Get a first impression, scheduled soon.

Request a demo to see how NIPO can help you meet your requirements with our smart survey solutions.

If you want to conduct an online survey that refers to frequently changing information, or needs to extract relevant information from a large database, you’ll need to connect your survey to an external source via an API. This is easily achievable with Nfield Online.

There is a wide range of scenarios which might call for this. To give just a few examples, you might want to show:

Or you might need to utilize real-time information to route your survey according to current stock status.

The connection to your external source consists of one or two components:

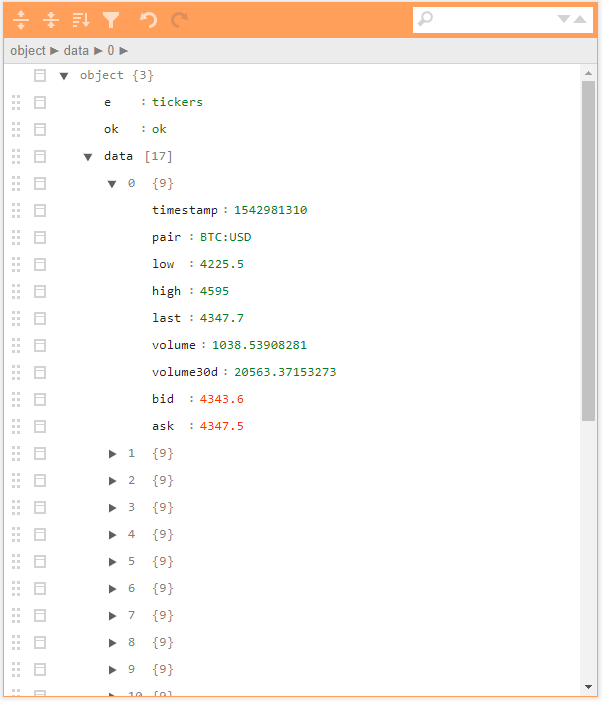

To illustrate how it works, let’s take a look at the Cryptocurrency demo we’ve set up. This demo survey connects to https://cex.io/api/tickers/USD/EUR to retrieve the latest cryptocurrency prices. As you can see, this URL takes you some JSON code. Copying this code into a JSON editor will present it as shown in the illustration below. Note that Nfield will only load the content from the “data” section and will ignore other information.

Step 1 is therefore to identify the URL to connect to your survey. However, every survey has its own unique requirements and ready-made API URLs are rarely available. Your IT team will actually need to create the URL(s) that return the relevant JSON format data results. Of course, NIPO can provide any support you need for doing this.

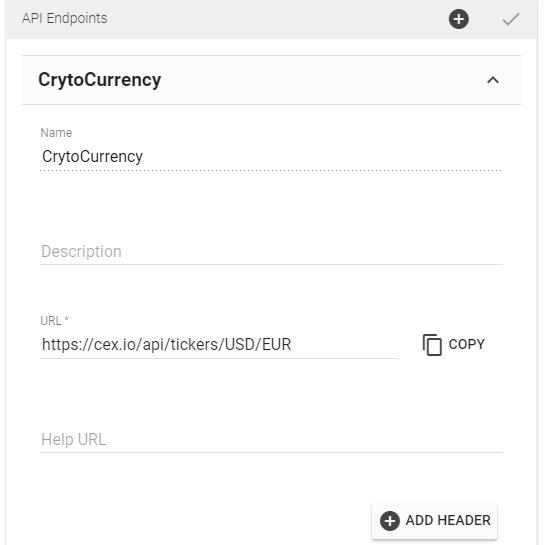

Step 2 is to set this up in Nfield Online. Under Survey Default Settings, simply add the URL as an API end point and give it a name. Doing this tells Nfield that calling “CryptoCurrency” from the survey script refers to a call to this particular URL.

Step 3 is to call the API from your survey setup.

The call status is stored in “result” and the answers are stored in the arrays of var1 and var2. In our example var1 is filled with the ‘pair’ info and var2 with ‘ask’ (asking price) information, so our *GETDATA command looks like this:

*GETDATA result pair,ask "CryptoCurrency:"

Note that our demo example doesn’t utilize the second component option for parameters.

We hope this article inspires you to explore the possibilities opened up by the use of API endpoints. If you have any questions or require any assistance, please feel free to contact us.

With GDPR coming into effect in May 2018, which protects and expands the privacy rights of EU citizens, it’s clear, that now more than ever, all market research professionals have to pay close attention to the protection of both their own personal and business customer data. With that in mind, we have revised all our privacy and terms of use policies, which are now readily available on our website. If you are a user of our systems or you are thinking about becoming one, surely don’t miss reading these documents.

In our effort to make these policies as transparent and simple as possible for you, we have divided them into various groups:

(1) If you are our customer, we encourage you to read these documents:

Customer privacy policy

When employing Nfield:

Nfield acceptable use

Nfield terms of use and conditions

When visiting our website:

Website privacy policy

Nipo.com cookie disclosure

(2) If you are a visitor to our website, but not a customer, please pay attention to these documents:

Website privacy policy

Nipo.com cookie disclosure

We believe that it’s important for you to know your privacy rights, so here they are:

Under various data protection laws, you have the right to access and rectify your personal information. You also have the right to delete your personal information from our systems, unless we have a legitimate reason for holding it.

Especially, if you find yourself in one of the following situations:

then please notify us by email to info@nipo.com. We request objections to be clear and specific and to provide us with detailed information on how we should handle and alter your data.

You are welcome to contact our team at the same email address info@nipo.com with any questions and concerns regarding our policies and terms of use. If you are a customer, you can also contact your NIPO representative directly.

Market researchers all around the world utilize our Online, CAPI and CATI survey software solutions to gain valuable insights into the minds of consumers. This places our software solutions right at the heart of the market research business, and nobody – whether it’s us, a survey software provider, or you, a market research professional, can afford to let that be compromised.

We have always aimed to build survey software solutions that are secure by design. Which is why we have been the world’s first survey software provider certified to ISO 27001-2013 standards since 2015. Our data security systems are outlined in the “NIPO’s data security” article. We encourage you to learn more about them as you play a crucial part in maintaining the bulletproof security of our survey software solutions.

Data privacy and protection have always been paramount to us. We hope you will support us on this journey.

In an exciting development for researchers who survey respondents in China, NIPO is proud to announce the release of a new Nfield deployment from Chinese mainland. This makes Nfield the only international market research platform approved as an Internet Content Provider (ICP) by the Chinese authorities. Researchers and respondents alike can now enjoy a uniquely superior experience with Nfield, as data no longer needs to pass through the Great Firewall of China.

Why Chinese mainland deployment matters: The performance of outbound internet traffic in China is impacted by what is known as the Great Firewall of China. This firewall actively checks all connections to the outside world, including cloud-based online interviewing platforms. For Nfield Online users in Chinese mainland connected to the Nfield deployment in the Azure data center in Hong Kong SAR, this previously meant unpredictable delays in load times for new questions and thus a poor respondent experience, with high drop-outs as a result. This was not only the case for NIPO’s Nfield, but for all CAWI interview systems hosted from outside Chinese mainland.

The new Nfield China deployment has both its primary and backup locations hosted in Chinese mainland. This has been made possible through the Chinese Government’s full approval of the deployment and granting of an Internet Content Provider (ICP) filing. This gives Nfield a unique status within the international market research industry and enables us to provide an unrivalled level of service.

As well as the obvious benefits for online surveys, the China deployment also means improved interface responsiveness when setting up survey projects and managing fieldwork. And Nfield CAPI interviewers will benefit from faster synchronization with tablets.

Final stress tests were carried out in January 2019 with a group of pilot users. Following the successful completion of those first projects, the domain is now available for use and we are delighted to have already welcomed our first new customers on board. Existing customers operating in China will be invited to switch to the local deployment.

The Nfield China deployment is running the latest Nfield version and will remain in sync with updates applied to other regions.

Nfield is fully offered as a Software-as-a-Service model, which leaves you free from capex and servicing commitments. Nfield is the only survey solution hosted from the Microsoft Azure cloud, which guarantees superb performance, reliability and stability. In addition to the Nfield deployments in China, Nfield is deployed from Europe, America and elsewhere in Asia. Nfield is a fully scalable system that can handle extremely high volumes. Nfield is fully secure, with ISO 27001-2013 certification for both NIPO and the Nfield platform. NIPO and Nfield are both compliant with GDPR legislation.

Integrating Nfield Online with panel providers is simple and easy via common market research industry practices. When you have sample information from a sample source (your own panel database, or sample database from your panel provider or client), Nfield can facilitate the sharing of this information and the interview status between Nfield and the source(s) concerned. The following Q&A has been compiled to help you understand how it’s done.

Integration automates the sharing of information between sample sources and Nfield. It keeps both systems up-to-date in real time, without human intervention. The following examples illustrate how this is of benefit to all involved.

