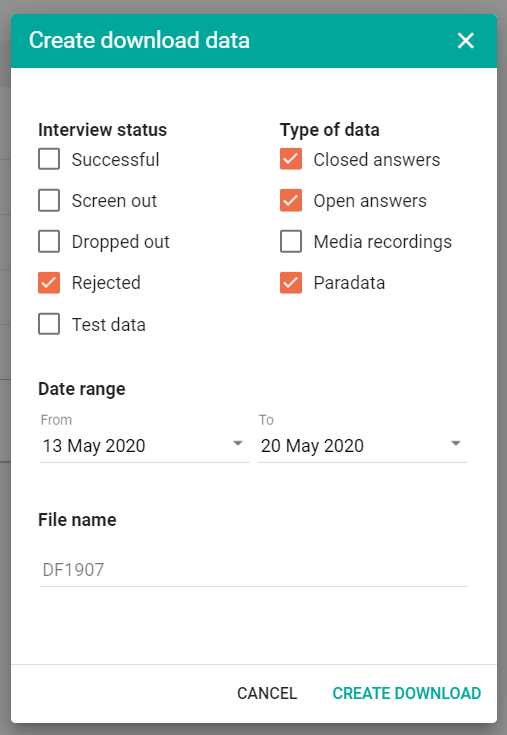

You can download a record of all rejected interviews in the same way as you do for other interview records.

If you have any questions or comments, please do not hesitate to contact us.

It is estimated that half of the world’s population uses two or more languages in daily life. This is no surprise to us, as 91.6% companies of our customers live in countries where the primary language is not their native one. With so many people having multilingual backgrounds, it’s a good idea to offer survey respondents a choice of languages, with the option to switch part way through.

This is because respondents sometimes choose to begin answering a survey in the local language, even when it’s not their native one, but start to struggle if terminology gets more specific. This could happen if questioning goes into detail about things such as medical issues.

Respondents can often deal with this using Google Translate, but that’s not ideal. Enabling language switching within the survey itself provides a far easier and more reliable experience, as you can control terminology and phrasing by embedding approved translations.

Nfield supports multiple languages with ease, allowing respondents to choose their preferred language at the start of the questionnaire. In the case of known individual preferences, these are automatically offered.

Thanks to a recently introduced feature, Nfield also now lets respondents switch language at any point during the survey. It’s as easy as turning a dial!

To create a multi-language survey in Nfield, you simply have to append the translations with the main script. The language switching feature is enabled by specifying the language codes. So, if the questionnaire is offered in English (“eng”) and Chinese (“chi”), the command should be added like this.*UIOPTIONS "languages=eng,chi"

When you have more translations, their language names should be added in the above with a comma separator.

The Nfield survey will automatically add a drop-down box on each page, allowing respondents to switch at any time without disrupting their completion of the survey.

If you have any questions about Nfield’s support of multiple languages within a survey, please feel free to drop us a line.

Good quality CAPI research relies on trustworthy interviews. You need to be sure fieldwork integrity isn’t compromised by interviewers taking shortcuts, submitting false responses. Nfield CAPI now builds on standard verification checks with an Audit Trail / Logging feature that highlights suspicious input patterns. By analyzing statistical details, this enables you to identify when interviewers are likely to be cheating the system, and take appropriate action.

Traditional quality control components such as field validation, logic checking, ordering and randomization are, of course, all supported in Nfield. For face-to-face CAPI interviews, additional features such as GPS locations, photographs and audio recordings can also be activated to provide evidence of interviews taking place. (More information about these can be found at Nfield’s quality control options for rock-solid CAPI data.)

All this gets you off to a great start, but still leaves room for cheating. To further close off the possibility of falsified responses, you need to look more closely at response input patterns. Nfield CAPI’s Audit Trail function enables you to spot the tell-tale signs of dishonest interviewer behavior, such as:

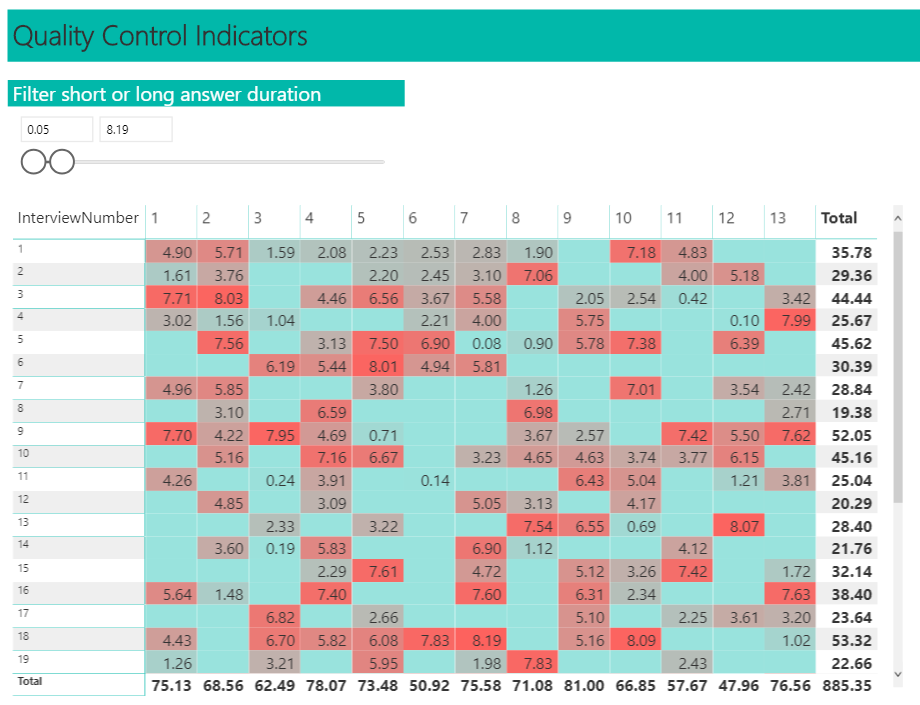

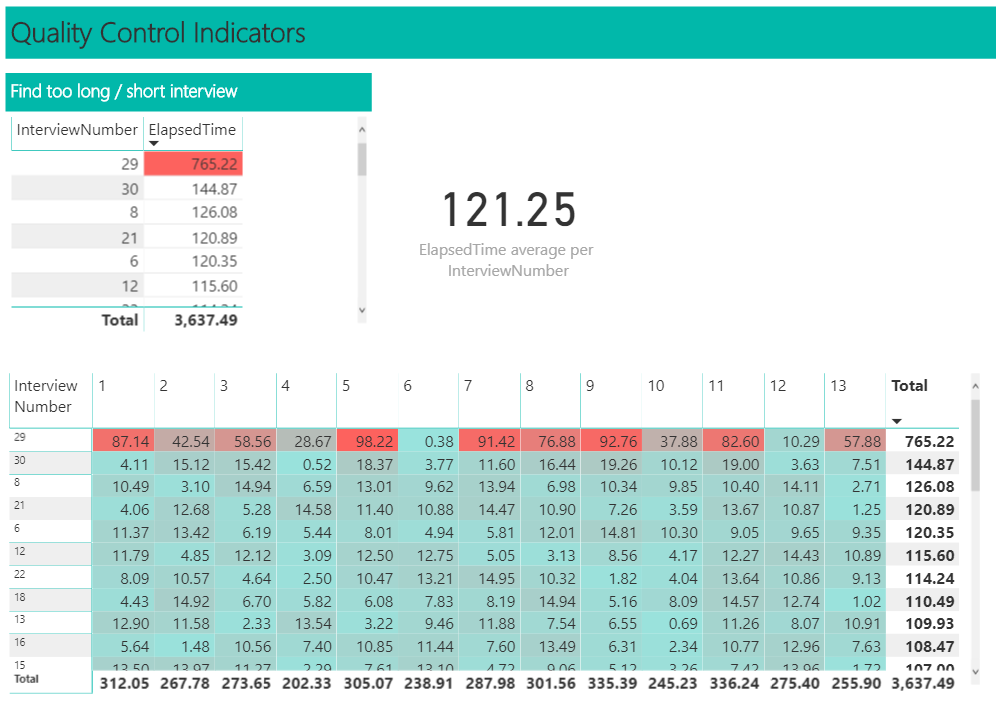

The data for annotated items 1, 2 and 3 can be found in the Nfield downloads:

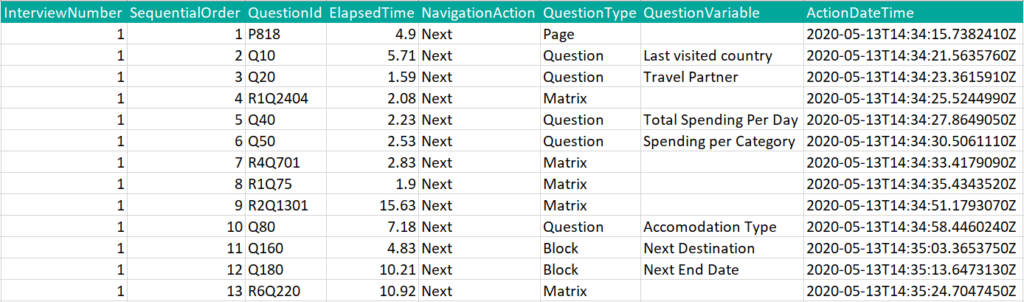

Nfield CAPI’s new Audit Trail feature records how long an interviewer stayed on a page and which button they clicked to move on. The results are provided in a csv file. The example below shows how this might look for a single interview.

You can compare each result line against your reasonable expectations and set benchmarks to flag up interviews that fall outside these parameters.

The best method for reviewing this is to build a report (in Microsoft PowerBI or other reporting system) to show suspicious interviews. Incorporating a drill-down function will give you an easy way to view more information.

The two illustrations below show how your reports might look.

Here, the results are sorted to show interview durations in descending order.

Armed with these insights, you can better fortify the quality of your CAPI surveys by eliminating falsified responses. Not only can you challenge interviewers whose input appears suspicious, and remove fake responses from your results, you can also use this feature to deter dishonest interviewer behavior from taking place at all.

And in case you are wondering, this Audit Trail feature will also be introduced for Nfield Online in the near future.

NIPO has introduced a new feature for Nfield, the Audit Trail. In this series of NIPO Academy sessions we will show you how to use this feature. With the help of Audit Trail, you can follow the journey of the respondent through your survey. You will see which questions were seen by the respondent, in what order these questions were shown, which navigation was used to move to the next question, how many times a question was shown to the respondent and how long it took to answer each question.

Have you ever concluded a survey to discover it’s generated many more completes than specified in your quota targets? This is called Quota Overshoot, and it happens when a lot of respondents fill in a survey at the same time. Quota Overshoot doesn’t reduce a survey’s quality, but it does result in higher-than-necessary expenditure on reward, sample and interview costs.

The good news is Nfield’s Max Overshoot feature enables you to control the number of excess completes, and so avoid unnecessary costs.

To understand how Max Overshoot works, you first need to understand why Quota Overshoot happens. The one-word technical answer to this is ‘concurrency’.

Concurrency is when two or more respondents are filling in a survey at the same time. For the most part, this is exactly what you need to get your survey completed in the shortest possible time. But if multiple responders remain active when just one more complete is needed, you’ll end up with more completes than the quota. This is because all the interviews already underway at the moment of the last required completion will also continue to completion

Nfield’s Max Overshoot feature gives you control over excess completes by limiting concurrency as your survey nears completion. You can set it to reflect your preferred balance between speed and excess respondent costs

To explain how this balance shifts, let’s play the Plane Game. Or in these COVID-19 times, imagine playing it!

THE GOAL:

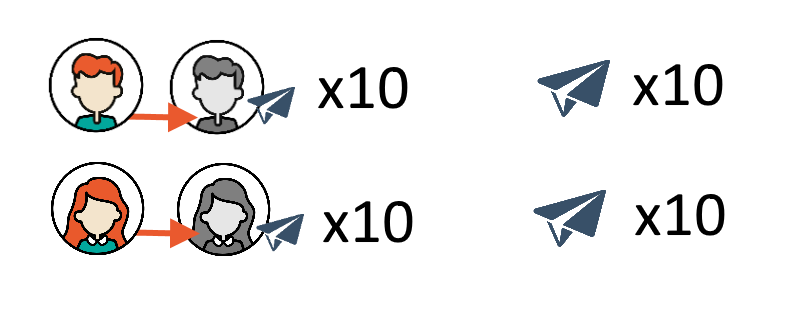

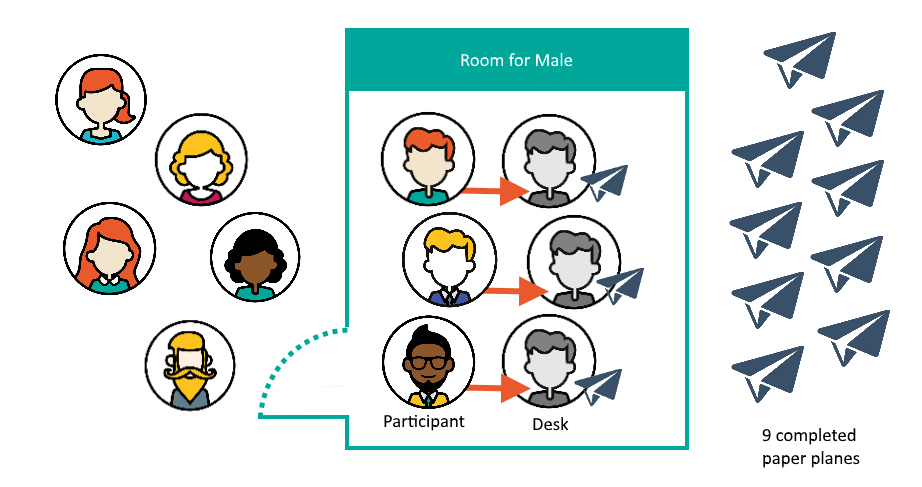

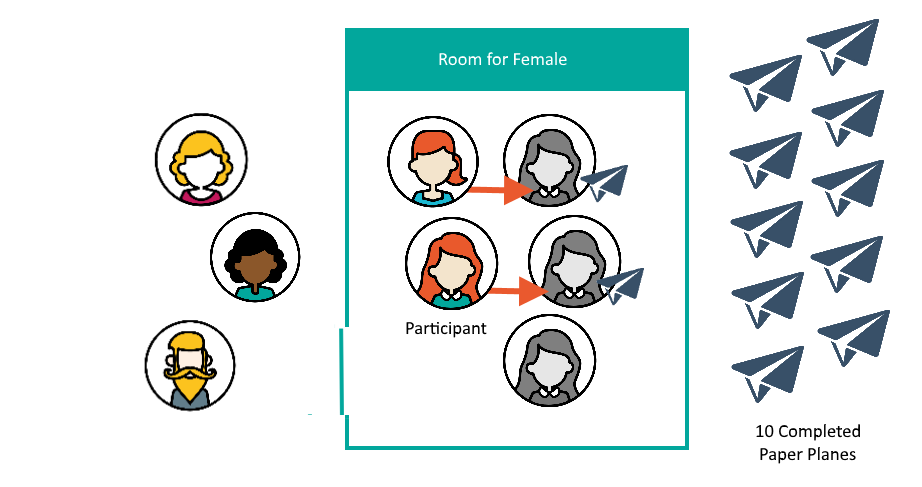

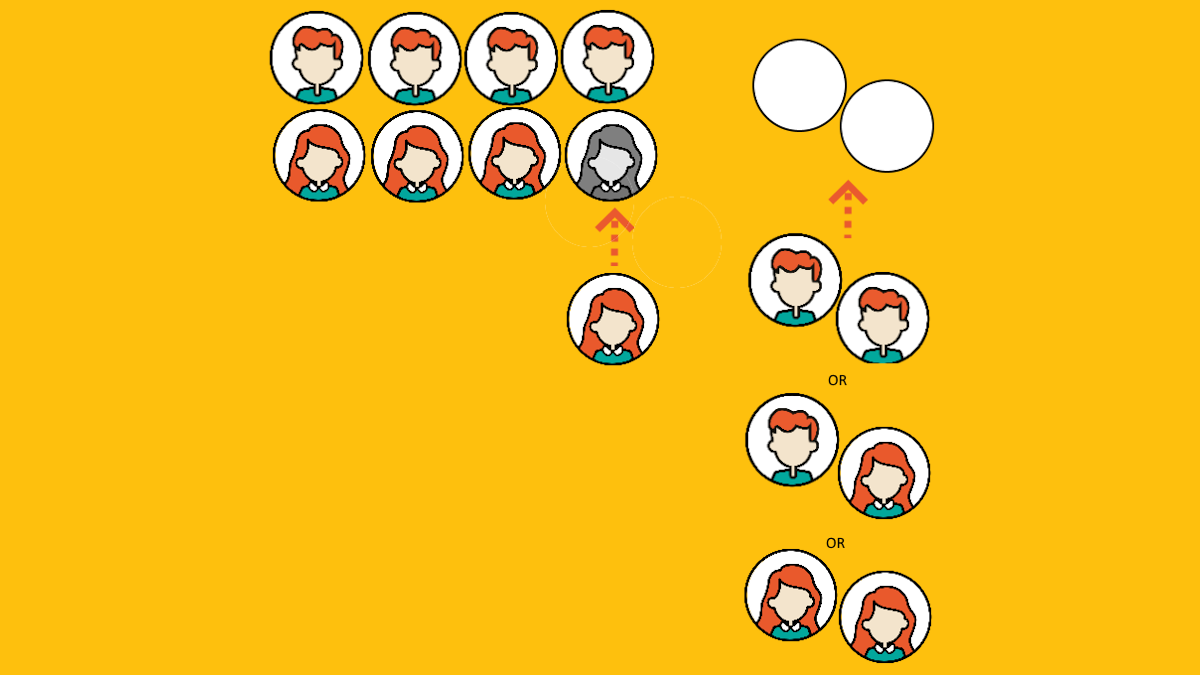

Get 20 paper planes made, each by a different person. Of these, 10 have to be made by males and the other 10 by females. (Want to know how to make a “world record paper plane”? This video shows you!)

THE RULES:

Each plane-maker has to sit at a separate desk while performing the task. When finished, they vacate the desk for a new plane-maker to take their place. This all happens inside a room that players can only enter when a free desk is available. Players who’ve completed their planes stay in the room. Players who decide to give up have to leave the room. When you’ve reached the target number of planes, no more people can come in.

Everyone in the room at the moment the last required plane is completed gets a voucher worth $8 as a reward, even if they’re still finishing their plane.

SCENARIO 1:

You invite a lot of people (let’s say 100) to participate and provide the same number of desks. This way, everyone is making planes at the same time, with nobody having to wait their turn.

This will produce a really fast result. But because you had 100 people in the room, and none of them had given up at the point the 10+10 target was reached, you have to pay them all. That’s a bill of $800.

SCENARIO 2:

You have two rooms, each with just 3 desks. One room is only for the males, the other only for the females. Both rooms operate at the same time. Once 10 male planes have been completed, the male game ends. The same applies for the female game.

This limits each category’s concurrency and, as a result, the number of participants in both rooms combined when the targets are reached will only be 24. An excess of two males and two females. The total reward payout will be just $192. But the game will have taken much longer to complete.

Of course this Plane Game is a metaphor for respondents completing surveys, with the two scenarios illustrating extreme ends of the cost vs speed spectrum. As a market researcher, you’ll probably be looking for a happy medium. Nfield achieves this via a formula which changes the number of “desks” as each quota target comes closer to completion. All you have to do is set your desired Max Overshoot number per quota target.

|

If we illustrate this according to the Plane Game, per quota it looks like:

|

One new participant is allowed to start after each new complete ONLY IF Successful Completes < the quota target. (Nfield doesn’t allow new interviews to be started once quota target for successful completes has reached its maximum.)

