Get a first impression, scheduled soon.

Request a demo to see how NIPO can help you meet your requirements with our smart survey solutions.

GPS logging is a game-changer when it comes to improving accuracy, reliability and relevance of market research surveys. From conducting face-to-face interviews to mystery shopping and retail store auditing, GPS logging brings additional layers of insight that let you work smarter and deliver more meaningful results.

Here’s an overview of what GPS logging is, and how it benefits market research.

GPS logging is the process of capturing and storing geolocation coordinates at the point where market research interviews are conducted. These coordinates are tied to the survey responses, providing precise geographical context.

GPS logging leverages existing GPS functionality in the smartphones and tablets used to record interview responses.

GPS logging provides a powerful means of validating survey data and assuring its integrity. It enables researchers to track exactly where fieldwork is being carried out, to ensure it’s taking place in the intended locations. For example, in mystery shopping or retail audits, GPS coordinates can confirm that interviewers actually visited the specified stores or locations. Using GPS logging thereby reduces the risk of fraudulent or fabricated data, which is the case when surveys are filled out remotely instead of at the designated site.

Because GPS logging enables researchers to map survey responses geographically, it also delivers insights into regional or location-specific trends. For example, a beverage company may discover that consumer preferences vary significantly between urban and rural areas, and this helps them fine-tune their distribution strategy.

For studies involving large-scale field teams, GPS logging enables real-time tracking of interviewer activity. This is helpful for ensuring full coverage of assigned areas, as supervisors can monitor progress and adjust fieldwork schedules dynamically to optimize efficiency.

GPS data can also be enriched with external geospatial datasets, such as demographics, traffic patterns, or weather conditions. This adds another dimension to market research insights, revealing correlations that might otherwise go unnoticed.

In summary, GPS logging enhances market research survey quality and efficiency in many ways, making the results even more valuable.

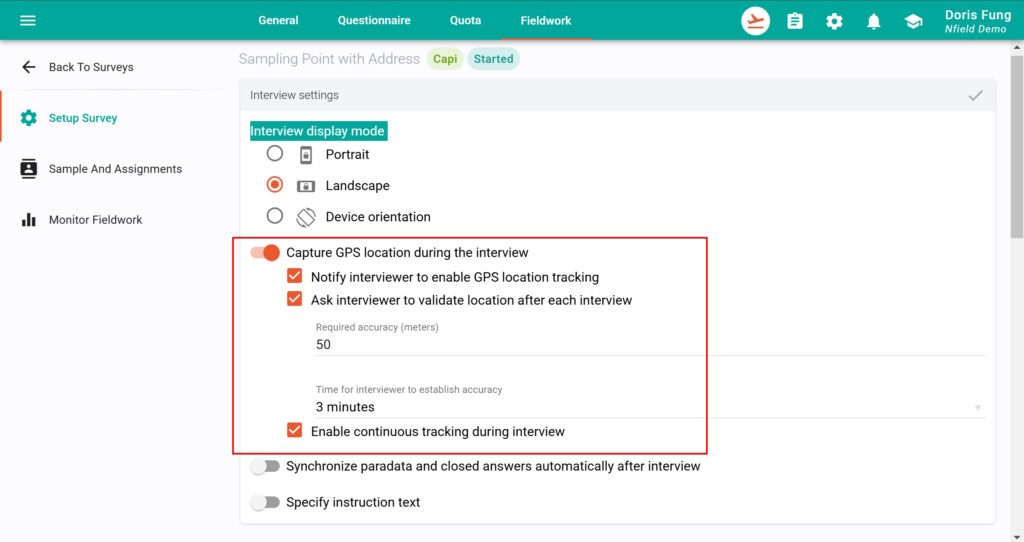

GPS logging is easily applied in Nfield surveys via three different options:

Learn more about GPS logging and how to integrate it in Nfield surveys

To explore GPS logging in deeper detail and learn how to integrate it effectively into your market research activities, check out our NIPO Academy session Academy 57: GPS location fix.

At NIPO, we’ve always prioritized the principles of security, privacy, compliance, and transparency in everything we do. These values form the foundation of the Nfield platform, ensuring every user can confidently entrust us with their data. The Nfield Trust Center supports our commitment to these principles by providing access to all relevant documentation.

The Nfield Trust Center is a central repository for all information related to our practices around security, compliance, and privacy. It facilitates full transparency into how we handle and protect our users’ data, providing documentation that can also be shared with market research clients to demonstrate Nfield’s reliability.

The Nfield Trust Center provides access to essential documents and resources covering:

The Nfield Trust Center is a practical resource that market researchers can turn to for information, reassurance and guidance. It provides transparency which can be shared with clients, to breed the trust that is a cornerstone of successful partnerships and supports business growth.

Confidence-building transparency

Providing centralized access to all key documents and information, the Nfield Trust Center ensures researchers can obtain everything needed for building client confidence. Whether it’s a security policy, compliance certification, or privacy guidelines, it’s all here to view and share.

Authoritative reassurance

When market research clients have questions about data security, compliance, or privacy, the Nfield Trust Center equips Nfield users with clear and authoritative answers. As well as providing reassurance, this helps market research businesses demonstrate their own commitment to ethical and secure research practices.

Alignment with global standards

The Nfield platform is designed to meet or exceed international standards for data protection, including GDPR and ISO certifications. The Nfield Trust Center enables market researchers to confidently navigate and comply with these regulations, thereby reducing risk and fostering compliance.

