Get a first impression, scheduled soon.

Request a demo to see how NIPO can help you meet your requirements with our smart survey solutions.

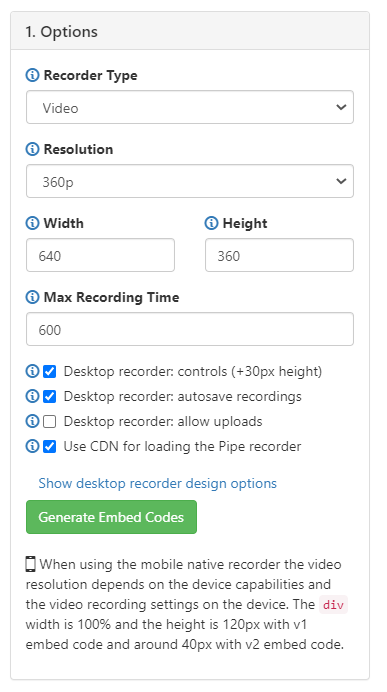

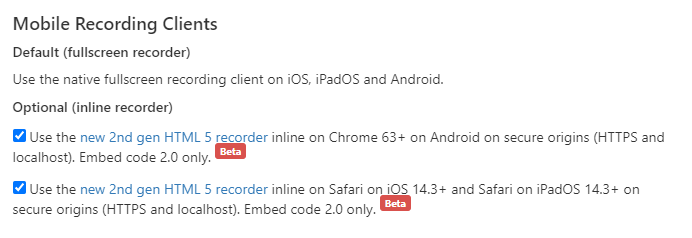

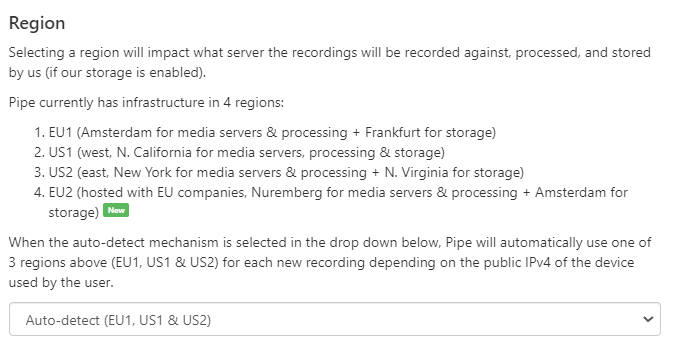

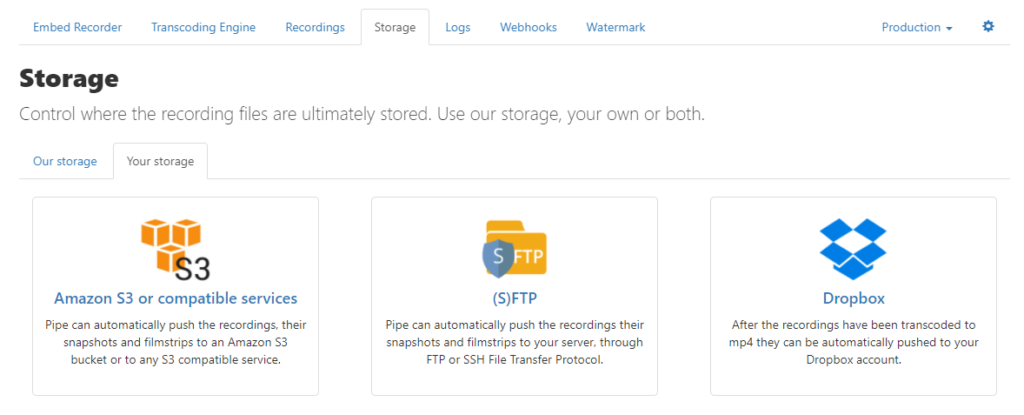

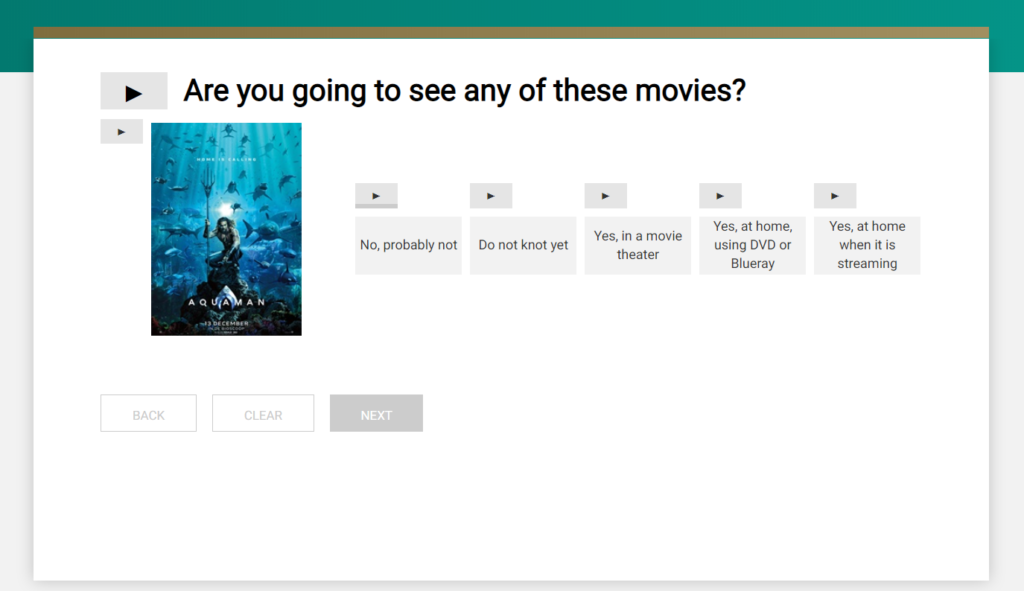

If you’d like to incorporate audio and video responses within Nfield surveys, you can do this by integrating Pipe’s recording platform. Below is an example of how this feature might be useful.