As completes start to accumulate, the number of desks gets reduced. This limits the number of active participants and, in turn, the number of excess participants at the time each quota target is reached.

Quota target = 10

Max Overshoot = 2

| Number of successful completes | Number of desks available | Maximum number of active participants |

| 0 | 12 | 12 |

| 1 | 11 | 11 |

| 2 | 10 | 10 |

| | | | | | |

| 8 | 4 | 4 |

| 9 | 3 | 3 |

| 10 | 2 | 2 |

You can set the Max Overshoot to zero to keep costs to an absolute minimum. However, it will take longer to achieve the final complete as, by the end stage, only one respondent can be active at a time, which will amplify the effects of any drop outs.

You can make a judgement call on how seriously this might impact things by looking at your survey’s dropout data in Nfield.

Two important points to note when using Max Overshoot:

Max Overshoot can be a very beneficial feature for controlling costs and provides flexibility to balance cost against speed. However, it does make quota evaluation more complex and may put a big load on Nfield processors. We are therefore rolling it out gradually and are currently only enabling it upon request. To enable Max Overshoot, please contact your account manager. At one point, we will enable this feature for all domains.

If you have any questions about Nfield’s Max Overshoot feature, don’t hesitate to Contact Us.

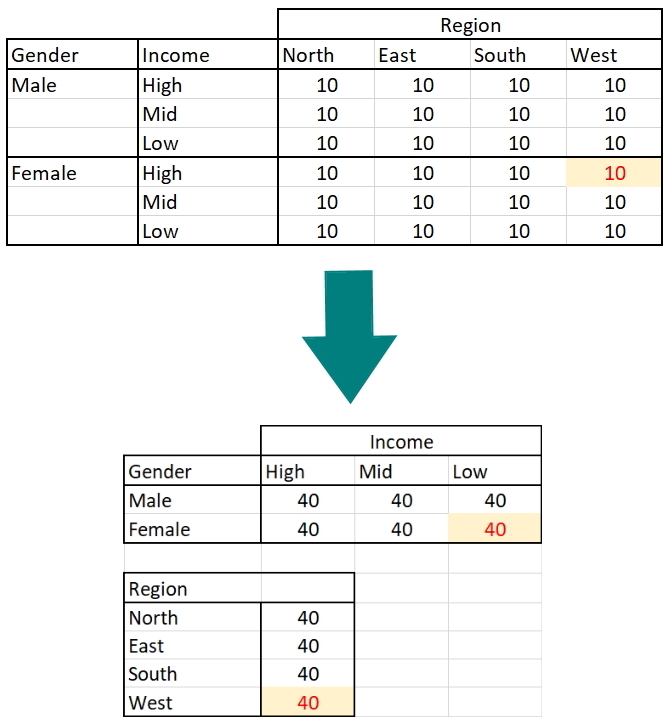

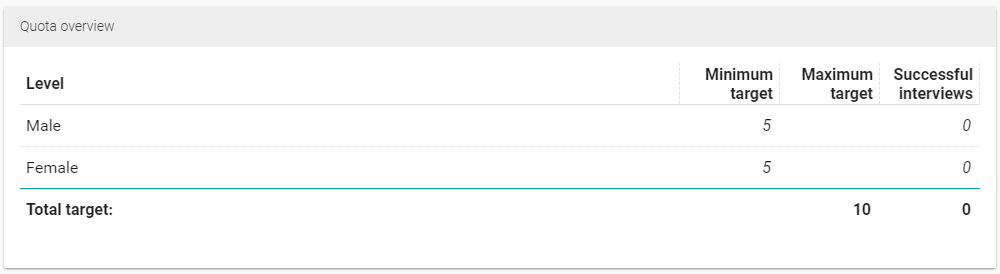

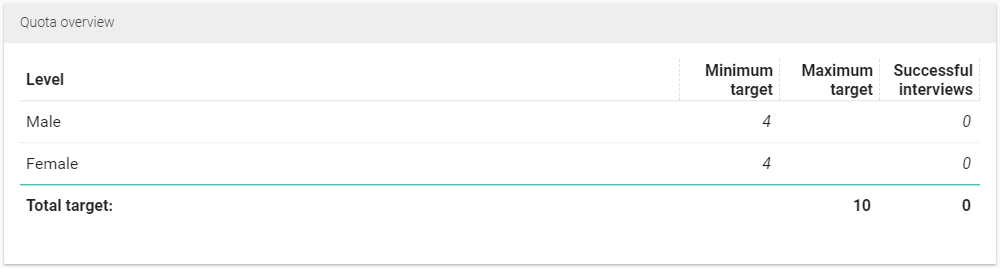

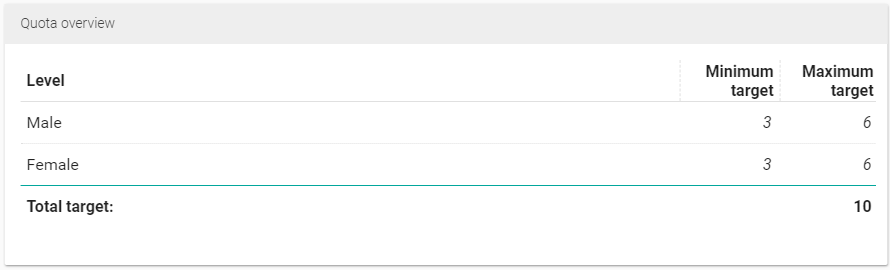

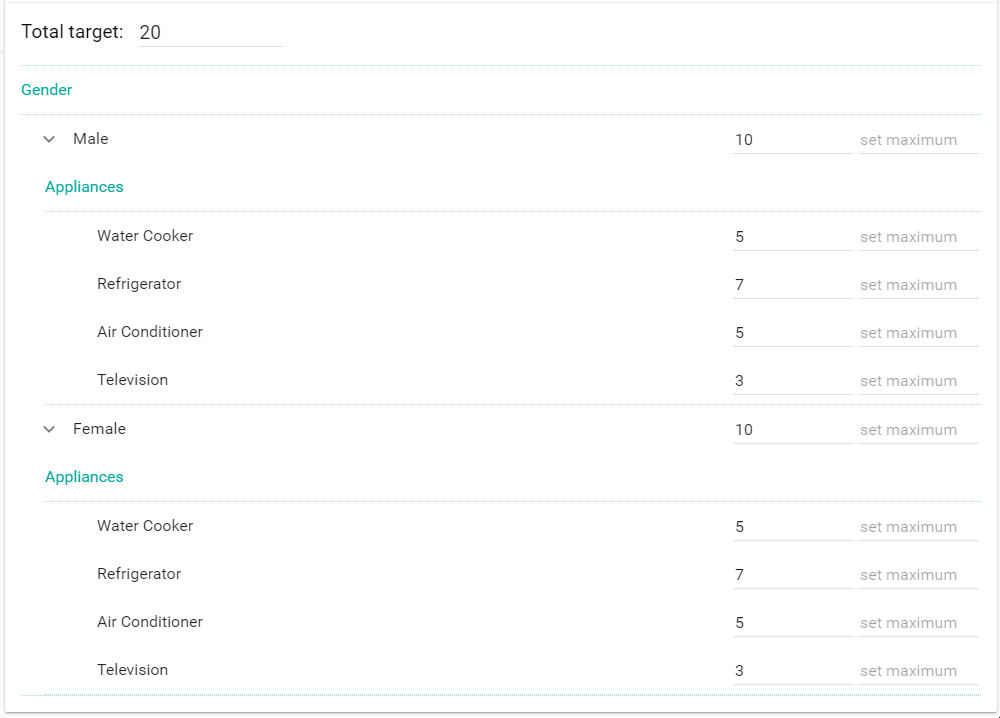

Quota management is important in fieldwork management. It ensures you have a representative demographic distribution and a good control on the cost (sample fee, respondents’ rewards, Nfield complete fee, etc). It starts with a simple concept – You set a limit of how many completes (5 males + 5 females = 10 total) should be done to meet your quota requirement. In this article we introduce the quota basics and variations and how you manage your quota well.

We will use visual illustrations to show the quota concepts available in Nfield:

Let’s start by creating an example for the basics using Minimum Quota.

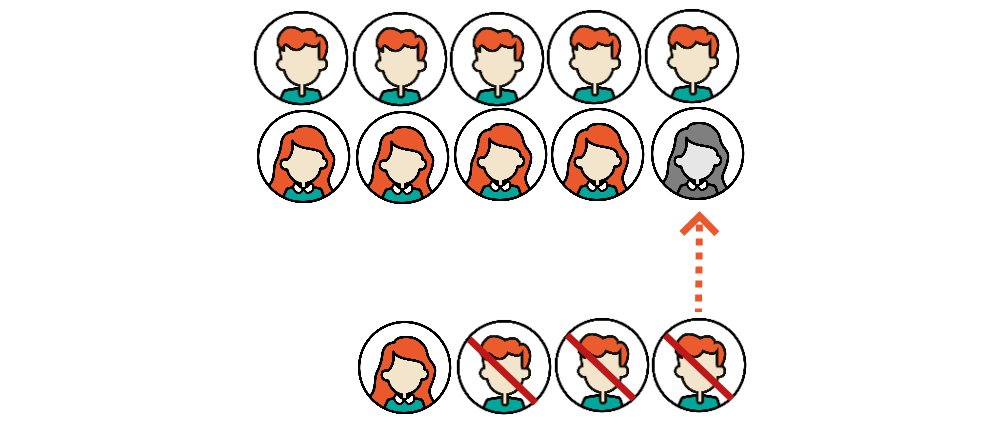

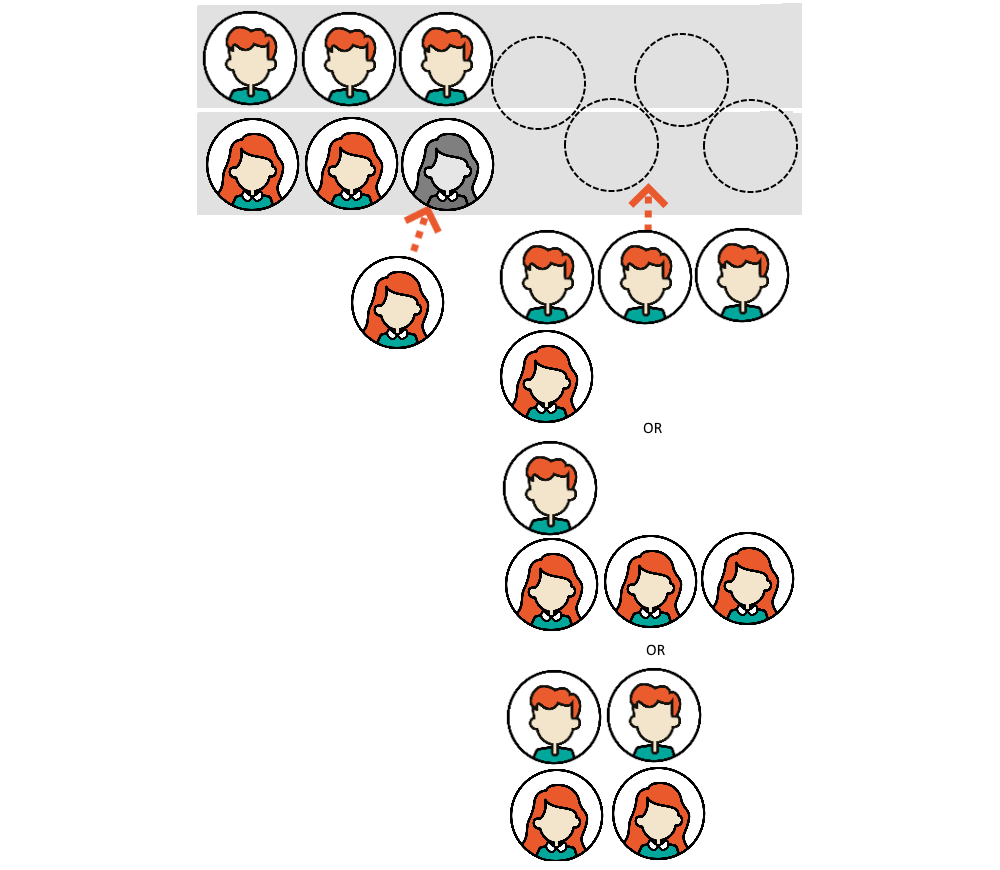

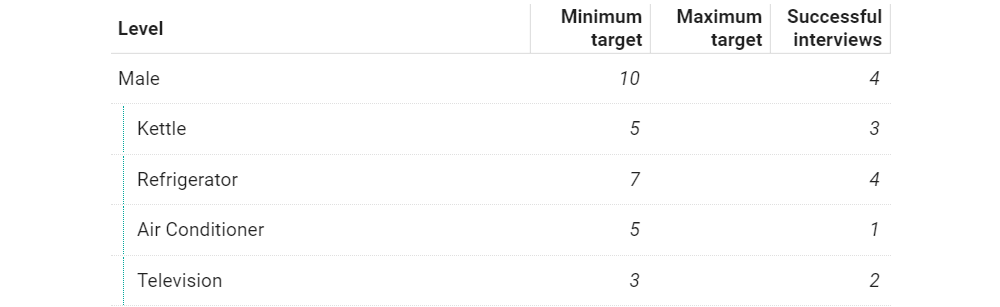

At the end of the fieldwork, when you are missing one final interview (the 10th respondent) needed for the quota target there’s a chance you may not get this straightaway (a female in this case, see the image below). It would be a waste to interview respondents and keep screening them out (3 males in this example) before the last female respondent is found.