NIPO is committed to continually enhancing the Nfield Trust Center, ensuring it remains a valuable resource for researchers worldwide. As we expand and refine our offerings, you can look forward to even greater transparency and support. Take a moment to explore the Nfield Trust Center and find out for yourself how it can benefit your market research business.

Longitudinal surveys are the way to go for monitoring how consumer preferences, behaviours, and attitudes change over time. This is the ideal research method for obtaining insights into things like customer satisfaction, brand loyalty, product usage, market trends, and advertising effectiveness.

Longitudinal market research involves repeatedly tracking the same variables over an extended period, by sending out multiple waves of similar questionnaires. It therefore makes sense to be able to work from a single core structure which can easily be adjusted for each subsequent wave. And that’s exactly what Nfield Online’s new Tracker capability lets you do!

Nfield Trackers support longitudinal surveys by combining creation of a core survey with flexibility to customize multiple iterations. This is complemented by shared survey settings which reduce administration and ensure consistency.

Here’s a brief summary of how Trackers can be set up to bring ease, efficiency and flexibility to longitudinal surveys.

Nfield Online’s Tracker capability utilizes several cutting-edge capabilities to save time, enhance workflow and ensure more accurate longitudinal surveys. It is designed to make repeated data collection as efficient and organized as possible, bringing ease to long-running research while enabling flexibility and control through streamlined management.

On 8 and 9 October 2024 , NIPO Academy sessions were held on how to use and make the most of our Tracker capability. This included a live demonstration, tips for maximizing its potential, and a Q&A session with our product experts.

A recording of the session is now available for you to watch:

Discover how this game-changing Nfield Online capability can transform the way you conduct longitudinal market research!

Market research and the technology that supports it are evolving fast, which means versatility is key. That’s why Nfield’s leading SaaS survey platform is designed with open architecture, so users can adjust it to every need. Both robust and flexible, Nfield’s extensive integration capabilities revolutionize how market researchers can gather, process, and utilize data.

From leveraging APIs to taking advantage of our centralized data repository and ability to integrate with panel providers, here are a few examples of what Nfield’s open architecture makes possible.

One of the features that really sets Nfield apart is its own powerful API, which can enable any manual action in Nfield Manager to be automated. This API opens the door to numerous opportunities for streamlining market research workflows and boosting efficiency.

Benefits of task automation via the Nfield API

Check out these examples of how the Nfield API can be used:

Nfield’s ability to call external APIs within scripts is a game-changer for integrating and enhancing data collection processes. It means market researchers can seamlessly retrieve data from and update external systems, to benefit from a more comprehensive and connected research environment. For a deeper understanding of this feature, watch Academy 48 – Request command.

External API integration lets you achieve

Nfield stores collected survey data in a centralized repository, from where it can be directly retrieved for reporting and further processing. This offers significant advantages for data analysis and decision-making. For more details, see Data Repository feature delivers real-time survey insights and watch Academy 35 – Standard and custom reporting.

Benefits of direct-from-database retrieval

Nfield’s ability to integrate with panel providers is another key feature that enhances its versatility and reach. It means market researchers can seamlessly access a broader and more diverse respondent pool, to collect better-quality data.

Benefits of panel provider integration

For more information on how Nfield integrates with panel providers, see Integration between Nfield Online and Panel Providers.

Nfield’s open architecture empowers market research companies to conduct more efficient, accurate, and insightful market research.

From automating tasks with the Nfield API to enhancing data collection with external API integrations, and leveraging direct database retrieval for advanced analytics, Nfield offers a comprehensive solution tailored to modern research needs. Integration with panel providers further extends these capabilities, making Nfield an indispensable platform for any market research professional.

Embrace the power of Nfield to transform your market research processes today!