That’s entirely up to you and how creative you want to be (see Creative Online Survey Distribution). Nfield has an email management module for managing, sending and tracking email templates. To find out which options are available to you, please check with your own organization and your panel providers. They probably have their own member portal or app to facilitate management of invitations and rewards.

This depends on your needs.

Nfield provides a sample management module to facilitate your fieldwork operation. You can upload / download sample information in Microsoft Excel format or using our API (see API – What you need to know). You can modify or delete information as necessary. To comply with GDPR, you can also partially clear confidential information and/or delete interview data (see GDPR and Nfield Toolkit).

Nfield allows you to define your own RespondentKey for each sample. So you can use an ID provided by your panel provider (such as SampleID or PanelMemberID) as the RespondentKey.

When you upload the sample information to Nfield, simply include this RespondentKey as a field in the Excel sheet. Note that there is no requirement to upload sample information if you don’t want to. The panel provider can also distribute the invitation link directly themselves using the following format:

There are two options for this. You can either upload these details to Nfield or incorporate the information in the survey URL.

If you choose to upload the information to Nfield, simply incorporate the RespondentKey in your invitation link to make it appear within the questionnaire.

Or if you prefer, you can incorporate the sample information directly in the survey URL, as shown below, to get the same result.

Yes. This can be done using an encryption key which is provided in each survey. Please contact our helpdesk for details on how to implement this. The resulting URL will be presented as shown below:

When an interview is completed, the redirection URL can be configured to a page published by your panel provider or to one of your own, which can be defined according to the result code in each case. You can include whatever parameters you choose in this result code (e.g. RespondentKey, additional products, duration spent). The panel provider should process these codes to update their database so rewards can be given accordingly.

Nfield constantly checks the quota status while interviews are being carried out. If you have access to Nfield, you can get a quick overview of the current status via Nfield manager. Third parties (e.g. your panel provider/client) have the following options for keeping up-to-date.

Note that we are currently developing functionality for direct sharing of quota status with panel providers. Please check in with us on how this work is progressing!

Yes, with some modification to the questionnaire. Contact our helpdesk for details.

We know that every customer has different needs. If your questions / requirements aren’t covered in this article, contact us and we’ll be delighted to provide answers.

On 3 October 2018 Microsoft and NIPO organized a Cyber Security War Game at NIPO offices in Amsterdam. A very interesting day that helped us understand a lot on the techniques used by hackers and made us gain insights in the power of cloud platforms in helping you defend against both internal and external threats.

The cyber war games are a business simulation event where one team must defend an (Azure) application from the attacks of another team. There is little to no upfront info on the application or any business processes for disaster. Is the application in a good state? Can we investigate what is going on? How should we divide priorities around all issues? How do we keep communicating well? Even without assuming high skills on the attackers you might be up for a big battle already. Let alone if the attackers bring out the big guns!

So, on Wednesday 3 October NIPO staff was up for this battle. Manas Bhardwaj and Rob van Abeelen from Microsoft came over to lead the game. NIPO staff was divided in a red and blue team. One team was attacking, the other defending an application.

The aim of the cyber war game was to:

Playing the game was a very fun and sometimes (intentional) stressful exercise. Our NIPO colleagues looked back on the event as a good exercise to make you more aware of security, as it brought many security aspects to the forefront. It was a good learning environment, to see how systems can be vulnerable. It was fun and a very close to a real event.

Apart from a solid confirmation that our efforts to collectively maintain security standards at the highest levels is nothing less than a necessity for a cloud Saas provider, we found these valuable learnings:

In conclusion, it was a very useful experience with positive feedback from our colleagues. We aim to repeat this session at our Madrid office soon.

Do you read all your text messages? It seems you probably do! According to Esendex Research, in 2018 SMS messages have a 94% global average open rate. What’s more, 82% of messages are read within 5 minutes of receipt.

At NIPO, we believe SMS is a great channel for distributing invitations for online surveys. So we’re taking this opportunity to explain why, guide you through setting it up with Nfield Online and provide useful tips for making the most of it.

Distributing online survey invitations via text means you can reach a wider audience, really fast. Plus your messages stand out and get attention. What’s not to like?

SMS is a faster way to reach respondents at key moments, with a higher chance of getting noticed and triggering action.

The first thing you need to do is find out who your SMS gateway providers are. This is easily done via a Google search for “SMS gateway providers”.

What should you look for in an SMS gateway provider? That depends on the level of technical integration you want. This can be broken down into three levels:

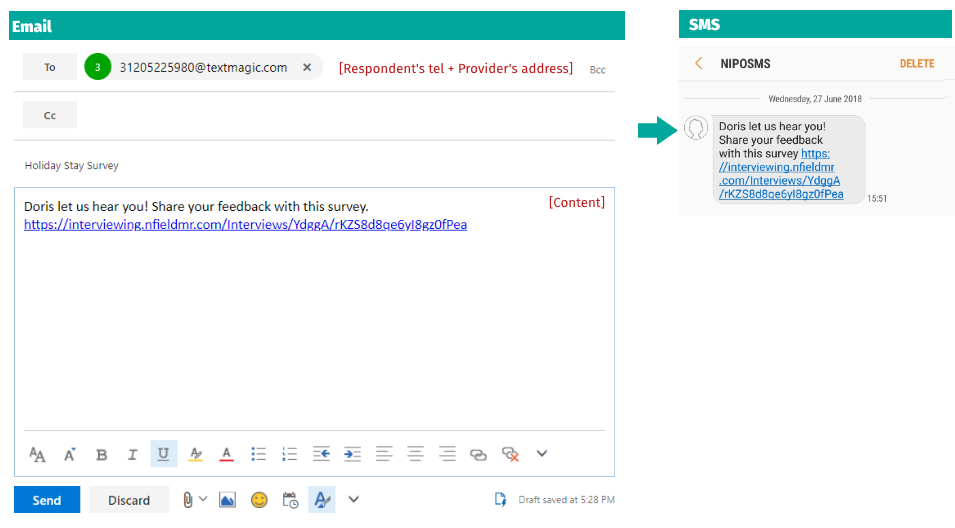

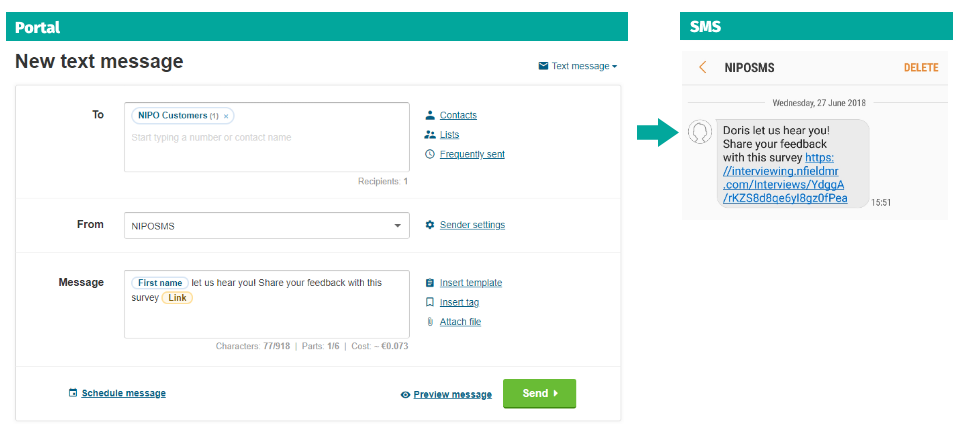

This is the easiest way to implement text messaging with Nfield Online. The illustration below shows how you can manually create an email to a specific address. If you want to send multiple emails at once, just use mail merge. Your SMS gateway provider will tell you how to construct the email address, which usually comprises a combination of the recipient’s telephone number and the provider’s email domain. Then all you have to do is compose your SMS content and hit send.

To show you how this works, we’re using TextMagic’s solution as an example. The first thing you need to do is set up your contact list in a contact group by uploading an Excel file. Then compose your email and use the relevant Excel field (e.g. First name) for personalization. TextMagic also lets you configure the sender name to be your company/client name and schedule a distribution time.

We talked about the technical side, now let’s give you some recommendations to make your SMS campaign a success.

Content

Timing

Get permission

We hope you have found this information to be informative and inspiring. Please feel welcome to contact us if you’d like to explore your possibilities together. We love hearing about our customers’ individual challenges and seeing what solutions we can offer. And we love hearing about your successes too!

Open online surveys can be distributed via a whole range of methods. You’re not just limited to email! This means you have opportunities to be creative and try out different ways as you reach out to more interactive audiences. Take a look at our ideas and share yours with us.

Facebook is the world’s most popular social media network with over 2 billion active users every month. That’s a huge collection of sociodemographic data for your surveys! However, the organic reach on Facebook is not what it used to be and won’t be sufficient for distributing your online surveys. These days, Facebook’s real potential lies in paid posts and ads. Facebook offers impressively extensive and detailed options for targeting, which enables you to pinpoint the exact audience you want to reach.