When your quota requirements get more complicated (e.g. a female of 20-25 year old living in a small city who purchased a specific wine in the last year), we would need to screen out even more respondents. To have more flexibility in the quota design, you can make use of minimum targets.

In this example, we fixed 80% of the required gender distribution and left 20% of the sample free in the choice of gender. Anyone can take the final two spots (20%) of the target. The principle behind this¹ is to fulfil the minimum gender target (so one female spot in grey is reserved) and limit the total target by setting a maximum. So once the minimum targets are fulfilled, it is more flexible for accepting the last ones instead of screening them out.

Benefits of this use of minimum targets are:

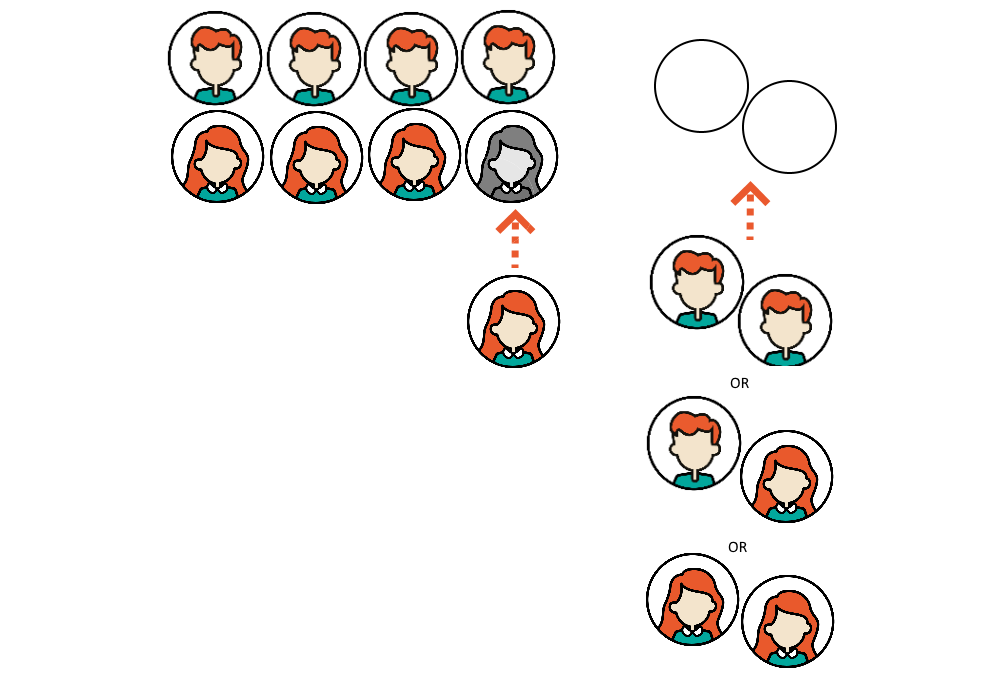

Quota requirements can be complicated. You may have different quota cells, interlinking with each other. Some quota cells are more important than the others. Together with minimum targets, you can have good grip of your quota control.

We revise the minimum quota example with smaller minimum targets.

Nfield ensures 3 minimum males and 3 minimum females and has 4 spots to be filled in by anyone. In extreme cases, it can be 7 males or 7 females.

Having 70% males may seem too much. To add a control on this, maximum targets can be added on the quota cells.

To understand this, we now add a border (maximum target) on how many circles can sit in one gender row. 3 males and 3 females are minimum targets. They must be filled. The total maximum target is 10 (ten circles in total), meaning four circles/spots are available. However, only three circles can sit in one row (in the male row or the female row). Then you can have 3 to 6 males or 3 to 6 females, totaling 10.

Benefits of a mix between minimum and maximum targets are:

This allows the survey to use routing based on the least-filled quota or offer selections based on a list ordered by least-filled quota. It helps lagging-behind quota to catch up by giving them advantages on higher position in the answer list or on routing to their sections. The following scenarios may sound familiar.

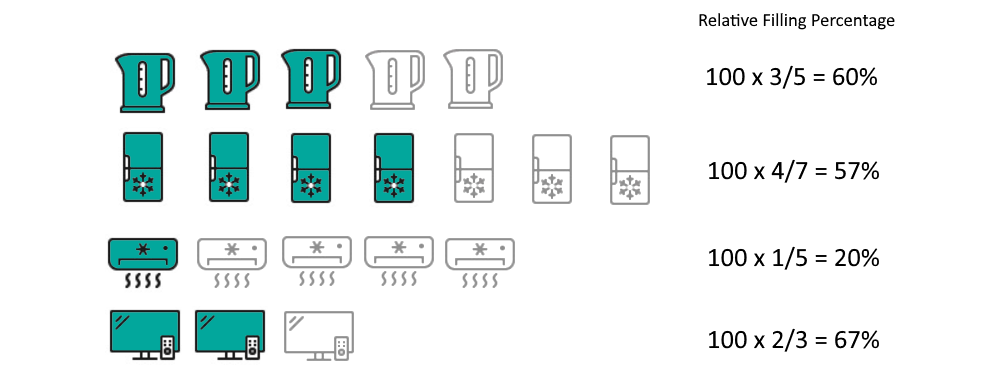

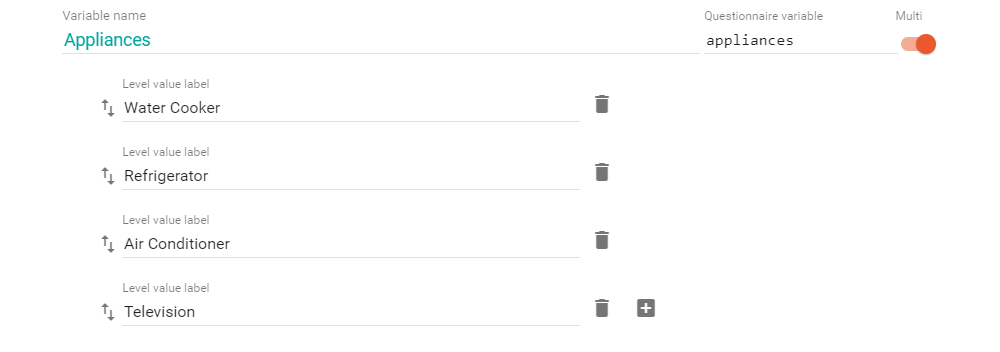

The how-to is quite simple, with the use of command *GETLFQLIST (which literally means Get Least-Filled Quota List). It returns the quota list in its ascending relative filling percentage based on minimum target values. With the following example, the relative filling percentage is calculated like this: 3 completes on electric appliance kettle out of 5 targets, giving its relative filling percentage as 60%. The least-filled quota list will now show the order: Air conditioner (the least filled), refrigerator, kettle, and last television. You can then route your survey to show the section of the air conditioner.