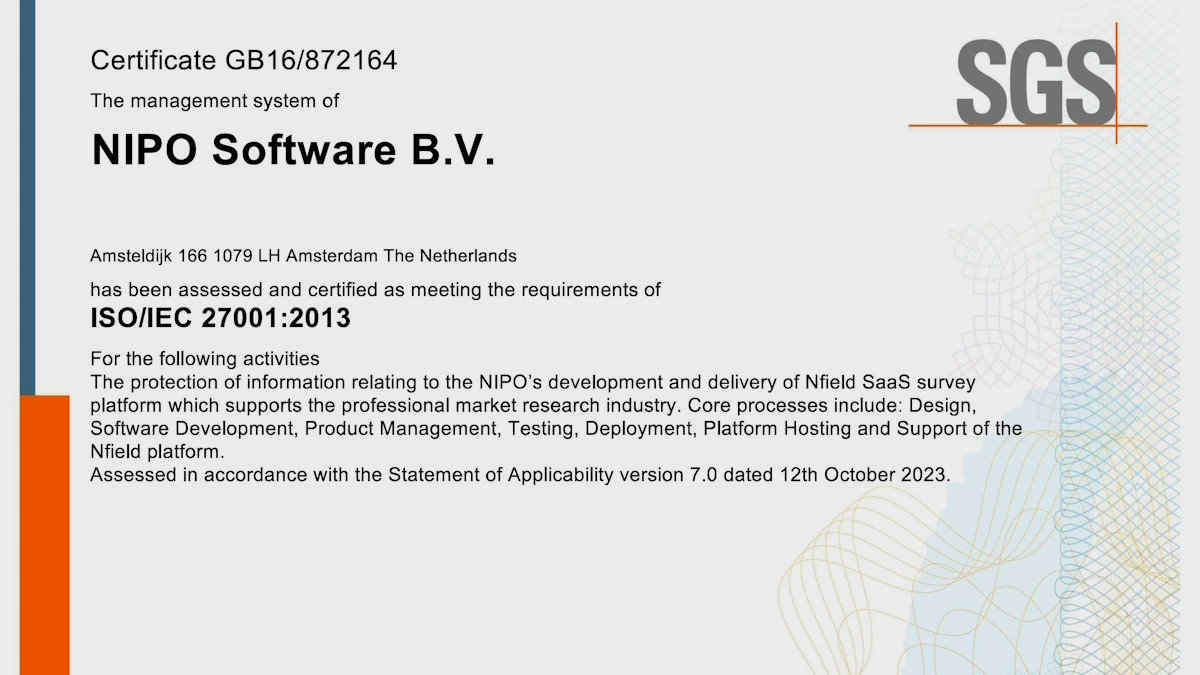

ISO 27001 is an international standard for managing information security, and a must-have for any organization that is entrusted with large amounts of user data, as we are here at NIPO.

Following an intensive 5-day audit which scrutinized both our Amsterdam and Madrid offices, we are pleased to share the news that NIPO’s ISO 27001:2013 certification has once again been extended. Performed by SGS, this audit was fully focused on NIPO’s ISMS.

NIPO has been certified to ISO 27001:2013 since 2016. We have retained this by undergoing re-certification audits every three years, along with two additional annual surveillance audits in between.

Continuous improvement is at the heart of both the ISO 27001 certification and NIPO. In line with this, we are now working on all the measures necessary to conform to the latest iteration, ISO 27001:2022, before October 2025.

Alongside ISO certification, we also implement many additional security measures to ensure every Nfield customer can use our market research platform with confidence. To learn about these, see Your data is secure with Nfield: here’s how.

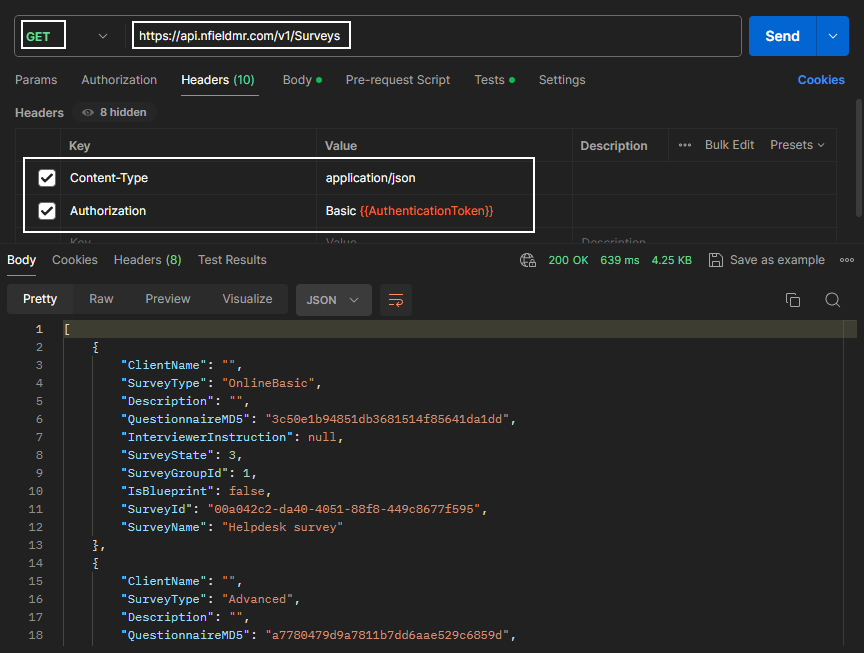

Integrating Nfield with your own system(s) can significantly enhance your organization’s market research capabilities, and the Nfield API enables this to be a seamless experience. Here is everything developers need to know about Nfield integration via the Nfield API.

Before diving into the integration process, let us start with a few basics that underpin successful integration.

| Your region | Nfield API help page |

| Asia Pacific | https://apiap.nfieldmr.com |

| America | https://apiam.nfieldmr.com |

| China | https://apicn.nfieldcn.com |

| Europe | https://api.nfieldmr.com |

Here’s how to initiate your Nfield API integration process by setting up authentication and understanding key endpoints.

Figure 1: An example in Postman for getting surveys from Europe region.

Adhering to best practices will help make your integration more efficient and reliable.

To stay updated and efficiently resolve issues, make effective use of available documentation and support resources.

Integrating Nfield with your system via the Nfield API can streamline your market research operations and provide valuable data insights.

By preparing adequately, understanding the API’s fundamentals, and following best practices, you can ensure your integration is a success.

Make the most of Nfield’s capabilities by leveraging all available resources, such as Nfield API manuals and your own researchers’ expertise.

Enhance your integration’s efficiency and performance by adopting optimized data retrieval methods and respecting API usage policies.

Stay up to date on system changes to continue getting the absolute best out of Nfield.

NIPO is pleased to announce the introduction of its survey-level data retention policy feature. Designed to simplify the management of long-running trackers, or waves, this feature can be set to automatically clean out Online survey data after a specified number of days.

These settings are in the Nfield Manager under the Setup survey/Retention tab. They can be configured separately for each survey, so storage practices can be tailored to specific project needs.

Setting and adhering to data retention periods aids compliance and data governance, while also simplifying long-running trackers and mitigating risks associated with prolonged data storage and privacy breaches.