Incorporating Pipe into Nfield surveys requires specific technical expertise. You’ll need someone who is

Gather your resources

| Note: You should set the display size according to the device your respondents will use. It is also possible to make the sizing responsive to a range of device screens. Please refer to Pipe’s own instructions for this. |

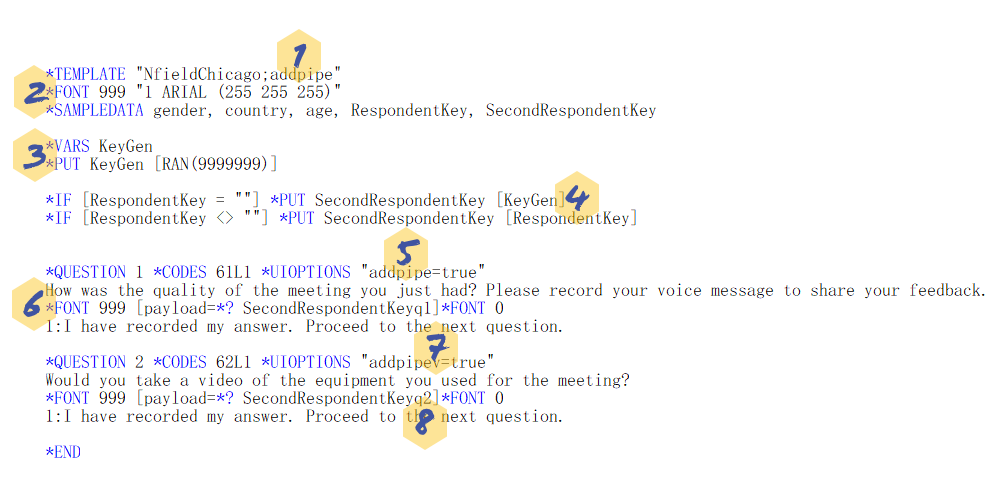

Here is an example of ODIN script that will show an audio recorder and a video recorder. You can also download the script here. See beneath for explanations.

| Note: The higher the random number, the lower the chance of the duplicate SecondRespondentKey being made. You should therefore check this or decide which recordings to pick in the data processing part. |

| Note: Once each recording is uploaded to Pipe, you might want to add *BACK to prevent re-recording or do a check on re-recordings (spotted by same payload). |

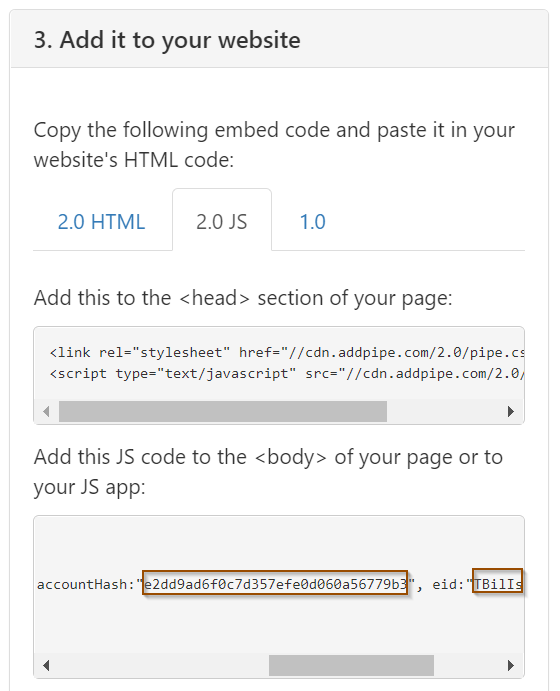

accountHash:" YourAccountHash", eid:"YourEID"YourAccountHash and YourEID with the JavaScript values previously generated in Pipe. (See step 5 in Setting up Pipe.)

| Note: These recordings will be out of scope of Nfield. You should therefore be aware of the location where the data is stored, along with any different security and compliance levels. |