Since its launch in 2003, LinkedIn has gathered over 547 million professional users and one million company profiles. These volumes are very interesting if your surveys research professionals and industries. Within LinkedIn you can share a survey as a company update, a personal post, banner, text ad or send it directly to selected individuals as a private message.

Twitter’s audience comprises 310 million monthly active users. It is more diverse as engages consumers and professionals alike. Within Twitter you can use ads to target people based on their location, age, gender, device or keywords.

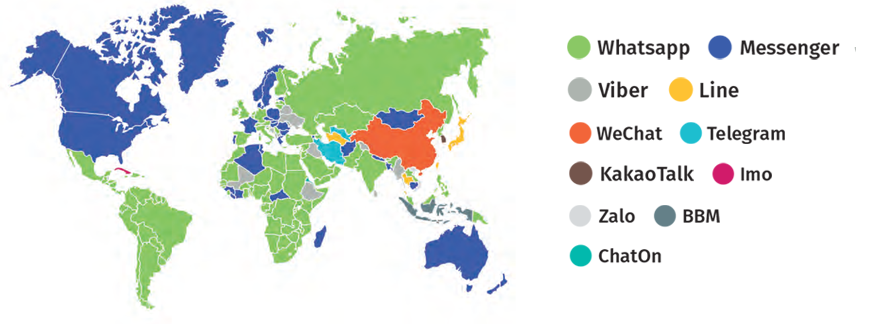

In China, some market research organizations use a local social media network called WeChat to distribute online surveys. The WeChat messaging app is massively popular in China with 768 million active users every day.

Most popular messaging apps per country

Although WeChat’s network structure is often compared to WhatsApp or Facebook, it is, in fact, very different. The WeChat app has been evolving into a full-service platform as it strives to be everything at once: a place for chatting, shopping, gaming and banking. Alongside a wider range of services, WeChat’s users benefit from easy integration with other apps, including Facebook.

All this makes WeChat a fantastic opportunity for engaging different audiences across China. For example, if your organization has a company page on WeChat with followers, then it’s possible to display your survey link either on your page or send it directly to followers via a private WeChat message. To incentivize followers to respond the survey, you can redirect them from the WeChat app to the company’s website where a reward awaits.

Even though this idea is easy to implement, it still requires a bit of technological knowledge. You can take advantage of our experience with this solution by deploying your WeChat project through Nfield Online.

WhatsApp currently holds the status of being the most popular messaging app in the world. The Facebook Corporation bought WhatsApp a few years ago and in 2016 partly integrated user accounts across the two apps. Even though this has happened, the Facebook Corporation remains very cautious about privacy and spammy user experiences and doesn’t allow third-party ads to be displayed in WhatsApp. Compared to WeChat, WhatsApp’s commercial usage is more restricted and it doesn’t allow for distribution of online surveys in the same way – at least for now.

Offices, reception desks, shops and presence at trade shows, seminars and other industry events are all physical touchpoints between companies and potential survey respondents. Printed materials, interior décor, products and touch screens all provide opportunities for inviting survey participation. Which means you can turn any physical environment into a place for conducting everything from customer or employee satisfaction surveys to product research.

Quick Response (QR) codes are those digital squares you find in all kinds of places. The square contains a unique two-dimensional, usually black and white code, which can be read via dedicated QR barcode readers and smartphones. You can easily generate unique QR codes for your surveys with simple tools such as www.qr-code-generator.com. These can then be printed on business cards, product sheets, leaflets, posters, packaging and even products, and displayed in exhibition booths, reception areas, around premises, on vehicles and more.

It’s worth remembering that printed QR codes will remain in circulation for an indefinite period of time. This means they are only appropriate for surveys which will remain active for a long time, such as ongoing consumer satisfaction surveys.

Because people usually read QR codes from their smartphones, the surveys these link to must be optimized for completion via a smartphone.

Beacons make it possible to invite passersby to take a short survey about their current experience of a precise location in real time. For example, you can instantly survey visitors to buildings and events about their opinions of their immediate environment. A great opportunity everywhere from airports to trade shows to ask people for improvement suggestions.

Each Beacon is effectively a cheap, small Bluetooth transmitter. The standard broadcast range spans from a couple of centimeters to 100 meters. While GPS is a great tool for locating bigger targets on a map such as streets and buildings, Beacon technology enables you to pinpoint exactly where an individual is standing, even inside a building, to a precision of one meter.

Beacons don’t follow people, they search for devices within their range. When they detect nearby smartphones and tablets, they send out a message which has been designed and saved in the Beacon. However, this is a one-way transfer. Beacons don’t receive messages from the nearby devices. This means that the survey invitation you send from a Beacon has to redirect the recipient from the Beacon message to the first question of the survey, because the Beacon cannot receive and save the survey responses themselves.

Every smartphone or tablet is a potential receiver of Beacon messages, but they will only work is they have:

The two biggest players in the beacon market are Apple with iBeacon and Google with Eddystone. The latter is better suited for market researchers. Messages coming from Eddystone Beacons are automatically picked up by the ever-present Google Chrome app. So you don’t have to build your own app. In contrast, Apple’s iBeacon solution requires a specially designed app to interact with the Beacon’s messages.

https://developer.apple.com/ibeacon/

https://developers.google.com/beacons/

Organizers sometimes install Beacons around event venues and offer exhibitors the opportunity to use them.

Do you have other creative ways of distributing survey invitations? Maybe there’s more we can do to help you integrate these with Nfield Online? Tell us about them by emailing info@nipo.com

Download the ‘Online Survey Distribution’ brochure in the PDF format.

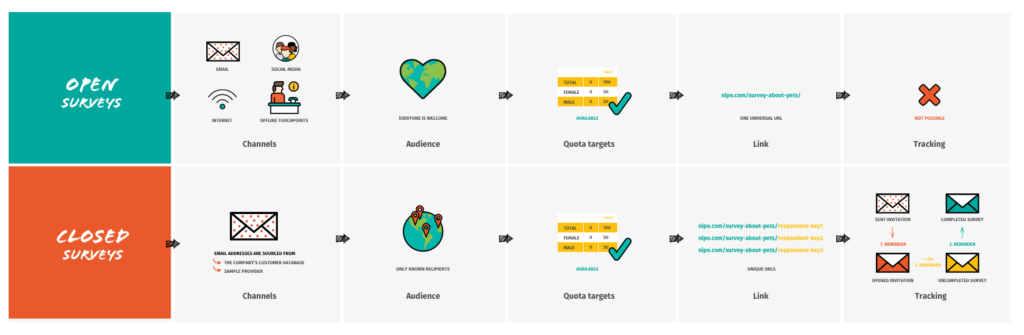

Distributing online surveys via email has become the most common way to reach an audience. While emailing itself is an easy method, professional survey systems provide more sophisticated options to help you achieve your desired results. Here’s what you need to know about the two most important ones.

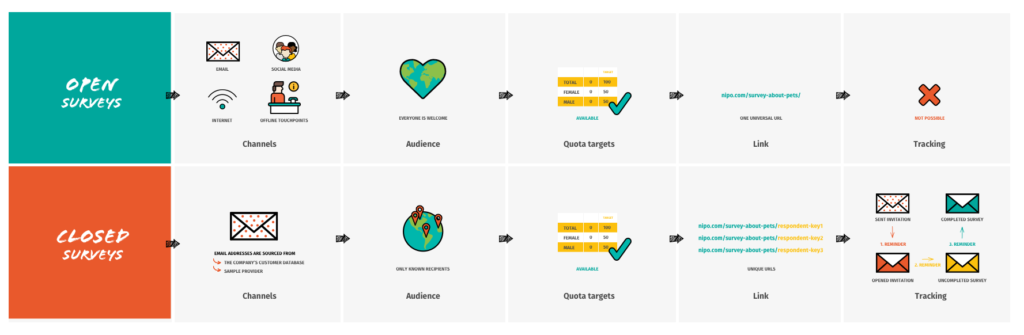

Open survey distribution boosts the organic reach of your surveys.

A survey is shared with anybody through one identical URL link, which is universal, public, and therefore anonymous. In the Nfield Online survey system, you copy the URL of the survey and paste it as a link directly into the email you send out.

The simplicity and uniformity of this link allows you to:

However, these two opportunities also mean you lose the control of the survey’s distribution. You can’t send out a reminder because you don’t know all the recipients it’s reached, or who has already completed the survey. The absence of tracking has one other major implication: a recipient can do the survey more than once.

Please note that the open distribution method is best used for surveys with a limited email list.

Get inspired by more creative options for distributing open surveys.

Closed survey distribution gives you more control.

A survey is shared though a set of URL links only with known recipients. Each URL link has a different unique ending which corresponds to a different individual recipient invited to take the same survey. In professional market research, these unique endings are known as respondent keys.