Based on the selected retention period, the following data will be removed automatically:

Important notes

Survey-level data retention policy is just one of the many tools Nfield equips you with to take your market research to the next level. Say hello to streamlined processes, enhanced efficiency, and control over your data retention policies.

In market research, CAPI devices used for conducting surveys and collecting data are crucial to the fieldwork process. These devices, which are typically tablets powered by Android systems, are essential for enabling a smooth and efficient experience, while protecting valuable data.

Like every technical tool, CAPI devices need regular attention in terms of updates, data management and security checks to keep them performing as they should.

Here are our top-5 tips for optimizing the performance of your CAPI devices:

Regularly updating your Android operating system is vital for maintaining device security and performance. Android frequently releases updates, which often include important security patches and system optimizations. By ensuring you’re always running the latest software version, you can mitigate potential security vulnerabilities and ensure compatibility with applications – such as the Nfield CAPI app – as these, themselves, get updated.

Like every good app, the Nfield CAPI app periodically gets updated with new features, bug fixes, and security enhancements. To ensure you are always getting the best experience by using the latest version, we advise enabling automatic updates in your Google Play Store settings. This way, app updates are automatically downloaded and installed in the background without anybody having to remember to check and manually initiate the process.

Staying on top of your fieldwork operation calls for the ability to track CAPI device usage, troubleshoot issues, and maintain compliance with data security protocols. All this can be achieved by implementing a device management solution, such as Mobile Device Management (MDM) software, which provides centralized monitoring and control. MDM solutions enable administrators to remotely manage device settings, deploy applications, and enforce security policies.

CAPI device security is always essential, which is why we recommend implementing robust security measures such as device encryption, screen lock passcodes, and biometric authentication (e.g. fingerprint or facial recognition). It’s also a good idea to install reputable antivirus and security software to detect and mitigate potential threats such as malware or unauthorized access. For times when there is no secure Wi-Fi connection available, consider using a Virtual Private Network (VPN) to preserve security by encrypting data transmission.

Regularly doing a bit of a clean-up by clearing cache files, removing unnecessary apps, and managing device storage will go a long way to keeping your CAPI device operating well. These tasks can be conducted using built-in system maintenance tools and third-party optimization apps. The less clutter there is inside your CAPI devices, the better their performance will be.

These five top-tips for managing and maintaining security and performance on your CAPI devices are simple to implement, and will go a long way to keeping your fieldwork flowing smoothly. Optimally performing devices create a better user experience for fieldwork researchers and the people they interview, while enabling your market research company to get the most out of Nfield CAPI.

Most online market research surveys begin with an email invitation to participate. If these emails don’t reach their intended recipients and attract their attention, your survey is going to suffer. Successful delivery, which means landing in each recipient’s inbox, not their spam folder, is never guaranteed. And being recognized by them as a legitimate message, which should be opened, is essential to avoid being clicked straight into the trash.

It may sound a bit like a game of chance, but you can take steps to tip the odds firmly in your favor.

To protect ordinary people from being bombarded with huge amounts of unsolicited and undesirable emails which flood the internet every day, email service providers and email apps implement a range of checks on each item before allowing it to reach an inbox. The best practices outlined in this article will help your emails to pass these checks.

The domain your survey invitation emails come from matters. Recipients are more likely to open emails sent from a domain they recognize and feel they can trust. Nfield can easily be configured to send from custom domains as necessary. (Of course, you need to send from a domain you are legitimately entitled to use and have the credentials for – you can’t just borrow any domain you feel like using!)

To ensure each custom domain passes relevant delivery checks, you should set up email authentication protocols such as DMARC (Domain-based Message Authentication, Reporting, and Conformance), DKIM (DomainKeys Identified Mail), and SPF (Sender Policy Framework). This is something for your email administrator to take care of.

These protocols authenticate emails to confirm they are legitimately being sent from the domain they appear to be from, effectively removing one of the reasons that emails get flagged as spam.

Once these protocols have been set for a custom email domain, please contact our support to connect this domain to Nfield.

Obtaining consent to email the people you want to invite to your online survey is important for various reasons. For a start, your emails won’t come as a surprise, so they’re less likely to be suspicious and bin them without opening, or report them as spam. Either of these actions will be unhelpful to both your survey response rate and your domain reputation.

Aside from this, obtaining recipient consent to include them in a distribution list is both a best practice and a legal requirement under the General Data Protection Regulation (GDPR). Compliance with GDPR demonstrates your commitment to respecting individuals’ privacy rights and strengthens trust between your organization and the survey respondents you rely upon. By securing explicit consent, you not only uphold ethical standards but also mitigate the risk of non-compliance penalties. Prioritizing consent as part of your email outreach strategy aligns with GDPR’s principles of transparency and accountability, which fosters a positive relationship with your audience.

Read more about EU GDPR specifications.

Sending survey invitation emails to addresses that don’t exist results in hard bounces that reduce your delivery rate and damage your email reputation. Even when you think you’ve done everything right, invalid addresses can still get into your system through people accidentally mistyping or deliberately providing false information.

You can flush out bad email addresses by using validation tools (such as Emailable or ListWise). Maintaining a clean and validated distribution list will return higher delivery rates and keep your reputation intact.

Even if recipients have consented to being on your distribution list, they have the right to change their minds. It is important that every email contains an unsubscribe link through which recipients can easily manage their preferences. Any requests to opt-out need to be honored promptly to avoid reputational damage caused by unwilling recipients failing to open emails, and possibly reporting them as spam. If you continue to contact people who’ve opted out, they will also develop negative feelings towards the brand being represented.