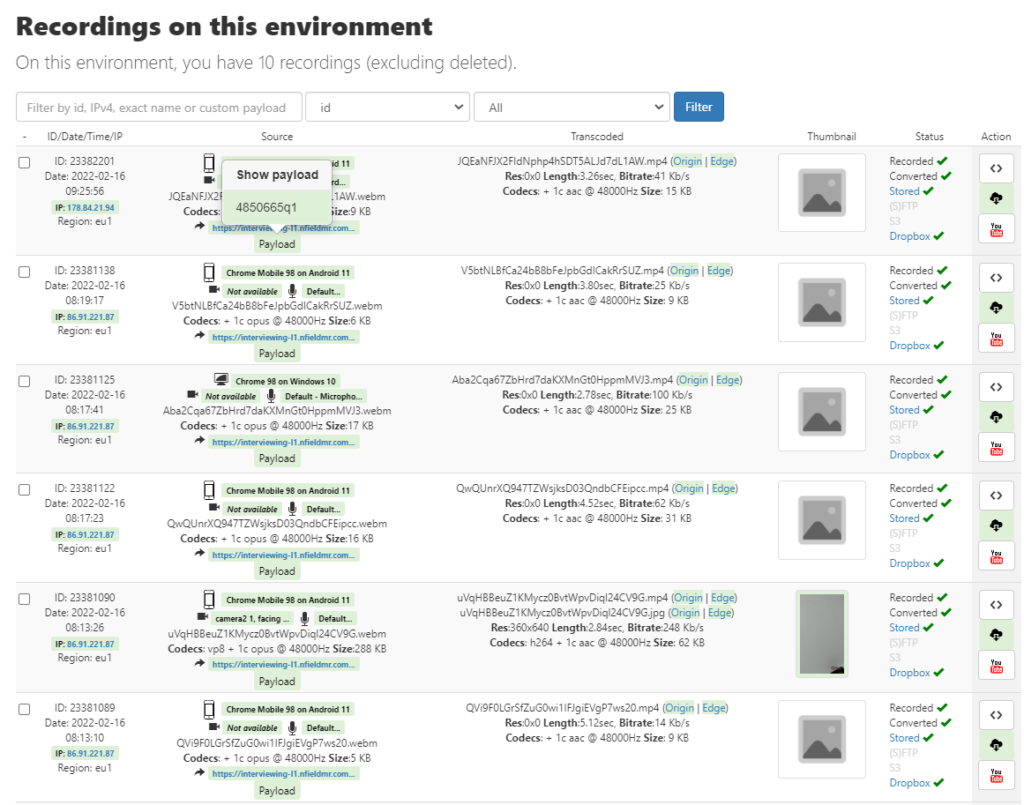

It would be too labor intensive to click every individual record to find the payload information (respondent key and question id) to rename its recording file. But you can automate this task by using a webhook to send the payload and file name to trigger file renaming (optimally in batches). Please refer to the Pipe Webhook documentation for how to use their webhook. Alternatively, you can program something yourself or use other codeless automation tools, such as Microsoft Power Automate, to do the work.

We hope you find these instructions useful. Please feel free to share your feedback with us.

NIPO has released a Markdown theme to be used on top of the NfieldChicago template. With this theme you can use various Markdown language commands in your survey to highlight text, organize the survey page and style your survey. In this series of NIPO Academy sessions we will explain how to use this theme and demo some of the new options it provides.

Attractive, easy-to-digest presentation plays an important role in encouraging survey response. Nfield automatically wraps surveys in a professional design that’s consistent with our industry’s highest standards. Most of the time, this provides everything our users need. However, there can be occasions when you want to customize your presentation more extensively.

Experienced scripters with knowledges of common web development techniques (Javascript and CSS) can add extra presentation elements by incorporating their own theme packages (via a zip file).

Markdown is a lightweight markup language that can be used to add formatting elements to plaintext documents.1 It is very popular, especially among developers, and is widely used by our own teams and in Nfield documentation.

We’ve added a new pre-packaged theme (markdown.zip) to the theme example section in NfieldChicago documentation for you to use. This includes a third-party library as a Markdown parser, which provides you with additional options for formatting your text using basic Markdown syntax.

Here’s how it works.