This system of unique links enables you to monitor the survey activity of every recipient. This means you also know what is happening throughout the entire recipient pool, so you can send out appropriate reminders at every stage to those who:

Nfield Online prevents recipients from responding more than once to the same survey’s questions. In the case of recipients who started but did not yet complete the survey, it also enables you to send them a reminder which takes them directly to the point where they stopped. All this results in clean and more credible survey data.

Because of these specifics, closed surveys cannot be distributed through any other channel. You always need an email list that is big enough to satisfy the survey’s requirements. In many cases, the company’s customer database is perfectly sufficient. But when it isn’t, the solution for professional market researchers is to use the services of sample providers.

Respondent keys

A respondent key is a random combination of characters and/or numbers added to the end of the survey link. It’s this combination which makes each survey link unique, even though it points to the same survey. This uniqueness enables Nfield Online to identify recipients and ensure that only those who were directly invited can participate in the survey.

domain.com/survey-about-pets/respondentkey1

domain.com/survey-about-pets/respondentkey2

domain.com/survey-about-pets/respondentkey3

A respondent key can only be used once within the same survey. Never two or more times, as that would affect the monitoring. However, it’s possible to re-use a respondent key for more than one survey.

Sample providers

Sample providers administer extensive databases of individuals who at some point agreed to participate in surveys. Their databases usually contain basic sociodemographic data by which email lists are filtered. Sample providers also perform more detailed and time-consuming pre-selection of individuals according to survey requirements.

Thanks to unique respondent keys, once a survey project is finished, market researchers can inform their sample providers about which recipients didn’t start the survey or unsubscribed from the email list. This information is very important for a good email reputation and the privacy rights of recipients.

In addition to the administration of contact databases, sample providers incentivize recipients to participate in surveys. Respondents are typically redirected by Nfield Online to the sample provider’s website after completing the survey.

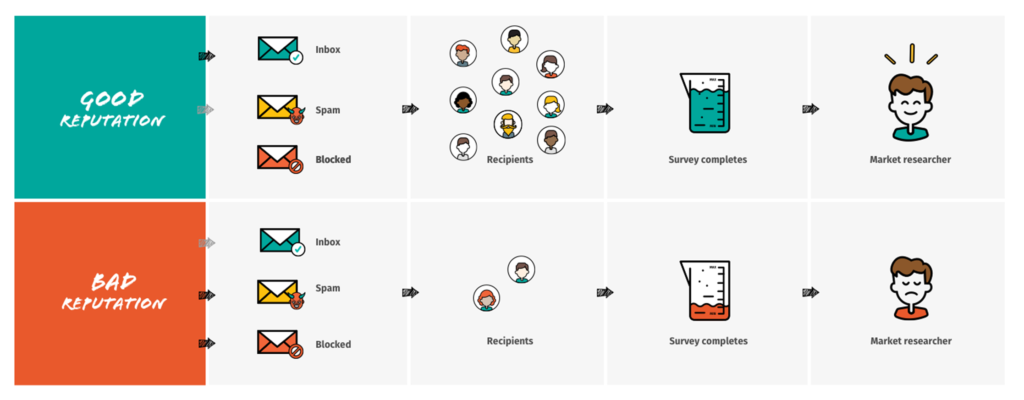

Even when you use Nfield Online to send your survey invitations to a contact list, it doesn’t necessarily mean all your invitations will arrive in their intended inboxes. As with any other marketing and sales emailing activity, the distribution of surveys through email is inspected under a set of rules known as email reputation. These rules decide whether the email is successfully delivered to inboxes, diverted into spam folders or blocked.

Email reputation directly affects the success of your online research, so make sure you find out everything you need to know in our two articles:

Your email reputation score directly affects how many of your survey invitations actually arrive in people’s inboxes. If you have a bad email reputation score, your survey will be diverted into spam folders or may even be blocked completely. The result of which is the people you hoped to participate in your survey will never see your invitation. So you’ll never receive their responses and your survey conclusions will be less complete. Here is a handy guide to looking after your email reputation, so your surveys can be more successful.

Every Nfield Online customer gets a new Nfield Online domain to set up surveys, manage respondents, send out survey invitations, monitor respondents and gather collected responses.

Your Nfield Online domain is unique and can only be accessed by you, the owning customer. We don’t even have the right to look inside its administration unless you specifically ask us to do so for customer service purposes. This means you have complete control over your Nfield Online domain’s email reputation.

We understand this may seem like a daunting responsibility if you are new to the topic of email reputation. But don’t worry! Nfield Online is equipped with tips to guide you through. We’ve also compiled the handy guide below on how to successfully build a good, everlasting email reputation.

If you don’t already know what email reputation is, and why it matters to market researchers, it’s a good idea to read our email reputation introduction article before reading the rest of this page.

Identifying where an email has been sent from plays a major role in email reputation. Recipients have a right to know who’s contacting them. And email service providers endeavor to ensure this happens by checking you are who you say you are.

State who you are

Absence of a physical address and/or signature in an email will add to its spam rating. To protect your email reputation, we have made this field mandatory in Nfield Online. Our survey system doesn’t allow you to send out emails unless you provide the company’s real name and physical address.

Specify your sender email address

Nfield Online survey invitations allow you to choose which email address they are sent from. Because this information must be provided, the default ‘From’ field is automatically filled in with noreply@yourNfieldOnlinedomain.com. If you wish, you can overwrite this with any valid address of your choice. Either at the default domain level or at individual survey level. So if you want to, you can send different surveys from different email addresses.

1. Your Nfield Online sender address

Because a new Nfield Online domain has never been used before, its email reputation is also completely ‘clean’. In fact, it’s even better: thanks to good technical practices at Nfield Online, all new domains are already rated 3 out of 5 when we hand them over. So if you decide to keep the Nfield Online sender address (e.g. companyname@nfielddomain.com), your first emails should arrive reliably. They are unlikely to be classed as spam unless you immediately adopt bad practices. But beware, as soon as you start using the Nfield domain, everything you do will influence its reputation moving forward. For better or for worse. So look after it well!

2. Your other sender address

If you choose to use a different email address (e.g. companyname@gmail.com), at any point, your survey invitations will be treated according to that address’s email reputation. So be sure to check whether the reputation of the address you want to use is good enough to reliably deliver your invitations.

Prove it’s really you

Spammers often pretend to be other people by spoofing their IP addresses and sending domains. Spam filters therefore check for ownership authentications when deciding what to do with an email.

An IP address is a unique identification of a device and its location within a network.

Verify your emailing domain with:

This verification is an easy task for your system administrator. It’s only required once and must be done before you send out the first email. If you experience any difficulties in doing it, please contact us and we will help you out straightaway.

Email providers consider engagement as a crucial indicator of how welcome your messages are to their recipients. The way people interact with your emails, from whether or not they open them and click the links to whether they unsubscribe or mark them as spam, reveals whether or not they wish to keep them coming.

The best scenario for your email reputation is when recipients open and click the links. Unsubscribes, as long as you don’t have too many of them, are neutral. The very worst outcome is when recipients mark your messages as spam. Some email providers are very sensitive to this and only a few spam reports can send a reputation steeply downhill. As a sender, you need to do everything possible to prevent this from happening.

The two biggest influencers of engagement are the appropriateness of your database and how interested recipients are in the content of your messages.

Enable recipients to unsubscribe, simply and immediately

If somebody doesn’t want to receive your messages and you don’t make it easy for them to unsubscribe, they are likely to hit the spam button instead. To encourage unsubscribes over spam marking, we have made the ‘unsubscribe link’ field mandatory in Nfield Online survey correspondence. It’s worth remembering that if you only send survey invitations to people who are expecting them from you, the unsubscribe rate should be low anyhow.

Only send survey invitations to people who are into you

If you send survey invitations to people who either didn’t specifically give consent or aren’t interested in your survey activities, many of them will simply move the survey invitation from an inbox to a spam folder. This will damage your email reputation. It’s possible they might just unsubscribe instead. But if you have a very high unsubscribe rate this also may be damaging.

Clean your email database. Again, again, and again

Ask your sample provider about their database practices

Many researchers contract the services of sample providers to obtain contact details of suitable survey recipients. This transfers responsibility for the database’s administration to a third party. But it’s your reputation that will suffer if the contacts provided are not suitable. To protect these, it’s a really good idea to ask your sample provider about their practices for acquiring new contacts and maintaining their database.

Compose an eye-catching survey invitation

With so many emails, articles and shocking news stories constantly competing for attention, getting your survey invitation noticed is a tough job. To be successful in this, you need to be meticulous in every detail. The survey invitation must be visually appealing and instantly clear. Never just present it as unformatted text on a plain white background. Personalize, be straightforward and be honest. Briefly explain why you are contacting this recipient, why this survey matters (to them) and what you plan to do with the information they provide.

Composing emails which are suitable for multiple recipients is a specific discipline. The way you present words, images and other elements can have a huge impact on your recipients’ behavior. And your email reputation.