The most needed quota item gets answered first, resulting in earlier completion of the quota and saving costs by using less sample.

Least-filled quota can apply to multiple quotas too. You may ask “Which electric appliances have you used yesterday?” or “Which brands you have purchased in the last months?” Respondents can give multiple answers. The questionnaire can route to show one/more section(s) of the least-filled answers (appliances/brands) of his/her answers. Or it shows a follow-up question with his/her answers in an ascending relative quota filling. The most demanding quota is at the top, which hopes to gear the respondent’s selection to that item.

In Nfield, you can toggle the “Multi” button on in the Quota page.

And multi quotas should always be at the root (thus the lowest in the nesting quota frame). It can be standalone, or nested under another quota cell, but not having other quota cells under it. As one respondent gives multiple answers, the counts would not sum up nicely. In the following example, the minimum target is 10 male and 10 female with a total of 20. These numbers are controlled gender quota variable, not in the minimum targets set for each appliance. The minimum targets in each appliance are used as the calculation of the relative filling which is 100% x (minimum target – number of respondents in that answer). Another important note is that the multi quotas do not contribute to quota check itself.

Then this *GETLFQList command can be used to return its result.

When the quota status is like the following (same as the example in least-filled quota), the relative quota filling in ascending order is air conditioner (20%, the least filled), refrigerator (57%), kettle (60%), and last television (67%).

See this in action:

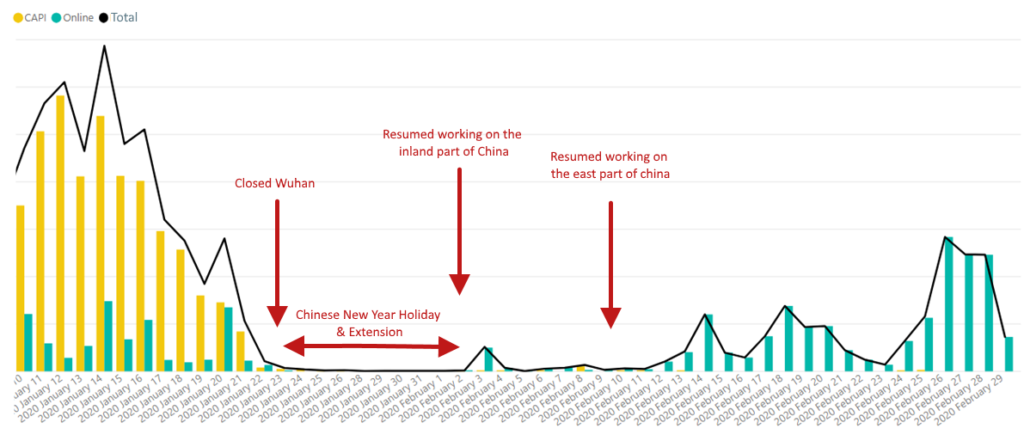

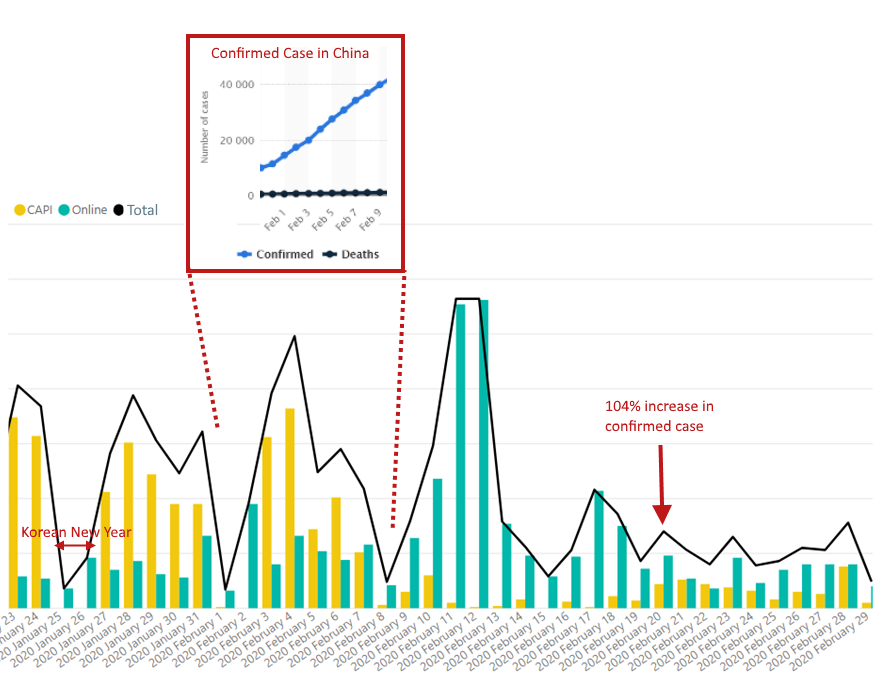

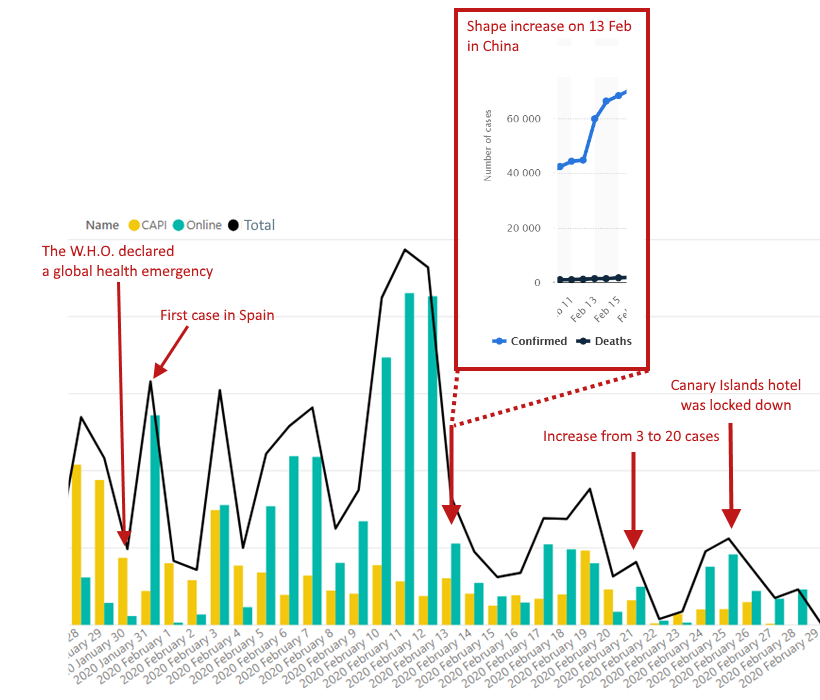

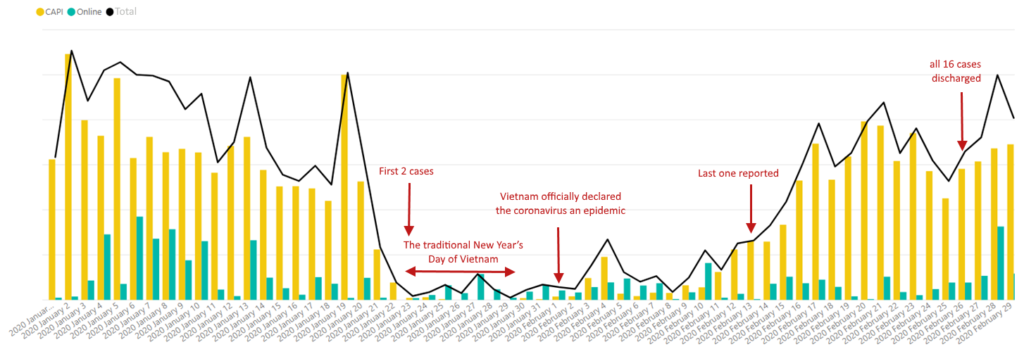

With the spread of coronavirus (COVID-19) disrupting daily life all over the world, we’ve noticed the changes in human activity being reflected in Nfield surveys. As regions have gone into lockdown and people have been discouraged, or even ordered, to avoid contact with others, CAPI interviewing has become all-but impossible in some places. Where this has been the case, there has been a significant increase in Online surveys to compensate. To illustrate, we’re sharing usage patterns for Nfield CAPI and Online in our China, South Korea, Spain and Vietnam deployments, so you can see how survey execution has changed along the coronavirus timeline.

While we are, naturally, as concerned about the situation as everybody else, we are pleased to see that our customers have been switching between Nfield CAPI and Online without any problems. This is because we developed these two survey channels with the same scripting language and result format. Switching can therefore be done in just a few minutes, with minimal support needed from our helpdesk.

Nfield CAPI vs Online in China

At the time of writing, China remains the country most heavily impacted by coronavirus (COVID-19). This is reflected in a uniquely dramatic shift in survey channel usage. In normal times, CAPI very much dominates China’s survey activity. But with public spaces mostly deserted, and people being reluctant to interact with researchers, face-to-face interviews have almost completely ceased. Meanwhile, Online surveys have increased significantly to fill some, although not all, of the gap.

The correlation between Nfield usage in China and events on the coronavirus timeline clearly confirms how these are linked. A decrease in survey activity before long holidays such as Chinese New Year, which began on 25 January 2020, is common. Our graph shows an expected reduction in CAPI fieldwork leading up to this. Survey activity remained extremely low while the Chinese New Year holiday was extended to 2 February, due to the disease. As people gradually started returning to work in Beijing/Tianjin/Hubei/Sichuan, albeit from home, survey activity resumed on a very small scale. After the first ten days this increased to some extent, but almost exclusively via Online.

Nfield CAPI vs Online South Korea

As of 5 February, there were fewer than 20 confirmed cases of coronavirus in South Korea, although the gradual increase in neighboring China was starting to cause alarm in other countries. By 7 February we were seeing a drastic decrease in CAPI face-to-face interviewing, while use of Nfield Online grew to twice its normal amount. As widespread infection took hold in South Korea, Online survey usage tailed off again to normal levels. Meanwhile, CAPI diminished greatly, but not completely.

Nfield CAPI vs Online in Spain

Spain’s Nfield usage pattern is very similar to that seen in South Korea, although the early February switch from CAPI to Online happened sooner and more drastically than in South Korea. In Spain, a 3-day Online spike suddenly dropped off again on 13 February, after which there was a reduction in both CAPI and Online. CAPI continued to play a diminished role in Spain’s survey landscape until the last two days of the month.

By 5 March (a week after CAPI all-but disappeared from use), the Spanish government advised companies to send workers home to reduce contact. On 6 March, Spain ranked 7th in the world for the number of confirmed cases. We expect to see the impact of these measures in March volume reports.

Nfield CAPI vs Online in Vietnam

Thanks to prompt and decisive governmental action, Vietnam did a very good job of containing the spread of coronavirus and preventing it from getting out of control. Like China, Vietnam had a relatively long new year holiday. However, the Vietnam government declared coronavirus to be an epidemic at a very early stage, on 1 February, when the number of confirmed cases stood at 6. As a result, Vietnam only had 16 reported cases, with the last one declared on 13 February. Usage patterns for both Nfield CAPI and Nfield Online very quickly returned to normal when new cases stopped being reported.

A WHO official, called Park, told Al Jazeera¹: “The country has activated its response system at the early stage of the outbreak, by intensifying surveillance, enhancing laboratory testing, ensuring infection prevention and control and case management in healthcare facilities, clear risk communication message, and multi-sectoral collaboration.”

Hoping for a speedy recovery

At the time of writing, nobody knows how things will develop with coronavirus. As with the rest of the world, we are very much hoping the disease will be contained, cured and eradicated quickly. In the Netherlands, which is our home base, the first case was confirmed on 27 February. This was relatively late compared to other European countries. In 9 days, the number had risen to 128 cases. Everyone has to remain on high alert. We hope our customers worldwide and teams in the Netherlands, Spain and India are able to stay healthy and strong.

We proudly present our Nfield Top 15 Customers! We would like to take this chance to give them a round of applause and to recognize their project success with Nfield. Conducting projects in Nfield means they have also put security and data compliance to their top priority as we do.

Fully compliant practices and ISO 27001:2013 certification in our data collection solution Nfield means you can rest assured when it comes to data security. There is a strong security policy to ensure that your data are safeguarded. Nfield includes features to assist in the efforts to address GDPR controls enabling you to take care of consent management and other important privacy requirements.

These top 15 customers are selected based on their usage in 2019. And the winners are (in alphabetical order):

Nfield comes with a build-in reporting tool, that we keep enriching with new features. In this series of NIPO Academy sessions we will first do a quick refresh on the features of the Fieldwork Overview report, then focus on the select, relabeling and split/merge transformations that have recently been added.

Request a demo to see how NIPO can help you meet your requirements with our smart survey solutions.