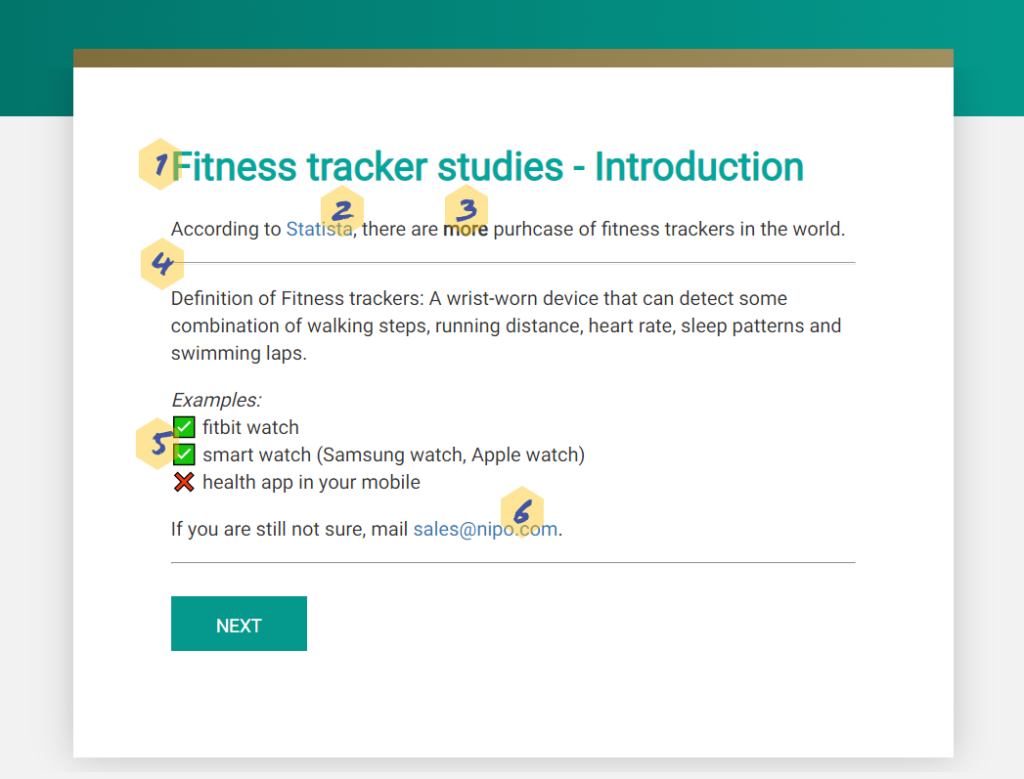

Adding headers improves respondents’ experience, by clarifying where they are in the survey.

These are created by simply using # for header 1) and ## for header 2) …etc.

Links are sometimes useful for enabling respondents to reference relevant information, which helps them understand context and increase their trust.

A clickable link that opens in a new tab is created by using [text](url) "optional hover-over text".

There is no need to define bold, italic and bold and italic for every different font.

In Markdown language, this is achieved simply by using _italic text_, __bold text__ and ___bold italic text___. This results in much simpler, easier to read scripts.

If you want to add supplemental information to help respondents answer specific questions, enclosing this between two horizonal lines makes for a good, clear presentation.

A line can be created in Markdown by using ---.

Millennials are more likely to engage in surveys that are presented in a more visual and gamified way. Emojis3 are also a good tool in this regard.

You can now copy and paste emojis to your script. See a list of emojis in Unicode 1.1.

It is usual to provide a means of contact either at the beginning or the end of a questionnaire.

You can now easily incorporate a clickable link by enclosing your email address as shown here <[email protected]>. This will launch the users email program / app.

Instructions for doing this begin at step 7 of 10 Steps to create a theme. If this will be your first time incorporating a theme in Nfield, we recommend watching Academy #6 NfieldChicago theming.

The world of Markdown is quite extensive, with possibilities ranging from standard headers to more advanced options. Please look at theming in NfieldChicago documentation to download and try this out. We also have another example theme available for setting font colors called markup.zip (See bottom right for download link). Please feel free to share any feedback or questions you have about themes with us.

NIPO is proud to announce the opening of our new Mumbai office. In recent years we have seen a strong growth of our business in the Asia Pacific region, something that also was the result of our Nfield China deployment we launched 2 years ago. This major step is now followed by the opening of our new office in Mumbai, that has been in business as of 1 November 2021.

The NIPO Mumbai office will be dedicated to supporting our customers in the Asia Pacific region, with backup from the NIPO Helpdesk in Amsterdam.

NIPO offers remote support to all Nfield users by email (no telephone at the moment, due to all staff working at home for reasons related to Covid), hosts Nfield introduction sessions and on-site training sessions on topics ranging from survey creation to fieldwork management.

Office contact details:

3rd Floor,The ORB

IA Project Road, Andheri

Mumbai 400099, India

We are delighted to announce the opening of this new office and look forward to supporting you from Mumbai!

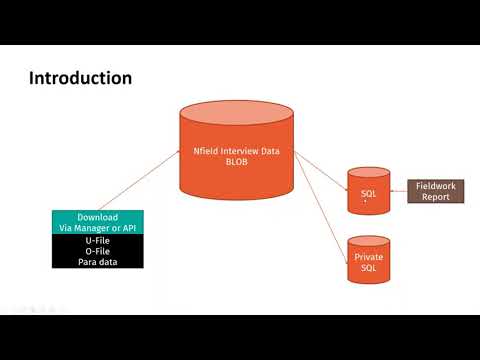

In this new series of NIPO Academy sessions we will do a short recap of the standard fieldwork report, but most time will be spent on how to create a private data repository and how you can use this to create your own reports.