Choose your words carefully

Avoid words which are typically found in spam such as ‘urgent’ and ‘for free’. If you look at the emails which have arrived in your own spam folder, you can get a good idea of which words repeatedly appear. These are likely to be the red flags which lead email service providers into believing an email is spam.

Write an appealing subject line

The right choice of words for your subject line is even more important. This line should be short, clear (to the point) and personalized. In a world of short attention spans, it’s essential your recipient can instantly identify your message as interesting to them. Otherwise they may not even bother to open it.

Avoid ‘dirty’ formatting

Don’t let pictures take over

Pictures can be great attention grabbers, but when they are too large or there are too many of them in an email, the spam alarm bells can start to ring. Many email providers block pictures from appearing automatically, which cancels their impact as recipients don’t even see them.

Use original URL links

Avoid using URL shorteners (such as bitly) in emails. Spammers frequently abuse these tools, which means email providers will count them against you.

Keep your email’s HTML code clean

This means ensuring the HTML code only contains directly relevant instructions. If you copy-paste styled text from a Word file straight to your email, the HTML will include all kinds of irrelevant formatting elements, which have a negative impact on your email reputation score. To avoid this, either compose your email text directly in Nfield Online or copy-paste it from Notepad and then style the formatting in Nfield Online.

Ultimately, learn a few practical tips that may impact the success of your survey invations. These tips are not topic-specific and give you the references on useful websites and contacts you may need when discovering how to make your email delivery spotless.

Build up slowly and carefully

Starting safely with sending your Nfield Online survey invitations is a good exercise for enhancing your email reputation and developing good habits. If you limit your first survey invitations to recipients you know you can rely on to engage, you set yourself up for giving email service providers a positive impression.

Send your very first survey invitations to people who already know you, are really interested in what you’re doing, and therefore very likely to open them and complete the survey.

If possible, perform this ‘reliable respondent’ exercise more than once to really boost your email reputation. This will give your future distributions a much better chance of getting straight to their intended inboxes. If you commence your survey invitation activity by sending an invitation to a bad quality database, your email reputation will rapidly spiral downwards. And that can be a very hard thing to undo.

Be a predictable communicator

Random and erratic emailing activity will bring your reputation down. Try to establish a consistent email sending routine, as distribution spikes won’t help your email reputation.

Forget trials

There’s no such thing as a ‘trial email’ when comes to email reputation. Every testing round is real to email service providers and absolutely every sent email is evaluated. Regardless of the purpose, treat every email as a VIP.

Check your sender reputation score

This score is calculated using traditional email metrics such as unsubscribes and spam reports. The sender score is on a scale from 1 to 100 – the higher the better. Emails with a score lower than 70 aren’t usually delivered to inboxes.

www.senderscore.org

Test for technical errors

Technical errors can also be bad for email reputation. Test how your email looks on different platforms and devices before sending it. Check the technical report for errors. Correct these and test again, until it’s perfect.

www.litmus.com or www.mail-tester.com

Could you be on a blacklist?

If things go extremely wrong with your emailing practice, your survey domain can end up on a blacklist. This would result in your emails being blocked as you are considered to be a serious abuser. If you find yourself experiencing serious delivery problems, please let us know and we will check whether your domain has found its way onto any blacklists.

Say ‘hello’ to NIPO team members

We are happy to help, guide you through and receive feedback on your emailing experiences via Nfield Online. Feel free to contact our team members at info@nipo.com or go straight to your regular NIPO contact person.

Download the ‘Email reputation guide for market researchers‘ brochure in the PDF format to have this important guide always on hand.

“Sorry, I’m giving up on this!” I was responding to an airline’s flight experience survey via my mobile phone. The airline in question had taken good care of me and enabled me to carry my precious cat as hand-luggage from Hong Kong SAR to Amsterdam. I was willing to give them a great rating for every aspect of my experience, from booking to food to inflight service. But during the process of answering their questions, I reached my tolerance limit for the task. Providing a seemingly endless stream of responses within a continuous grid layout was simply too mundane and boring.

I got to the point where I was just entering random responses in a quest to get to the end. Which did nothing for the accuracy of their results and lowered my overall glowing perception of the company. Nobody gained anything.

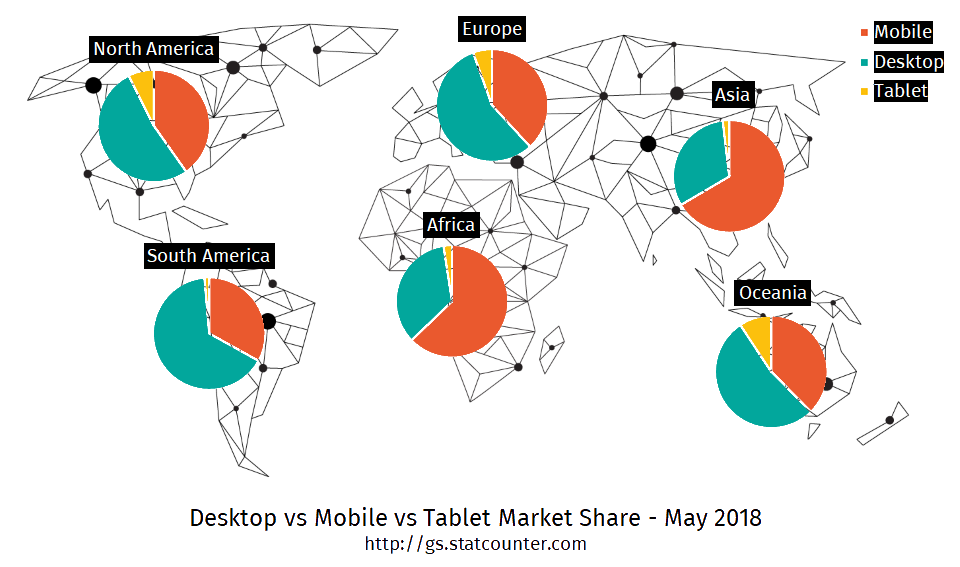

The use of mobile devices is continuing to grow rapidly and is a not-to-be-ignored element in the online communication mix. In some parts of the world, mobile now exceeds the use of traditional desktop machines.

Go to StatCount to find out how the mobile coverage is defined in your region.

So how does this impact your surveys?

Because mobile devices have smaller screens than desktops and are often used away from the calm, static office environment, they need to deliver content in a way that’s more instantly digestible and engaging to keep users focused. When it comes to surveys, long, boring-looking questions are doomed to failure, as they demand too much effort. User attention is best achieved by keeping them entertained.

For this reason, you need to think a lot more carefully about how to approach and design surveys. Yes, you’ll need to invest time and effort, but the rewards will be noticeable, with significantly higher response rates and better quality answers.

You’ve probably heard of the term “mobile first”. This refers to the principle of initially designing all content to meet the needs of mobile users, then adapting it afterwards for desktop consumption.

Designing surveys in this way starts with considering the specific requirements of mobile users. For example:

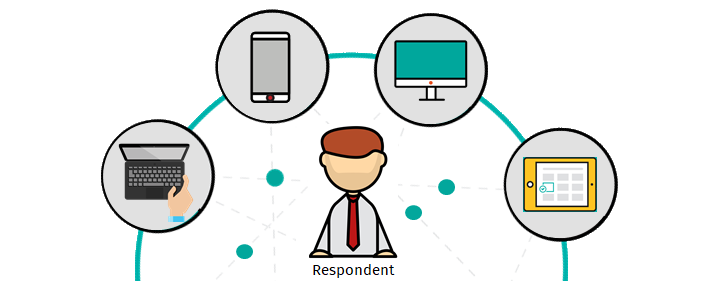

Nfield surveys are designed to accommodate a mobile first strategy, while continuing to satisfy desktop users. For a start, our layouts are fully responsive to all screen sizes and device types. You only have to create your survey once, while Nfield automatically detects the nature of the screen it’s being viewed on and presents the most appropriate layout. So every user experiences your survey in an optimal way, no matter what device they are using, even if they switch mid-completion.

Switching between devices while continuing the same activity is a recognized phenomenon. Just as Netflix lets you seamlessly continue your viewing as you switch between television, tablet and phone, Nfield lets survey respondents start on one device and continue on another. This relieves pressure on respondents to complete the survey while on-the-go. Their already-entered answers are stored and they can continue right where they left off, on any device.

What’s more, Nfield makes the most of mobile respondent behavior and delivers a range of additional benefits, including:

By ensuring your surveys truly meet the needs of mobile users, Nfield sets you up for survey success.

“Clickable” on-screen elements are very reactive and easy to use, without the need to trigger the magnifying glass feature offered by some devices.

Nfield capitalizes on mobile users’ instinctive actions by presenting functionality in similar ways to commonly used apps. For example, questions can be answered by drag-and-drop or by swiping, thereby adding variety and keeping users engaged.

Images play a big part in giving respondents an enjoyable and engaging experience. But it is essential to keep your image file sizes to a minimum. No one wants to wait for an 8 MB image to load before getting on with the survey! There are many programs available for reducing image size without losing sharpness or causing distortion.