Enabling easy opt-out demonstrates respect for recipients’ choices and helps preserve your email sender reputation. Nfield supports customizable unsubscribe options, allowing you to tailor the process to align with your branding and compliance requirements.

Alongside this, Nfield provides a blacklist facility where you can keep track of email addresses which have unsubscribed, had delivery problems, been flagged as fake or should not be contacted for any other reason. These blacklists are compiled at domain-level, as another tool for helping you protect your email reputation.

The content and formatting of emails is another factor that can easily trigger spam flags if you’re not careful. Before sending out your email invites, you should evaluate them by using a spam score checker (such as mail-tester) that analyzes subject lines, content, formatting and other attributes that may be scrutinized by the “spam police”. This will help you avoid another deliverability pitfall, while resulting in emails which appear more genuine to the people you need to participate in your survey.

Following best practices for sending invitation emails is essential for online survey success, and Nfield has a number of in-built features to help you do this. For more advice on building a robust email reputation, and to find out why this matters, check out our related articles

Why spend valuable time on routine tasks that can easily be automated? If you’re using Nfield for Online and CAPI surveys, you can reduce manual workload by hooking up with Microsoft Power Automate. Nfield’s API enables seamless integration with this user-friendly automation tool, without the need for any coding.

Integrating Microsoft Power Automate with Nfield can speed up your operations, reduce errors and omissions, and keep communications flowing, while freeing your people to focus on applying their expertise.

Here are five examples of what Nfield and Microsoft Power Automate can achieve together.

Providing regular updates on project progress is good for client relationships, and demonstrates commitment to transparency and timely communication. But doing this takes time out of your day and can easily be forgotten.

With Microsoft Power Automate, you can schedule automated delivery of Nfield quota progress tables to clients, as often as you choose.

Survey respondents are the lifeblood of market research, so keeping them onside is crucial. Simple things like sending thank you notes for completing surveys goes a long way to building loyalty.

Microsoft Power Automate allows you to automate this. Reminding your respondents that their contribution is valued, and encouraging them to continue participating, without any members of your team having to disrupt their schedule.

For CAPI surveys, assigning addresses to interviewers is an essential routine task. But it takes time that can be spent on other things.

Microsoft Power Automate can take care of this work by automatically assigning new addresses to each of your Nfield CAPI interviewers as required, ensuring fair distribution of workload and optimizing how each field worker is used.

The faster your research team are informed, the faster they can get on with the next stage of their work.

Microsoft Power Automate can be hooked up with Nfield to notify them immediately when a survey quota target is met.

Everyone knows the importance of back-ups, which is why these should never be left to chance.

Microsoft Power Automate can initiate backup processes the moment fieldwork is complete. Ensuring this crucial task doesn’t get forgotten, while lessening your team’s post-fieldwork workload, so they can focus their attention on analysis.

Integrating Nfield with Microsoft Power Automate, via the Nfield API, enables you to optimize your market research operations in many different ways. From enhancing various communications to automating routine tasks, this powerful combination allows you to focus on what matters most – extracting meaningful insights from your data.

Automation of routine tasks is a great way to improve efficiency in any line of work. For market research companies conducting Nfield Online and CAPI surveys, this is easily achieved through integration with codeless tools such as Microsoft Power Automate and Zapier.

The beauty of no-code automation tools is they don’t require specialist expertise to set them up. All that’s necessary is an amount of familiarization with the tool and how it integrates with Nfield Manager via Nfield’s API. For the purpose of this demonstration, we’re showing how sending reports to clients can be automated using Microsoft Power Automate. This task is one of the Five ways no-code automation can improve efficiency in market research operations.

Here’s what’s necessary for integrating Microsoft Power Automate with Nfield:

| Your region | Nfield API Manual |

| Asia Pacific | https://apiap.nfieldmr.com |

| America | https://apiam.nfieldmr.com |

| China | https://apicn.nfieldcn.com |

| Europe | https://api.nfieldmr.com |

Our video follows every step of the process of setting up automated sending of quota progress reports from Nfield Manager using Microsoft Power Automate:

1. Log in to Power Automate (0:00 to 0:25)

2. Create a new flow with a schedule trigger* (0:25 to 1:05)

3. Create an HTTP connection for Nfield API authentication (1:05 to 2:54)

4. Extract and store authentication token (2:54 to 4:09)

5. Create another HTTP connection to retrieve the quota table (4:09 to 7:11)

6. Send an email with the quota table (7:11 to 8:12)

*In this example, reports are being scheduled to go out daily at 9am.

Happy New Year everyone! As we enter 2024, we hope you are looking forward to a positive year ahead. That’s certainly the case for us here at NIPO, where we never stop looking for ways to make Nfield even better aligned with users’ needs.

While we’re hard at work improving our products and developing new features, we thought this would be a good moment to reflect on the changes Nfield underwent during 2023. The 24 releases made over the course of the past year included the following major developments:

Keeping your Nfield domain clean – by deleting outdated surveys to avoid unnecessary data storage – is vital for your GDPR compliance, security, and efficient operation. Helping you achieve this is all part of our responsibility within Nfield’s ISO 27001:2013 certification.

To make it as simple as possible, we introduced an automatic survey clean-up feature. You can learn all about it in our 30-minute webinar Academy #39 Automatic clean-up feature session recording.

Maintaining a clean, clutter-free domain promotes internal collaboration and enhances teamwork. Doing this will also help you keep in line with Nfield’s acceptable use policy, making it less likely that you’ll incur additional charges from exceeding storage limits.