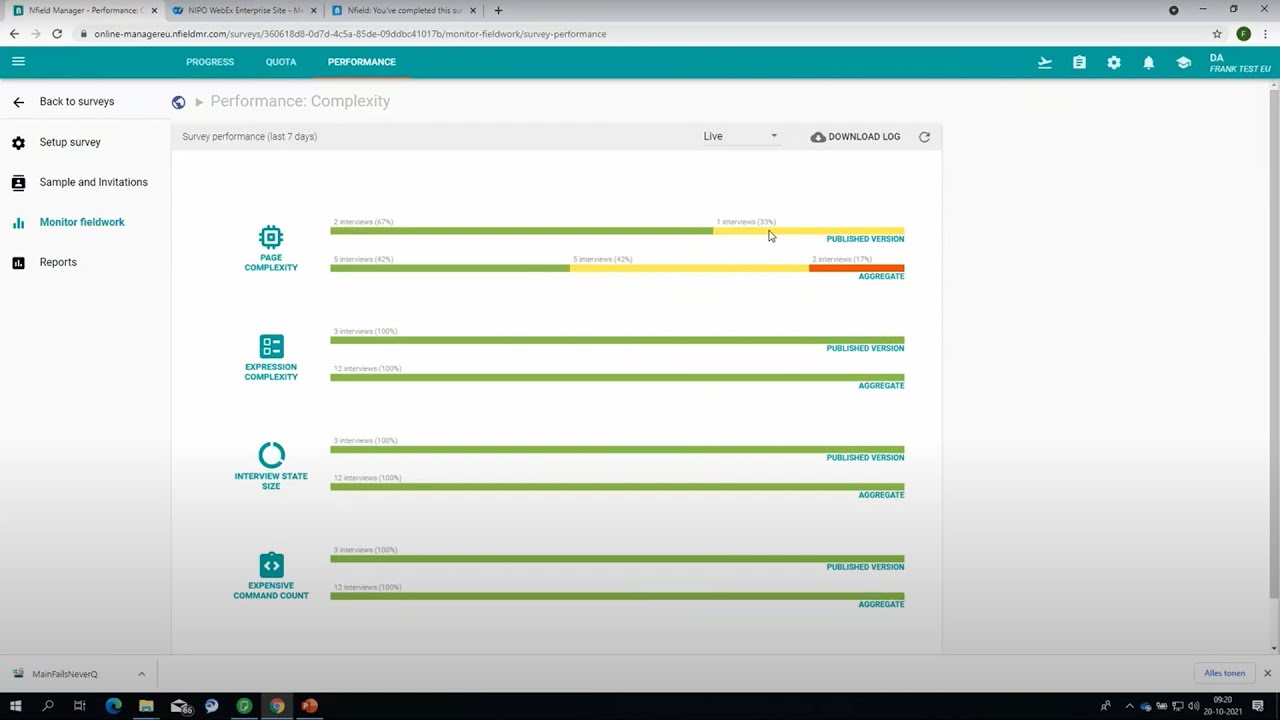

Recently NIPO introduced Survey performance for Nfield Online, as part of fieldwork monitoring. Survey performance metrics are very important to make sure that your survey is technically running fine. But perhaps even more crucial is that these metrics give insights in how your respondents are experiencing your surveys.

Nfield’s Voice Over feature is a very useful tool for both Online and CAPI surveys, which can be used to overcome visual impairments (Online), interviewer bias (CAPI) and local dialect differences (CAPI and Online).

By voicing survey questions and the various response options, Voice Over broadens the scope of people who can contribute to answering surveys.

In particular, it provides the following benefits:

Nfield has recently enhanced its Voice Over functionality by making it possible to play audio for questions and answers separately. So users can repeat-play specific answers for clarification, without having to listen to the entire question with all its answers over again.

Go to the page produced by our NfieldChicago team for a simple demonstration of Voice Over in action and instructions for implementation. You’ll also find this in the NIPO Academy video #19.

Setting up Voice Over isn’t difficult. It simply needs some patience for the time taken to link each separate audio file with each part of the question.

If there’s anything else you’d like to know about using Nfield’s Voice Over feature, don’t hesitate to contact us!

Having achieved gold status for the Application Integration competency for the Microsoft Partner Network at the end of last year, we are proud to share the news of NIPO’s success in achieving an additional Silver status for the much desired Security competency.

The competencies Microsoft awards are a strong confirmation that these partners have demonstrated the highest, most consistent capability and commitment to the adoption and implementation of the latest Microsoft technology. Securing a competency is highly dependent on successful certification of technical staff, which implies a deep and continuous investment from both the organization and the individual software developers.

Our Nfield users can benefit directly from NIPOs status within the Microsoft Partner Network. Next to our annual ISO 27001-2013 (Information Security) certification, this is another proof of leading external recognition for the NIPO team and our Nfield platform. This information can be used in client pitches for those projects where Nfield, as Kantar’s destination platform, is used and where the customer would like to understand how, for example, security is addressed.

Securing the Silver status for the Security competency was one of our goals for 2021. Now the NIPO team will continue her efforts to upgrade the Security competency to Gold status.

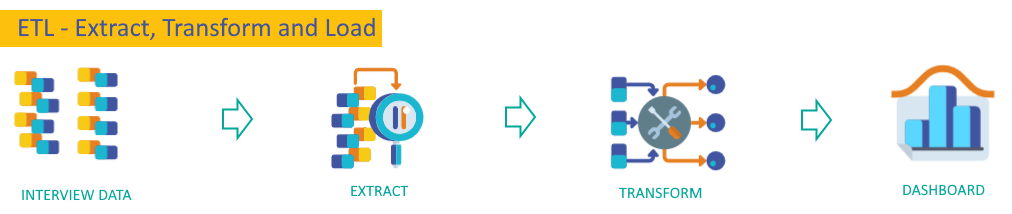

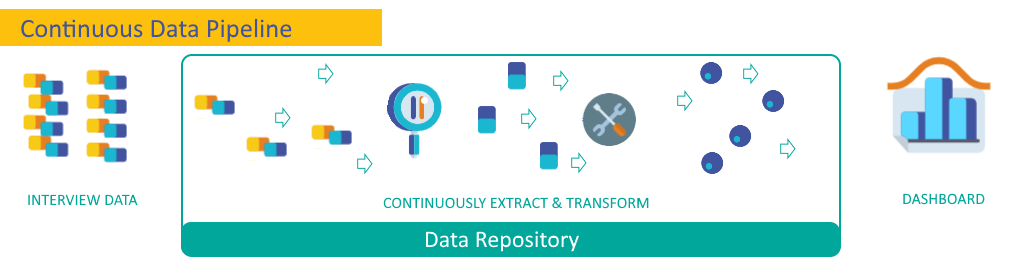

More and more customers have been asking for real-time insights while a survey is still in progress. And now, Nfield is able to deliver these via our new Data Repository feature, which provides a continuous data delivery pipeline straight into your dashboard.