Once you’ve taken care of the size of your image data, Nfield takes care of the size of your image on the screen, automatically adjusting each one to fit. So no matter what device or screen size your respondent is using, they always get a perfect view without having to scroll.

Nfield also enables the use of images for answering multiple code questions. Sometimes using icons (with single color) can be a good way to reduce boredom and improve the experience.

Nfield provides a good variety of question types to make the whole experience for your mobile respondents more engaging.

You can use drag-and-drop, image maps, sum sliders, star-ratings, matrices and more. Mixing these up within a survey creates variety which keeps the respondent more attentive and focused, which will result in better data quality.

Nfield even takes care of matrix questions, which can be a real problem on mobile devices if not correctly resized. By automatically re-structuring these into a card presentation for mobile devices, Nfield makes matrix questions as easy as any other to answer. Readable, finger-tip friendly and fully aligned with the mobile first principle.

Click the following link to see how Nfield Online looks on your smart phone, tablet, laptop or desktop. Get a first-hand experience of the benefits of mobile first!

Are you looking to improve your response rates? Are your surveys delivering an enjoyable experience to respondents? Feel free to share your example with us so we can examine it together and identify where improvements can be made.

You can now connect and query an external source during an online interview in Nfield. A much sought-after feature by many of our customers. Forget about complex list and algorithm management in the script. Instead connect to a web service to consult up-to-date lists of e.g. car brands or postal codes and apply these in the Nfield interview.

Click on the link below to do a (short) survey on crypto currencies that monitors the real-time value of your wallet as you are progressing through the questions.

Check our demo survey that highlights this new and powerful feature in action.

Click here!

Because the amount of data sources / APIs / systems that you may wish to query is endless, we have implemented a standard way to pass parameters, consume responses and a configure secure HTTPS endpoints. This way you get predictable performance at maximum flexibility.

HTTPS endpoints can be configured for the whole domain. The configuration is as simple as adding a URL and one or more named headers and values. These headers can be used for example to pass along an API key or a JWT token. Nfield does not attach any meaning to the configured headers; it simply sends them. As an extra measure of security domain administrators can see which headers are configured, but the value will be masked once entered and saved.

Because we have standardized the interface, you may need to develop bridging applications between the source you try to connect and Nfield. In calling an API you can pass your own parameters and values. The result format however is strictly defined. The JSON output from your web service or API to Nfield must be data: {xxxxx}. Nfield cannot process anything else (e.g. result: {xxxxx} or location: {xxxx}). In this case you either must find another API that does provide date output in the required format or -more likely- create a bridging layer that re-formats the data output. The NIPO Support team is available to explain how to do this.

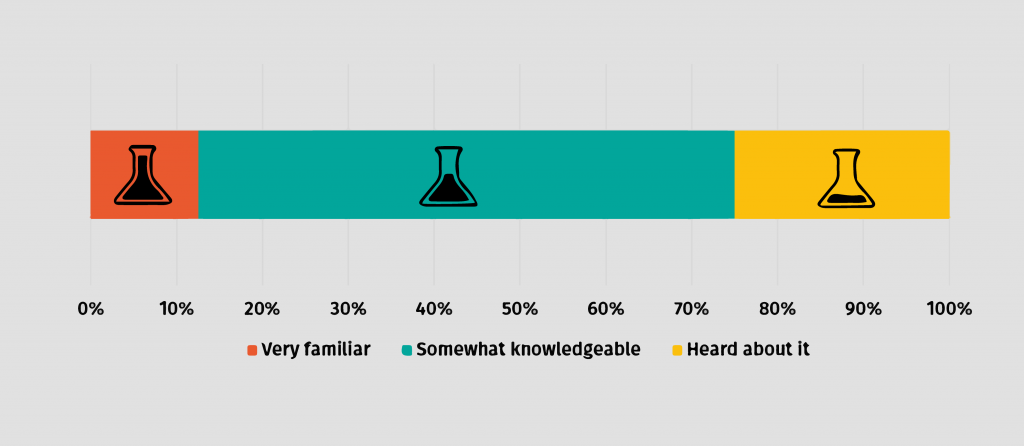

We asked market research professionals if their organizations are ready for the rapidly approaching validation of GDPR, and what their thoughts are about this topic. This article, which presents the most interesting questions from the survey, is certainly worth your attention because the answers provide an interesting insight into the GDPR readiness of market research organizations. Where does your organization stand? How would you respond?

Response: 75% of market researchers is aware of GDPR.

NOTE! Nobody chose the “This is the first time I hear about GDPR” option, which shows how seriously market researchers take the new data security legislation.

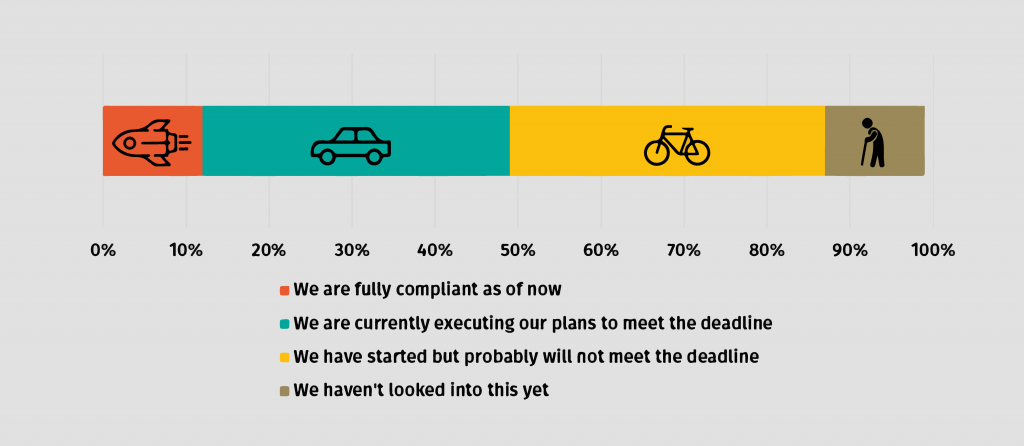

Response: Some of you are GDPR-ready, but many still have enough to do.

NIPO! Our ISO 27001:2013 certification and strong data security measures show how seriously we take it. We’ve always made sure that everything in our organization and survey software solutions has been built from the start following the highest security standards. This has already placed NIPO at the top of the GDPR compliance scale as our systems have been proven to be GDPR-ready even before this new legislation began to worry the whole market research industry. Our team is currently working on strengthening instruments that will help our customers comply with GDPR without troubling their survey projects operations. We will inform our customers in detail about these developments soon.

Response: Understanding is the most difficult part.

NOTE! GDPR was approved by the EU Parliament in April 2016, giving organizations a two-year transition period for making changes within their activities and processes to become compliant before the new standards come into effect in May 2018. We surmise that the robustness of the legislation, the risk of wrong interpretation, and the higher costs related to the changes deterred many organizations from starting the adoption on time.

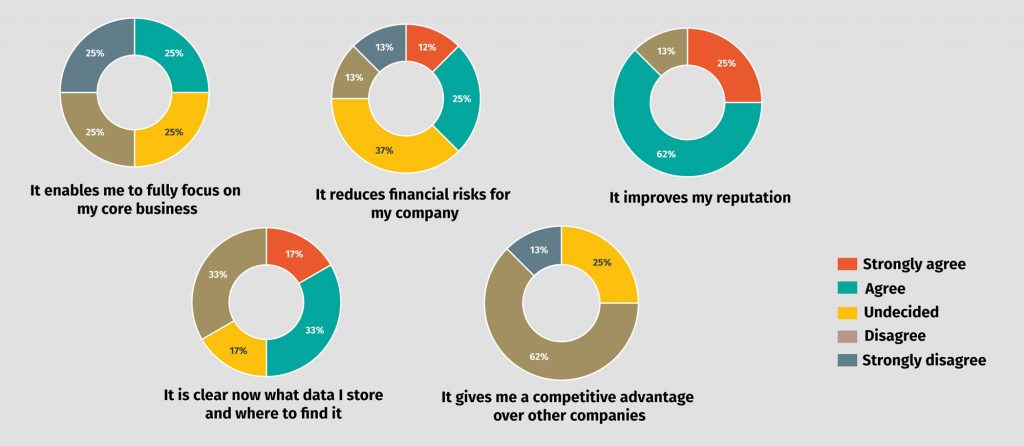

Response: GDPR benefit: a stronger company reputation.