When you’re creating a new survey with the same configuration as one you’ve done before, starting again from scratch is a real waste of time, right? That’s why we introduced blueprints, which let you quickly set up new surveys based on identical channels and quota frames, without having to manually enter the details all over again. Pretty much like a template.

Thanks to blueprints, you no longer need to hold on to old surveys as setup references. Find out how to benefit from the efficiency of blueprints in our 22-minute webinar Academy #40 – Survey blueprints.

You wanted a more integrated and streamlined data management experience. We responded by developing a way to transmit CAPI data directly into the Nfield data delivery pipeline, enabling instant availability of comprehensive fieldwork progress reports.

This is still a work in progress, but Beta access is now open for integrating CAPI survey data into fieldwork progress reports and repositories.

Scripting continues to evolve, and so do our tools for checking your scripts are free from logic errors. The NIPO ODIN Developer now incorporates both the legacy (NFS) parser and the new (Nfield) parser for ODIN questionnaire scripts. At the time of writing, both parsers are currently available, but the legacy parser will be phased out during 2024.

While developing the new Nfield parser, we discovered several commands and constructs that are no longer functional in Nfield. To help you transition to updated practices, these commands and constructs are now proactively reported as warnings.

To make your CAPI survey experience even better, we enhanced Nfield Manager capabilities to enable truly seamless management, including for surveys with Sampling Points, Addresses, and Quotas. Day-to-day survey management is now even more streamlined via a more intuitive interface, and includes added support for Excel upload. As a result, the Nfield Manager lets you do more in one place, without having to use separate tools. So you get to enjoy even more convenience, efficiency and user-friendliness. This latest evolution of the Nfield Manager has led to retirement of the Classic Manager.

We know how frustrating it can be when you’re experiencing performance or availability issues and you don’t know if anything is being done to address them. That’s why we introduced our Nfield Status Page to provide real-time information about availability of our main services across different regions. Through this page, you can easily check whether the issue you’re encountering is already known to our team before deciding to raise a support ticket. It’s all part of our commitment to giving you the smoothest and most efficient service possible.

In 2023, we gave our users a gleaming new toolbox for streamlining the process of Nfield domain configuration. Nfield API Endpoints v2 is a set of meticulously crafted tools, such as DomainEmailSettings, DomainLanguageTranslations, and DomainPasswordSettings, designed to make your work faster, smoother, and better overall.

APIs (Application Programming Interfaces) act as a bridge connecting two completely different programs (e.g. Nfield and CRM / Nfield and Membership database / Nfield and your reporting system. See API – What researchers need to know for further explanation.

With the release of this updated toolbox, the older v1 endpoints have been deprecated, as indicated in the Nfield API help page.

Our improvement journey is continual, and Nfield customers can look ahead to yet more innovations aimed at further enhancing the user experience and data collection efficiency.

For every visible change, a significant amount of hardening, performance improvement, security enhancements, and maintenance work also goes on behind the scenes. It all adds up to fulfilling our commitment to delivering a robust and reliable platform for every single one of our valued customers.

Here’s to an exciting, inquisitive, and productive year ahead in market research!

NIPO recently had the pleasure of seeing one of our affiliates recognized by PAMRO (The Pan African Media Research Organization) for a groundbreaking project made possible by Nfield’s API.

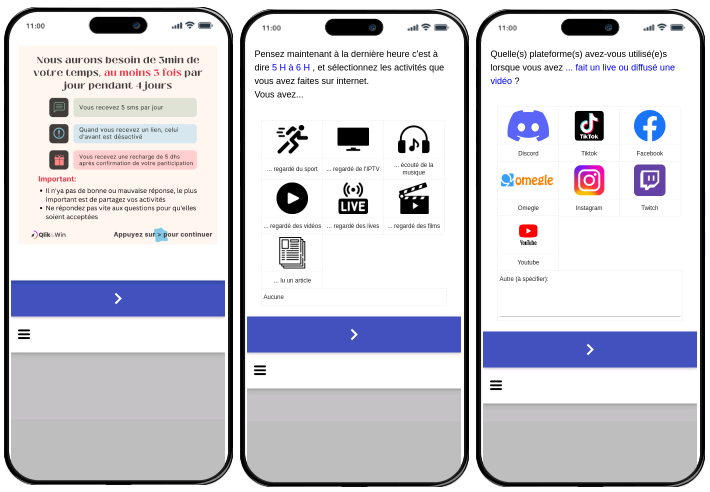

Integrate, which is a data and evidence-based agency operating out of Morocco, was awarded the runner’s-up prize at PAMRO’s 2023 annual conference for “A Non-invasive Methodology for Tracking Digital Behavior in Morocco”. This pioneering initiative was designed to delve into Moroccans’ digital behaviors and attitudes, to shed light on their digital interactions and experiences. It was the first survey of the Moroccan population focused on gaining insights into their digital moments, with the aim of gathering valuable data for both marketers and researchers.

Nfield and its API were instrumental in enabling this research to be carried out, and we are delighted to share the details of how these made a difference.

Integrate pursued a non-invasive methodology to overcome privacy concerns which often deter respondents from granting permissions, thereby limiting the tracking scope. It was a decision designed to enhance the level of participation.

Compared to other approaches that use real-time monitoring via in-moment tracking tools, such as web analytics, cookies, and software installed on users’ devices, non-invasive market research relies on self-reported data. This presents two challenges:

Because non-invasive market research can’t use online activity to trigger surveys, Integrate needed another way to collect data in a timely fashion from trustworthy respondents. Their solution was to prompt respondents, selected from a pre-vetted panel, into voluntarily providing information through time-restricted SMS invitations. To encourage participation, rewards were offered for in-time survey completion.