Today’s fast-paced world calls for ever-faster reporting. Nfield Online’s powerful interviewing capability enables a tremendous amount of data to be collected in a short time-frame, without hardware or network limitations. For many customers, the ability to quickly capitalize on this data is also very important.

A good example could be in media production, where survey data can be used to inform outlets of current audience interests. Let’s say, skateboarding suddenly becomes a hot topic at the Olympic Games. The content producer can choose to use this information to switch focus and retain audience attention.

With the Nfield Data Repository feature, insights can be attained immediately, without expensive setup and dependency on IT teams.

Transferring Nfield interview data into insights in customers’ own dashboards is a complex task. Traditionally, the ETL (extract, transform and load) process requires involvement from data processing and IT teams, either during initial setup or each time the process is run, which is a time-consuming overhead.

Now, with the Nfield Data Repository, data from completed interviews is extracted every 10 minutes and directly fed into an engine which converts it into a database format, from where your dashboard / reporting tool can instantly retrieve it.

To make the fast, high-performance engine that keeps the data pipeline flowing affordable to all customers, we offer a scalable pricing system based on usage.

You’ll find the new “REPOSITORIES” section toggled within the Nfield Manager interface. To enable it, please contact your Nfield account manager.

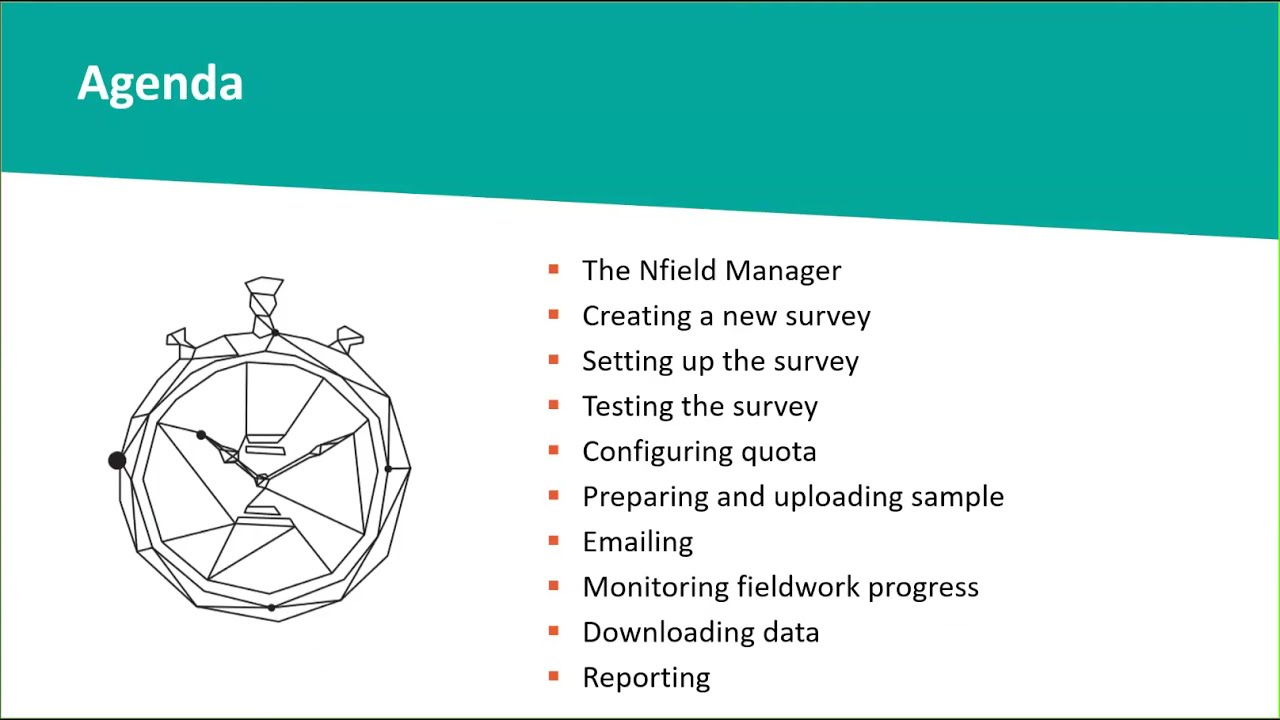

When onboarding new Nfield Online customers we always organize an online introduction course to ensure a smooth start using Nfield. One of the NIPO trainers will go through the whole research process and will teach how to use the many features Nfield Online has, also taking into consideration the specific needs of the customer. We decided it would be a good idea that in this series of NIPO Academy sessions we will do such a session for a wider audience.