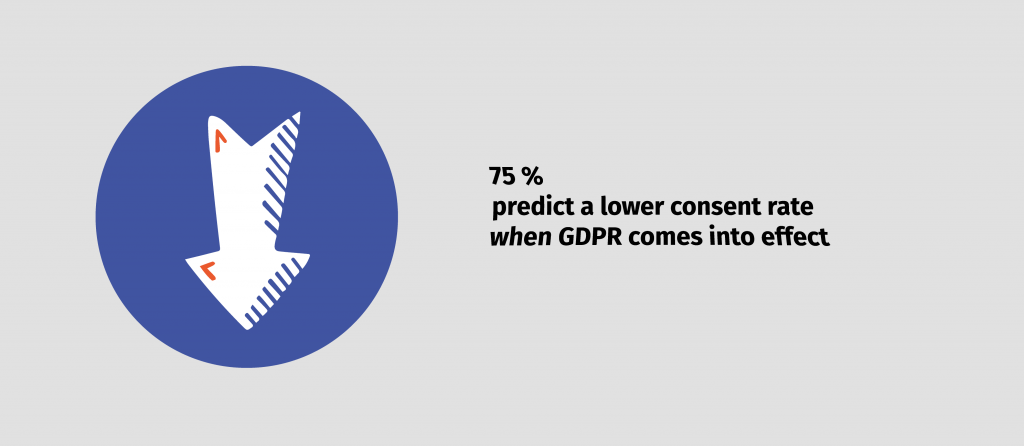

Response: Problems with the acquisition of consent are expected.

TIP! Now more than ever it’s important to have an up-to-date contact database and establish an honest, mutually-rewarding relationship with respondents. Clean your contact list with https://www.datavalidation.com/ or any other tool, and be honest with you respondents, telling them why their opinions matter.

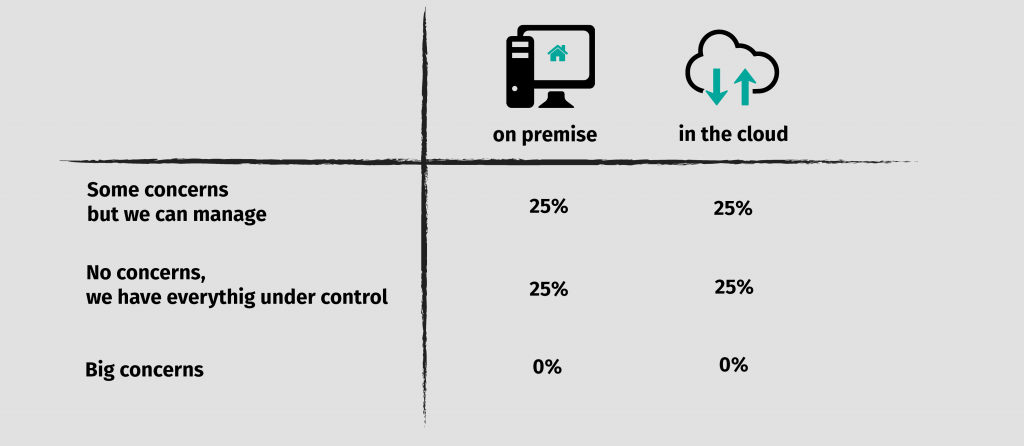

Response: Researchers are confident about the security of data within own organization.

NOTE! What’s interesting about this result is that the respondents are equally confident about the security of on-premise solutions as well as cloud solutions. In the past many organizations did not always trust cloud solutions. The investments in security and compliance of cloud providers seem to have changed organizations’ views.

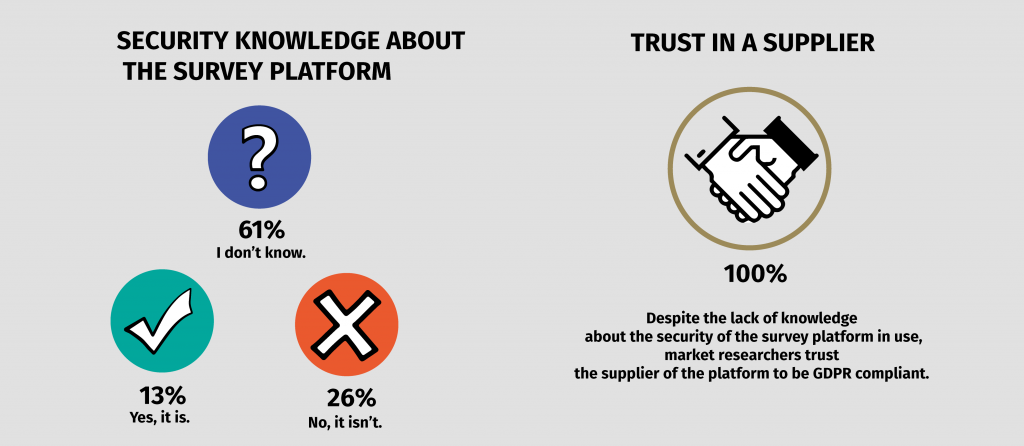

Response: Trust in the compliance of the survey platform in use is higher than the factual knowledge about it.

GDPR, which refers to the General Data Protection Regulation, aims to protect and strengthen the privacy rights of EU citizens, that have been clearly affected by the intrusive developments of the digital age. It comes into effect on May 25, 2018, and non-compliant organizations risk hefty fines up to 4% of global turnover or €20 million, and huge damage to their business reputation.

Among other things, it says that market researchers are required to have consent of every EU citizen to collect, use and share his/her personal data. Each consent has to define what personal data, for which purpose, and for how long the market research organization is allowed to hold it. Learn more about the important aspects of GDPR in our articles:

Do you have more thoughts about GDPR? Suggestions? Or questions? Contact our team at info@nipo.com, we would be happy to hear from you.

Thank you for participating in our survey.

Disclaimer: This blog is made available by NIPO for the purposes of providing general information and a general understanding of GDPR, and should not be considered or used as a substitute for legal advice. NIPO does not accept any responsibility or liability for the accuracy, completeness, legality, or reliability of the information contained on this blog.

Welcome to the third post in our GDPR blog series. In the first post, we gave you an overall high-level look at GDPR. In the second post, we focused on the legal basis on which market researchers can process personal data. In this post, we will focus on pseudonymization and anonymization, specifically how these measures can help you protect individual’s personal data and comply with the GDPR.

Although similar, pseudonymization and anonymization are two distinct techniques that allow data controllers and processors to use data. The difference between the two techniques hinges on whether the individual data subject can be re-identified.

The concept of pseudonymization is one of the favoured techniques under the GDPR to minimize the amount of personal data that is held.

The GDPR defines pseudonymization as the processing of personal data in such a manner that the personal data can no longer be attributed to a specific data subject without the use of additional information. It further provides that in order for the data to be pseudonymized, the data must be kept separately and subject to technical and organizational measures to ensure that the personal data are not attributed to an identified or identifiable natural person. This means that the personal identifiers are removed from the data and stored in a separate database, and linkage to a specific individual will not be possible without the additional information that is held separately.

Although this technique detaches the link between the data and the data subject, pseudonymous data is still considered personal data under the GDPR because the detachment can be reversed and therefore, falls within the scope of the GDPR.

The application of pseudonymization to personal data can reduce the risks to data subjects concerned and help controllers and processors to meet their data protection obligations. The benefits of pseudonymization of personal data for controllers under the GDPR include:

Anonymization of data means that it irreversibly destroys any way of identifying a data subject.

Data can only be considered anonymous if re-identification is impossible by the entity holding the data. Using anonymization, the resulting data should not be capable of singling any specific individual out, of being linked to other data about an individual, nor of being used to deduce an individual’s identity.

As long as the data is anonymized, it is outside the scope of the GDPR because anonymous data doesn’t include any personal data. Anonymization reduces any risks to data subjects, for example, where there is a data breach because the data cannot be linked to any specific individual.

In principle, organizations can use anonymized data for purposes beyond those for which it was originally collected and it could be used indefinitely as the data is no longer classed as personal data. In addition, once the data has been anonymized, then controllers do not have to respond to data subjects’ requests because they can no longer identify a data subject.

Pseudonymization techniques are different from anonymization techniques, however, they are both measures used to protect personal data and reduces any risks to the data subject. Both pseudonymization and anonymization are encouraged in the GDPR and enable GDPR compliance.

Disclaimer: This blog is made available by NIPO for the purposes of providing general information and a general understanding of GDPR, and should not be considered or used as a substitute for legal advice. NIPO does not accept any responsibility or liability for the accuracy, completeness, legality, or reliability of the information contained on this blog.

This is the second post in our GDPR blog series. In the first post, we gave you an overall, high-level look at GDPR. In this second post, we will focus on the legal basis on which personal data can be processed, more specifically on the legal bases that market researchers can rely on to process respondents’ personal data.

The GDPR provides several legal grounds on which the collection and processing of personal data can be based. In order to lawfully process personal data, at least one of these grounds must apply.

The collection and processing of personal data are fundamental to the work of many market researchers. Therefore, it is imperative to know and understand what lawful basis can be used to process respondents’ personal data. For market researchers,the two most common lawful basesto process personal data are:

The approach to deciding what lawful basis researchers should use for processing personal data may vary by member states, as domestic markets may have different characteristics. Researchers need to assess what legal basis are most used within their individual jurisdiction, and comply with any national research code of conduct, in addition to the GDPR requirements.