To carry out these procedures, Integrate implemented a set of strategic rules executed by a job scheduler, while the Nfield API enabled tasks to take place automatically. As a result, Integrate was able to track digital behavior, brand exposure, meal occasions, and other relevant time-related activities without human intervention, while solving the challenges described above.

| Purpose | Rules | How Nfield’s API helps | |

| Job Scheduler | Real-time engagement: Obtain the most accurate responses possible. | Participants are contacted via SMS, as close as possible to the moment of their experience. | Seamlessly uploads respondent sample group data from a panel database and creates unique survey links for sending via SMS. |

| Time-sensitive queries: Minimize risk of memory bias. | Each survey is exclusively focused on events that took place within the last hour. This is assured by invalidating survey links one hour after sending. | Automatically quality-checks submissions (according to Integrate’s custom algorithm) one hour after links have been sent, and invalidates unique survey links for any interviews not completed within that timeframe. | |

| Motivate respondents: Encourage higher response rates, to acquire more valuable data. | Participants are rewarded for completing surveys. | Triggers the process for sending rewards to respondents who completed surveys within the timeframe, to the desired quality. |

In addition to feeding the job scheduler, the Nfield API also helps to minimize memory bias by transferring information from the panel database into Nfield, where it is used to customize how questions are presented to each respondent. This helps jog respondents’ memories in a way which is already known to be relevant.

Nfield’s ability to incorporate visual aids, in the form of pictograms, in the survey design means this knowledge can be presented in a way that makes it even easier for respondents to recognize, and accurately recollect their digital interactions and experiences.

Integrate’s study revealed diverse digital segments with associated demographic details, attitudes, key online activities, expenditure, and preferred applications, without resorting to digital surveillance that would discourage respondent participation. The data they gathered is invaluable for businesses seeking to target distinct digital consumer groups in Morocco.

This non-invasive methodology can be extended as required to study other aspects such as brand exposure, moments of consumption, and time and activity diaries. Thanks to Nfield’s API making it easy to carry out, market researchers have another feasible option for reaching diverse target groups.

If you’d like to know more about this particular case, please contact [email protected] at Integrate.

Here at NIPO, we’re always thrilled to learn about our clients’ successful research endeavors. As well as giving us an opportunity to celebrate your achievements, knowing about your experiences contributes to our continuous improvement. Plus, your successes inspire and support fellow researchers, fostering a community of innovation. So don’t hesitate to share your successes using Nfield. Together, we can continue to push the boundaries of market research, and Nfield will be there to support you every step of the way.

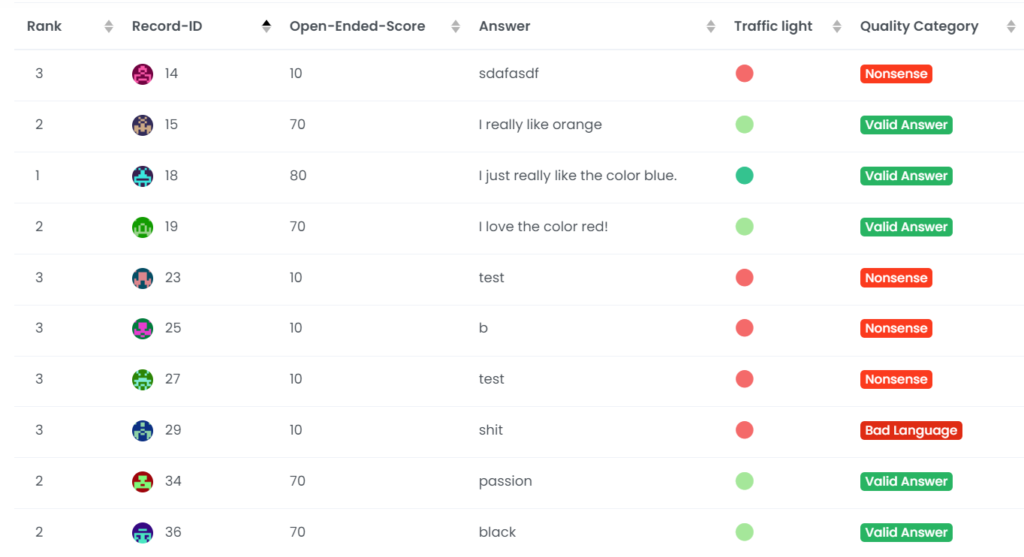

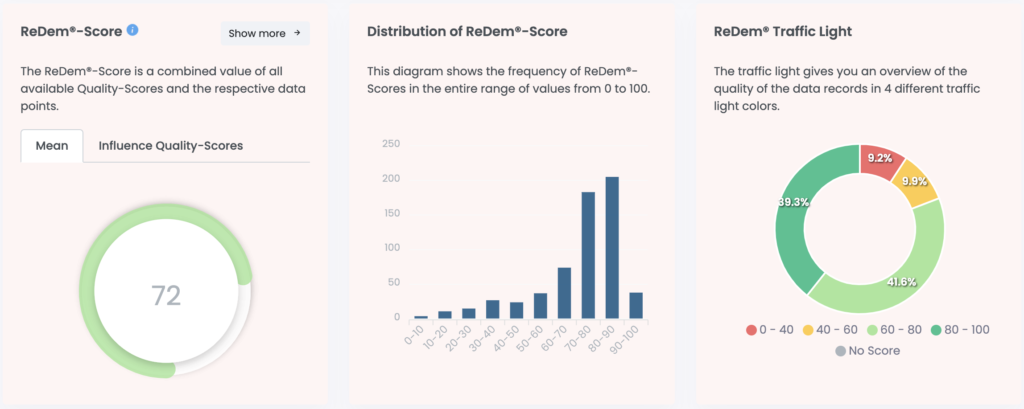

Quality data is the very bedrock of worthwhile market research. Survey results that are skewed through inappropriate responses are helpful to no-one. And the insights derived from these could potentially do more harm than good if used as a basis for strategy.