Nfield surpassed a significant milestone on 20 May 2021, smashing through the 100K completed interviews per 24 hours barrier. More importantly, the Nfield platform handled the 104,758 successful completes without showing the slightest level of stress.

The record completion rate was comprised of 86,949 Online surveys and 17,809 CAPI surveys. Of these, 49K were performed on the APAC server, an incredibly high figure which was driven by a single survey in Japan which produced 37,226 completes.

This Japanese survey is, itself, significant for the fact that it ran as an isolated survey using dedicated Azure resources (containers). Using this solution means that the load it generated did not have any impact on other domains and/or surveys. The ability to run isolated interviewing is facilitated via Nfield’s Function app, which has been made possible following intensive collaboration between our team and Microsoft architects. The Function app itself was hit more than 2 million times in 24 hours in relation to this Japanese survey.

Having confirmed Nfield’s ability to comfortably handle this level of traffic, we are looking forward to it becoming a daily norm. It’s good to know that isolation can be a very positive thing! 😊

Fully compliant practices and ISO 27001:2013 certification for our Nfield data collection solution means you can rest assured when it comes to data security. Nfield is a scalable solution with an open architecture that allows you to perform simple to complex surveys with stunning design. Nfield is the cloud survey solution for market research professionals.

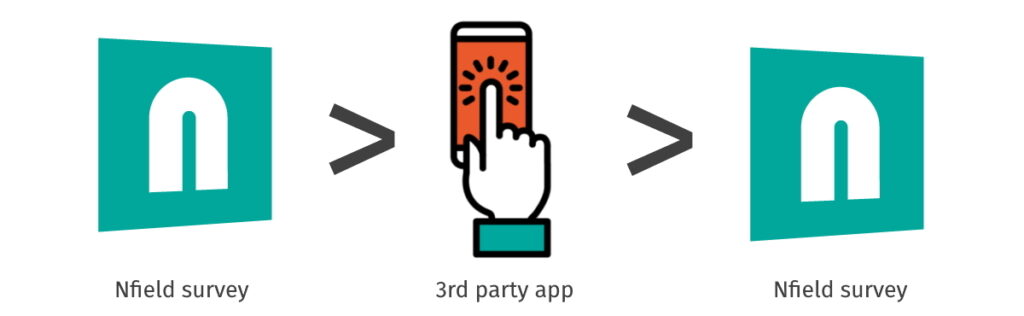

App-in-the-Middle is a feature developed for Nfield, in which control of a survey is temporarily handed over to an external application, so that functionalities not offered within Nfield can be incorporated into survey execution. This is useful, for example, if you want to make use of a Sawtooth module for implementing a complex conjoint.

All you have to do is instruct your Nfield survey when to switch to the external app, and instruct the external app when to switch back to your survey. Making sure, of course, that all the relevant data is handed over during both switching processes.