Consent of respondents will often be used as the lawful basis for carrying out research in many EU member states. The GDPR retains the concept of consent contained in the 1995 directive, but raises the bar for considering it valid, by setting out additional requirements.

Under GDPR consent shall be:

Where data processing has multiple purposes, consent should be given for all of them, unless such purposes are considered compatible. This essentially means that the data controller (market research company or its client) can further process personal data, where the purpose of the processing is compatible with the purpose for which the personal data was initially collected.

If a company that produces chocolate wants to know, through a survey, how many adults (ages 18-40) eat their chocolates, it needs to obtain consent for the processing of the respondents’ personal data and specify to the individuals the purpose for which they will be using such data, which is to know how many adults in that age range eat their chocolates. After completing the survey, the chocolate company compiled a list of the people that eat their chocolate often, this list is then used for direct marketing (they send emails and posts to the individuals about their new products). This will be considered incompatible with the purpose for which the respondents’ personal data was collected because the chocolate company never informed the respondents that they would use the information collected from the survey for profiling or direct marketing, and the respondents did not give their consent for the use of their data for this additional purpose.

If the legal basis used is consent, researchers must understand what GDPR consent means and the fact that respondents will generally have stronger rights (right to erasure, right to data portability) where consent has been given.

There is a higher threshold for consent when the processing involves sensitive personal data. The GDPR provides that the respondent must have given his/her ‘explicit’ consent, but it does not specify what ‘explicit’ consent entails. Therefore, existing interpretations and guidance from legal advisers and/or supervisory authorities should be consulted.

The Article 29 Working Party (an advisory body made up of a representative from the data protection authority of each EU Member State), in its guidelines on consent, provided that the term ‘explicit’ is the way consent is expressed by the data subject. This means that the data subject must give an express statement of consent. It further stated that, in order to make sure consent is explicit, the data subject must have given consent in a written statement (e.g. signed statement) or an oral statement.

Going back to the survey in the earlier example, let’s suppose the chocolate company also asked about health information (i.e. how many are diabetic) of the respondents, the purpose is to enable them to improve their products so their diabetic customers can continue to consume, but with reduced health implications. All health information is considered sensitive personal data under GDPR, and so before the data can be collected and processed, the individuals must have given their explicit consent for this use of the data (granularity will allow respondents to consent for each processing activity).

Children’s personal data is further protected under GDPR. If the research project involves respondents (children) that are below the age of 16 (age limit can change based on the jurisdiction), GDPR states that parental consent must be obtained in order for the processing to be lawful, if you intend to rely on consent.

The GDPR makes clear that consent is not a one-off compliance box to tick and file away, it is an ongoing actively managed choice. It is important to keep records of consent (i.e. how it was obtained, for what purposes and what was consented to).

Data subjects’ consent needs to be regularly reviewed to ensure that the consent is still valid. The GDPR does not give a timeframe for consent to be reviewed, this has to be determined by the controller (market research company or its client), taking into account its needs as well as the rights of individuals, and preferably included in its internal procedures.

The term “legitimate interest” refers to the reasonable business purpose that the market research company processing the personal data may have to process data. This may include a benefit inherent in the processing of the company itself or society at large.

The GDPR provides that the legitimate interests of the controller (or third parties) must be necessary for these purposes, except where such interests are overridden by the rights and freedoms of the data subject which require protection of personal data. This means that researchers need to determine whose legitimate interests (market research company or a third party) and understand what exactly the legitimate interests are.

Researchers using legitimate interests as a lawful basis, need to, first of all, do an assessment before processing any personal data of respondents. This assessment is referred to as a balancing test. The balancing test is weighing between what the controller considers a legitimate interest on the one hand, and what the rights of the data subjects are on the other hand.

The balancing test must always be conducted fairly, there are several factors that need to be considered, these include:

An example of legitimate interest is in a situation in which a market research company recalls respondents for quality control purposes, although the respondents have not consented to such recall. In this case, the legitimate interest of the market research company is to perform a quality control, while on the other hand, there are the rights of the respondents.

In order to ensure that the rights of respondents are not infringed, the balancing test needs to be applied: after identifying what the legitimate interest is (quality control), the market research company needs to look at what type of data is involved, and to put in place appropriate safeguards (among others encryption or pseudonymization) to protect the personal data of respondents. Only at this point, will it be possible to assess the existence of a balance and the consequent validity of the legitimate interest.

The GDPR provides several legal grounds on which personal data can be processed, however, when it comes to market research, not all the lawful basis can be used. Researchers need to identify which of the lawful grounds for processing can be used for the particular research project before processing any personal data of respondents. As explained above, in most cases, obtaining consent from respondents is the best option, while in other cases, using legitimate interests as a lawful ground may also be appropriate.

If legitimate interest is the legal basis chosen by the market research company for the processing of respondent’s personal data, then it must ensure that it has carried out a fair balancing test. If the balancing test shows that the controller’s interests do not outweigh the rights of the data subject, then legitimate interest cannot be relied upon and the market research company will have to use another lawful basis (e.g. consent) in order to process this personal data.

The relationship between reputation and business success is a well-known fact. While a good reputation improves sales performance and increases a brand’s value, a bad reputation can rapidly take a business downhill. Aware of this, many companies pay meticulous attention to detail when it comes to product quality and customer service. Yet they often overlook the need to also maintain a good email reputation, which directly impacts the ability to communicate online.

Email reputation is a technical metric which email service providers use to decide the ‘credibility’ of sent messages. It is defined by a score relating to the sender domain (i.e. the “nipo.com” part of an email address).

This score, which can continually change, determines whether messages get delivered into recipients’ inboxes, spam folders or are even delivered at all. You can think of it a bit like a personal credit rating, which banks use to decide whether they should lend you money.

There’s no point in sending out a survey invitation if it won’t arrive in recipients’ inboxes. If your sender domain has a bad reputation, your message is likely to be swallowed into people’s spam folders or, worse still, be blocked from being delivered at all.

But if care has been taken to adopt good practices which result in a good email reputation, your survey invitations are much more likely to arrive in a place they’ll be seen, reaching recipients’ inboxes directly and without delay.

The sender domain’s email reputation can therefore make or break the success of your market research project.

The ease and cost-effectiveness of using email to communicate with consumers and companies alike has led to staggering amounts of email traffic. There are currently 3 billion email users worldwide, and rising – approximately 50% of the planet’s population.

Unfortunately, this simplicity and accessibility has given rise to spamming and dishonest emailing practices, by which irrelevant or unsolicited emails are sent, typically to a large number of recipients, for the purposes of advertising, phishing, and distributing malware. This has turned into a big business, with various reports estimating that spam messages account for 50 – 80% of the world’s email traffic.

Email service providers needed to do something to protect email recipientsfrom the influx of unwanted and dangerous emails, which has resulted in the email reputation system currently in use.

Most of the world’s email traffic is spam. Email reputation is intended to help legitimate messages, like your survey invitations, take priority.

Email reputation is the total result of combining a number of quantitative metrics designed to evaluate how honest and well-targeted emails from a particular domain are. The total score a domain accrues determines whether its outgoing messages are blocked, directed to spam folders or successfully delivered to inboxes.

Whatever role you work in, it’s worth understanding the two most fundamental aspects of email reputation:

And this is one of the most difficult things with email reputation: it can take a long time to earn a good reputation, but it is possible to destroy it in an instant. Vigilance in responsible email practices needs to be applied at all times.

If you want impressive response rates, look after your email reputation!

Events and aspects which are widely understood to damage email reputation include:

Recipients marking email as spam – The more times your emails are marked by recipients as spam, the more likely email service providers are to conclude that you’re sending unsolicited messages.

Poor email engagement – Email providers are interested in how relevant your messages are to their recipients, and they judge this by what percentage of the mails get opened. A low open rate is considered to mean recipients aren’t interested in them.

Invalid recipient addresses – Sending messages to invalid email addresses is fatal for your email reputation. It’s a clear sign that you don’t actually know who you are sending your messages to.

Type of email content – Email providers have become very skilled in identifying certain keywords and phrases which are likely to indicate an email as being unsolicited or dangerous. All messages are scanned for these.

Unverified sending domain – Dangerous senders often try to pretend to be someone they are not by using someone else’s domain. Many email service providers therefore block emails coming from an unverified sender domain.

Irregular frequency and volumeof emails – Because spammers don’t tend to have a consistent send frequency, email providers look at how often your messages are sent out. Changing the frequency may damage your email reputation.

Lack of history – If there is no history, email providers cannot draw any conclusions about your intentions. Remember that you start enhancing or damaging your email reputation from the first send-out.

The good news is that you can always have control over your email reputation.

To find out how, check out our practical guide on building a good reputation and ensuring smooth delivery of all your survey invitations sent out by Nfield Online.

Learn how to build a good email reputation and deliver more survey invitations.

Request a demo to see how NIPO can help you meet your requirements with our smart survey solutions.