That’s why we’re excited to introduce a new tool to the Nfield armory: ReDem® AI-powered quality control for survey responses. ReDem AI automatically scans every survey answer for integrity, identifying and disqualifying those which are likely to be invalid due to respondent laziness or deliberate falsification. Our team has worked together with ReDem to integrate their service with Nfield, so you can hook up their capabilities directly with your Nfield surveys.

This is in addition to Nfield’s manual facility for identifying and disqualifying responses which show evidence of being falsified, as described in Upholding Survey Quality: How to Remove ‘Bad’ Interviews from Results.

ReDem is a leading research technology company specializing in AI-based SaaS solutions for survey data quality assurance. ReDem aims to improve quality control in the insights industry by bringing better efficiency and standardization to data cleaning.

ReDem uses artificial intelligence to check data quality, doing everything you can do through Nfield’s manual facility, but in a fraction of the time. And without the risk of human error that increases as concentration gets lost.

Learn more about ReDem-Score – The quality checks performed by ReDem and AI-powered quality checks for open-ended responses.

ReDem AI swiftly identifies any survey responses that fall below user-specified benchmarks, and flags them as rejected within Nfield. It also marks good quality interviews as approved. This proactive approach guarantees your results only contain high-quality data, which safeguards the integrity of derived insights.

Want to see exactly what the Nfield-ReDem integration can do for your surveys? We organized a webinar in 2 sessions on 30 and 31 October 2023. See the session video below.

NIPO and ReDem are proudly working together to shape the future of market research by ensuring top quality data that’s suitable for deriving genuine insights. Join us on this journey transforming how we understand the world through data.

Market research is all about helping organizations stay ahead of their competition. To be successful, market researchers themselves need to lead by example, using tools which leverage cutting-edge technology to produce thorough insights, in any given situation.

NIPO’s Nfield platform does all this, at the same time as considering research companies’ own business needs. With unwavering commitment to security and compliance, robust architecture, user-friendly design, and seamless API integration, Nfield provides a game-changing package for even the most complex data collection and analysis projects.

Data security is paramount in every business situation, and carries a whole new level of responsibility when data from a large number of third-parties is involved. Nfield is as prepared for this as it is possible to be. Certified to ISO27001, the international standard for information security management systems, Nfield guarantees all data is safeguarded against any unauthorized access, theft, or damage.

This highest-level certification is complemented with GDPR compliance, meaning Nfield adheres to the stringent General Data Protection Regulation set forth by the European Union (and CCPA).

For market researchers and their clients alike, this combination of data security and privacy compliance gives full peace of mind that everybody’s valuable and sensitive information is in safe hands. To learn more, visit the NIPO Data Security page.

Read More:

Faultless ISO 27001-2013 audit for Nfield

Keeping your Nfield domain clean for compliance, security and efficient working

Market research clients come in many different forms and seek insights from all kind of places. That’s why Nfield has been designed to seamlessly accommodate every eventuality, without missing a beat.

Leveraging the power of the Microsoft Azure PaaS environment, Nfield scales automatically as and when necessary to provide the right capacity for every size of project. And, thanks to strategically positioned servers across Europe, Asia Pacific, China and America, offers the fastest possible response times for researchers and respondents alike, wherever they’re located.

Nfield’s dedicated operations team continually maintains the platform to ensure reliability and uninterrupted access. Making the most of Microsoft Azure’s features and capabilities, including high availability and disaster recovery, Nfield delivers consistent and reliable performance to every size of company, all around the world.

Read More:

Seamlessly Migrating a High Volume Online Survey

Nfield sets new activity record, with 104,758 interview completes in 24 hours

Market research doesn’t all take place at a desk. That’s why Nfield is as mobile as the world we live in. The platform, complete with its responsive, user-friendly design, is effortlessly accessible via smartphones, tablets, laptops and desktops. So there are no limitations to where and when responses can be gathered.

Read More:

Bringing True Mobility to your Surveys

Customer Satisfaction Surveys: Nfield brings you Closer to Impactful Outcomes

Employee Satisfaction Surveys: Superior Nfield Capabilities leave Clients more Satisfied too!

Nfield’s API enables seamless connection with other software solutions of your choice, such as customer relationship management (CRM) systems and analytics platforms, to streamline workflows and enhance data accuracy. With endless possibilities for automation, data transfer and generation of custom reports, Nfield’s API integration can supercharge productivity while facilitating next-level customization.

Read More:

API – What researchers need to know

In our fiercely competitive world, speedy ability to leverage data-driven insights is key. Leaving no stone unturned in this highly complex task, Nfield is the ultimate industrial-strength survey platform for market research companies that really mean business. Nfield’s scalability and reach mean companies of every size, and in any location, can be empowered by fast, user-friendly processes that take our industry to the next level.

Request a demo to see how NIPO can help you meet your requirements with our smart survey solutions.