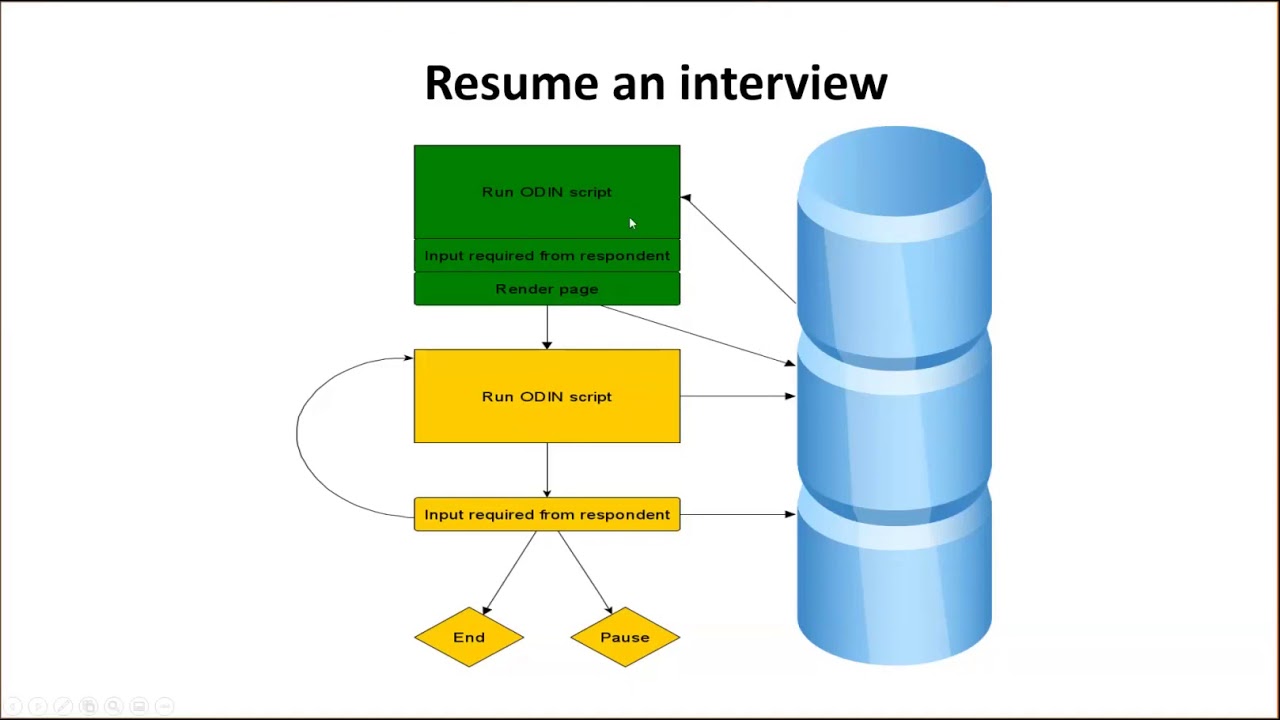

Within Nfield, this is handled in the sense of pausing and resuming interviews. We’ve accommodated the App-in-the-Middle feature by making it possible to resume paused interviews from an “as is” status, in addition to the usual “as was” status.

Under normal circumstances which don’t involve App-in-the-Middle, a paused Nfield Online or CAWI interview simply returns to its last-known state upon resuming, with all variables and routing restored to the point they were at when paused. This is known as resuming from the “as was”.

Incorporating App-in-the-Middle requires Nfield to accept changes made during the external app’s time in control and resume from this updated situation. This means resuming from the “as is” instead of the “as was”. We’ve introduced this option into Nfield, so you can now incorporate extra functionality via App-in-the-Middle whenever you need to.

This short video shows the basic principles without going into too much detail.

Control over conducting the interview is handed over from Nfield to the external app by using the ODIN command: *ENDST 107. This pauses the interview in Nfield and redirects to the relocation link defined for response code 107. The external app hands back to Nfield by redirecting to the survey URL with its corresponding respondent key and other information.

For the interview to continue in Nfield, some special script constructs must be used to prevent the interview executing *ENDST 107 again. This is done by using either the *INIT block or information that is handed over from the external app. You can find out more about using *INIT blocks in our Academy session video on pausing and resuming surveys.

The relevant information can be handed over to an external app by adding it as query string parameters to the exit link configured for the HandedOver response code (107).

For example:https://aitm.com?respondent={respondentKey}&extra={extraInfo}

This shows the names of ODIN variables between the {}. The variable names are replaced by the variable values before redirection to the external app’s URL.

The external app hands back to Nfield by redirecting to the survey URL. The survey URL must contain the respondentKey. Extra information can be added as query string parameters. The interview will then be resumed (from “as is”) with the ODIN variables having the values now shown in the query string parameters.

For example:https://{startlink}/{respondentKey}?aitmResult=199

This will resume the interview and if an ODIN variable with the name aitmResult is defined it will get the value 199.

Let us know if you want to integrate a specific app via App-in-the-Middle into your surveys. We’ll be happy to help you set up your project.

Recently NIPO launched a new DA course. This course concentrates on the responsibilities of the DA and the tools NIPO has built to help you meet these responsibilities. We would like to use this series of NIPO academy sessions to introduce this course. We will concentrate especially on the new features for survey groups and domain access that we have introduced over the last months.

The market research industry’s three main channels – Online, CATI and CAPI – each have distinct advantages in different situations. Online is fast, cheap and far-reaching. But better quality responses can sometimes be assured via CATI and CAPI channels, which can be backed up with visual, audio and GPS location evidence.

Circumstantial, cultural, demographic and geographic factors also come into play when it comes to which channel is most effective for delivering response. But these can vary within an individual survey and even within an individual sample.

To offer a comprehensive service that keeps all the options open, market research companies ideally need the ability to deploy all three channels, switching between them as necessary in a mixed-mode project.

While a particular survey type is often a preferred choice for a specific market research project, there are often circumstances when the ability to switch modes is beneficial.

Because Online, CAPI and CATI channels are driven by different technical systems, switching between them is often not as simple as it needs to be. Making a survey available by all three systems typically requires duplication of set-up work and additional effort to consolidate the results. For some market research companies, this is a burden to far. For the sake of efficiency, they dedicate themselves to a single channel. Thereby cutting off the many opportunities which come with multi-channel capability.

Here at NIPO, we are all about empowering market research companies to perform better. So we decided to get a grip on the situation by developing Online, CATI and CAPI systems which are fully compatible with each other.

Using our Nfield Online, CATI and CAPI survey solutions, you only have to set up a survey once for it to automatically translate across all three channels. Each respondent’s answers can be accepted via any channel and results are automatically consolidated.

If you’re currently burdened with incompatible systems for multi-mode surveys, switching to Nfield will noticeably boost your productivity.

And if you’ve been limiting yourself to just one or two channels, Nfield provides an easy way to explore the opportunities multi-mode survey capability could bring to your business.

What’s more, because Nfield survey solutions are specifically designed to meet the needs of market research professionals, they’re sully equipped with everything from stunning survey design and advanced scripting options to elaborate sampling, quota handling and much more.

Feel free to contact us to discuss your requirements and ask anything you need to know about Nfield Online, CAPI and CATI.

Nfield Online comes with the built-in capability to pause the interview and resume the interviewer at the precise location where the interview was previously suspended. We have recently added more control options to Nfield that determine how the interview is (differently) resumed in various situations. In this series of NIPO Academy sessions we will walk you through the options of this new feature.

Request a demo to see how NIPO can help you meet your requirements with our smart survey solutions.